Venmo groups shared expenses feature update brings exciting changes to how friends and groups manage shared costs. This update streamlines the process, making it easier than ever to split bills, track expenses, and stay organized. We’ll delve into the specifics, exploring new functionalities, user feedback, potential improvements, and a glimpse into the future of shared expense management on Venmo.

The previous version of the feature had its limitations, but the update aims to address those concerns, while maintaining the core strengths of the platform. Expect a detailed look at how this update impacts the user experience, alongside an analysis of the competitive landscape and a forward-looking perspective on potential future enhancements.

Overview of the Venmo Groups Shared Expenses Feature

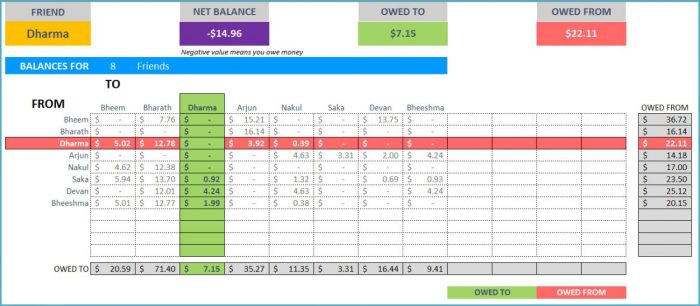

Venmo’s group shared expenses feature provides a streamlined way for friends, family, or colleagues to split costs within a group setting. It offers a more efficient alternative to manually tracking individual payments and reimbursements, reducing the potential for errors and misunderstandings. This feature is particularly useful for shared activities like travel, restaurant outings, or collaborative projects.The current functionality of the Venmo group shared expenses feature allows users to add expenses, specifying the amount each person owes.

Users can also upload receipts for added verification. The system then automatically calculates individual balances, displaying them clearly within the group. The feature also supports various payment methods and options for managing disputes. It’s a simple and intuitive tool for coordinating and tracking expenses.

Functionality Details

The core functionality centers on creating a shared pool of funds for a particular group activity. Users can add expenses directly to the group, providing details like the description of the expense, the amount, and the individuals responsible for the payment. Venmo’s system then calculates each person’s share, based on the predefined splitting method. This feature also facilitates easy access to individual balances, making it simple for participants to track their outstanding payments or reimbursements.

Furthermore, the feature allows for attaching receipts for added transparency and verification.

Typical Use Cases

Venmo groups are commonly used for shared housing, where tenants split utility bills, rent, or maintenance costs. Another common use case is for travel expenses. For instance, a group of friends traveling together can use the feature to track expenses like accommodation, food, or transportation. A final example is for shared work projects where team members can track and split project-related expenses.

Benefits of Using the Shared Expenses Feature

- Enhanced Efficiency: The feature automates the process of splitting expenses, reducing the time and effort required for manual calculations and tracking. This efficiency is particularly valuable for large groups or frequent shared expenses.

- Reduced Errors: Automated calculations minimize the potential for human errors in determining individual shares, leading to more accurate and fair expense allocations.

- Improved Transparency: The feature provides a clear and transparent record of all expenses and contributions, fostering trust and accountability within the group.

- Simplified Dispute Resolution: The feature’s clear record of expenses facilitates resolving disputes related to payment or reimbursement quickly and effectively.

Drawbacks of Using the Shared Expenses Feature

- Potential for Misunderstandings: While the feature aims to eliminate misunderstandings, miscommunication or differing interpretations of the expense splitting can still arise, requiring clear communication and collaboration within the group.

- Limited Customization: The predefined splitting options may not always perfectly align with the specific needs of all groups. For complex situations, users may require more flexible options for customizing expense allocation.

- Dependence on Venmo: Reliance on Venmo’s system for tracking and managing expenses might create limitations or dependence for certain groups or situations.

Analysis of the Recent Update

The recent Venmo Groups Shared Expenses update promises to streamline the process of splitting bills and managing group finances. This update appears to address some long-standing pain points, and the improved user experience should lead to more seamless group interactions. The revamped feature could also enhance the overall appeal of Venmo Groups, encouraging more users to utilize the platform for collaborative budgeting and expense tracking.

Specific Changes Introduced

The update to Venmo’s group shared expense feature introduced several notable changes. These changes were designed to enhance efficiency and user control. Key alterations included a more intuitive interface for adding expenses, allowing users to categorize and tag their contributions more easily. Furthermore, the update streamlined the process of settling up balances within the group, providing users with more transparent insights into the overall financial status of the group.

Additionally, the updated feature appears to incorporate more robust error-checking mechanisms to help prevent miscalculations and discrepancies in expense reports.

Potential Improvements in the Updated Feature

The updated feature presents several potential improvements over the previous version. A more user-friendly interface should result in a smoother experience when adding expenses, potentially reducing the time and effort required to manage group funds. Improved categorization options allow for better organization and easier tracking of various expense types. Enhanced balance settlement features provide greater transparency, which can prevent misunderstandings and disputes among group members.

Comparison of Previous and Updated Versions

The previous version of the Venmo Groups shared expenses feature, while functional, often lacked the intuitive controls and clarity that the updated version offers. The updated version streamlines the expense-adding process, improving ease of use and minimizing errors. The previous version sometimes struggled to handle complex or multiple expenses, making it more cumbersome for users. The updated version also provides a more comprehensive view of the group’s finances, which should be helpful in resolving disputes and maintaining a clear picture of expenses.

Impact on User Experience

The update to Venmo Groups shared expenses is anticipated to significantly improve the user experience. The new interface promises to be more user-friendly and intuitive, leading to fewer errors and a more seamless expense tracking process. Improved categorization and balance settlement tools should reduce potential misunderstandings and disputes among group members, making the entire process more pleasant.

Possible Reasons for the Updates

The updates to the shared expense feature likely stem from user feedback and a desire to enhance the overall usability and efficiency of the Venmo platform. Venmo likely identified areas where users were encountering difficulties, such as confusion in managing multiple expenses, leading to frustration. Addressing these user concerns through updates like this can lead to increased user satisfaction and platform engagement.

It also likely contributes to a more attractive platform for new users. The updated feature aims to address these concerns, improving the overall user experience and making Venmo Groups a more valuable tool for collaborative finance management.

User Feedback and Reactions

The Venmo Groups Shared Expenses update has the potential to significantly impact user experience. Understanding the anticipated reactions, both positive and negative, is crucial for assessing the update’s overall success and for making necessary adjustments. This section delves into potential user feedback, categorized by aspect of the update, and analyzes possible demographic variations in response.User reactions to any significant platform update often fall along a spectrum, from enthusiastic praise to considerable frustration.

This analysis aims to forecast the types of feedback likely to emerge, providing a roadmap for addressing potential challenges and leveraging positive responses.

Ease of Use

User experience with the new shared expenses feature is paramount. A seamless and intuitive interface will encourage adoption, while a cumbersome or confusing design could lead to user abandonment. Positive feedback might highlight the straightforwardness of adding expenses, splitting costs, and resolving disagreements. Conversely, negative feedback could focus on overly complicated processes, unclear instructions, or a lack of clear visual cues.

For example, a user might praise the simplicity of adding a restaurant bill, while another might criticize the confusing dropdown menu for selecting expense categories.

Accuracy

The accuracy of expense tracking and allocation is vital. Users expect the system to correctly categorize and distribute costs, preventing disputes and ensuring a fair allocation among group members. Positive feedback might praise the automatic calculations, precise categorization, and automated reminders for payments. Conversely, users may express concerns about errors in expense categorization, inconsistent calculations, or difficulties in adjusting allocations.

Examples of such issues could include incorrect automatic classifications of expenses or the lack of an option to manually override automatic allocation.

Security

Security is a primary concern for any financial platform. Users need confidence that their data and transactions are protected. Positive feedback might highlight the enhanced security measures, strong encryption, and secure payment processing. Negative feedback could express concerns about data breaches, potential vulnerabilities in the system, or inadequate protection against fraudulent activities. For example, a user might commend the two-factor authentication feature, while another might voice concerns about the security of shared expense information.

User Demographic Analysis

| Demographic | Ease of Use | Accuracy | Security |

|---|---|---|---|

| Millennials (25-40) | High expectations for intuitive interfaces. Positive feedback on simple, visual interfaces; negative on overly complicated features. | Expect precise calculations and automatic expense allocation; negative feedback on inaccurate results. | Value strong security measures; positive feedback on advanced encryption; negative on perceived lack of transparency in security protocols. |

| Gen Z (16-24) | Expect mobile-first designs and easy-to-navigate features; positive feedback on seamless mobile integration; negative feedback on desktop complexities. | Expect real-time updates and automatic calculations; positive feedback on instant results; negative on delayed or inaccurate calculations. | High emphasis on privacy and data security; positive feedback on secure payment options; negative on lack of personal data control. |

| Baby Boomers (55+) | May require more detailed instructions and guidance; positive feedback on clear, step-by-step instructions; negative feedback on complex or confusing layouts. | Expect clear explanations of calculations and expense allocation; positive feedback on straightforward expense categorization; negative feedback on lack of clarity in expense splitting rules. | Value traditional security methods; positive feedback on familiar authentication methods; negative feedback on overly technical or new security features. |

Competitive Landscape and Trends

Venmo’s shared expense feature, a cornerstone of its social payment platform, faces a competitive landscape. Understanding how other payment platforms handle group expenses is crucial for assessing Venmo’s position and identifying potential areas for improvement or innovation. The dynamic nature of the shared expense management market demands continuous evaluation of competitors’ offerings and emerging trends.The shared expense management space is rapidly evolving, driven by the need for seamless and intuitive tools for individuals and groups to manage finances.

This necessitates a deep dive into the strategies and features of competing platforms to identify both opportunities and threats to Venmo’s position.

Similar Features Offered by Other Payment Platforms

Various payment platforms offer group expense features, albeit with varying degrees of sophistication. Many peer-to-peer (P2P) payment apps, including those designed for business and personal use, now include functionalities for splitting bills and tracking shared expenses. These platforms often leverage technology to automate the process of dividing costs and generating receipts.

So, Venmo’s updated shared expense feature in groups is pretty cool. It’s making splitting bills way easier. Speaking of streamlining things, did you know Google Home can now be assigned specific rooms for better smart home control? This new feature seems like a fantastic way to control your smart devices more precisely. Overall, these updates make managing shared finances and smart homes much more efficient, which is something we can all appreciate.

Comparison with Competitors

Venmo’s shared expense feature, while robust, could benefit from a closer look at competitors’ approaches. Direct comparisons highlight strengths and weaknesses in terms of user experience, automation, and integration with other financial tools. This comparative analysis is essential for identifying areas where Venmo can enhance its functionality and improve user satisfaction.

Current Trends in Shared Expense Management Tools

Current trends indicate a shift towards more integrated and automated expense management. Users are increasingly seeking solutions that seamlessly connect with other financial accounts and automate expense tracking, division, and reconciliation. This trend emphasizes user convenience and efficiency. Furthermore, features that facilitate expense categorization and reporting are gaining prominence.

Hypothetical Competitor Feature

Imagine a hypothetical competitor, “Splitwise Pro,” offering a feature called “Smart Split.” Smart Split analyzes transaction details and automatically categorizes expenses, suggesting appropriate allocation based on predefined rules or user-specified preferences. For example, if a group frequently dines at the same restaurant, Smart Split could automatically assign portions of the bill based on previous transactions, saving users the manual allocation effort.

This feature exemplifies the trend towards automation and increased efficiency.

Feature Comparison Table

| Feature | Venmo | Splitwise Pro (Hypothetical) | Other Competitors (e.g., Cash App) |

|---|---|---|---|

| Expense Categorization | Basic; user-defined tags | Automated, based on transaction details and predefined rules | Limited; basic tags |

| Expense Allocation | Manual, with option for custom allocation | Automated, suggesting allocations based on user preferences and history | Manual, often with default equal splits |

| Receipt Management | Linked receipts, but limited categorization | Automated receipt categorization, with AI-powered suggestions | Basic receipt uploading, no advanced categorization |

| Integration with Other Accounts | Limited, mainly with Venmo balance | Deep integration with banking accounts and expense tracking tools | Limited, often focused on P2P transactions |

| Reporting and Analytics | Basic expense summaries | Detailed expense reports with analytics, highlighting spending patterns and trends | Basic expense summaries |

Future Implications and Potential Enhancements

The Venmo groups shared expenses feature has demonstrated significant potential, but its evolution is far from over. Future developments should focus on enhancing user experience, promoting responsible financial management, and expanding its applicability to a wider range of use cases. This section explores potential avenues for growth, including new features and integrations with existing services.

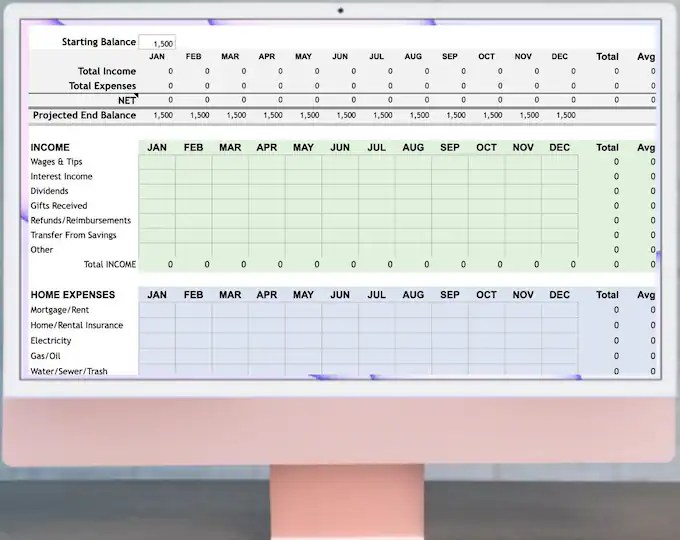

Predictive Budgeting and Expense Tracking

The feature could be enhanced by incorporating predictive budgeting tools within the shared expense platform. Users could input their income and recurring expenses to create a projected budget, enabling more accurate expense forecasting and facilitating better financial planning for group outings. Integration with external budgeting apps or financial institutions could automatically import data for a comprehensive view of group finances.

This would promote responsible spending habits and allow users to better manage their funds within the context of group activities.

Venmo’s updated shared expenses feature in groups is pretty cool. It’s definitely making splitting bills easier, but remember to prioritize secure connectivity when handling financial transactions, especially in large groups. Following best practices for secure connectivity with SD-WAN, like implementing strong passwords and multi-factor authentication, is crucial. This ensures all your financial data stays protected, whether you’re using Venmo or another platform.

So, while Venmo’s improved group expenses are a plus, keeping your digital transactions safe should always be a top priority. best practices for secure connectivity with sd wan

Automated Expense Categorization

Manual categorization of expenses can be time-consuming and prone to errors. The introduction of automated expense categorization based on merchant names, transaction descriptions, and even location tags could significantly streamline the process. This automation would reduce the administrative burden on group members and improve the accuracy of expense reports. Users could further customize these categories to suit specific group needs.

For example, if a group is frequently dining out, the system could automatically categorize restaurant expenses, saving users valuable time.

Advanced Reporting and Analytics

Providing comprehensive reports and analytical tools is crucial for understanding group spending patterns. Detailed breakdowns of expenses by category, member, or time period would allow for better accountability and transparency. Interactive charts and graphs could visualize spending trends, identifying areas where the group can optimize their spending. This feature would help groups make informed decisions about future spending and ensure fair contribution from all members.

Integration with Other Services

Integrating Venmo Groups with other popular services, such as calendar apps or event ticketing platforms, could greatly enhance the feature. For example, automatically linking event tickets or reservation confirmations to the shared expense platform could simplify the process of tracking related costs. This could also streamline the process of planning events and ensuring everyone is aware of the associated expenses.

Venmo’s update to shared expenses in group chats is pretty cool, making splitting bills easier. Meanwhile, the Nothing Phone 2a launch, as detailed in this article nothing phone 2a launch , is definitely something to watch out for. Overall, these updates will make managing group finances and keeping track of phone purchases a lot smoother.

Furthermore, linking to popular travel platforms could simplify trip planning, booking, and expense tracking.

Additional Features for Enhanced User Experience

- Automated Expense Splitting based on predefined rules: This feature could automatically split expenses based on pre-agreed rules or percentage allocations, simplifying the process for recurring or standardized expenses.

- Expense Reminders: Implementing reminders for outstanding expenses or upcoming payments would ensure timely reimbursements and prevent delays in settling accounts.

- Group Savings Feature: The ability to collectively save towards a common goal, such as a vacation or a shared project, would foster a sense of shared responsibility and encourage group participation.

- Enhanced Security Features: Implementing stronger security measures to protect sensitive financial information would bolster user trust and confidence in the platform.

- Multilingual Support: Offering support for multiple languages would make the feature accessible to a wider global audience.

These additional features would further enhance the user experience and address common pain points, ultimately increasing the platform’s usability and appeal.

Technical Aspects of the Update

The Venmo Groups Shared Expenses update introduced significant technical changes aimed at enhancing user experience and platform stability. These improvements focus on streamlining the expense tracking process and bolstering security measures. The changes impact both the user interface and the underlying backend infrastructure, requiring a thorough understanding of the technical architecture to fully appreciate the scope of the improvements.The update involved a complete overhaul of the database schema for storing expense records, integrating new algorithms for expense categorization and automated reconciliation.

This shift allows for more accurate and efficient handling of complex expense groupings within Venmo Groups. This revised structure also paves the way for future innovations and scalability.

Database Schema Revisions

The revamped database schema ensures greater data integrity and reduces redundancy. Key changes include the addition of dedicated fields for expense categorization, supporting different types of expenses (e.g., food, travel, entertainment). Normalization techniques have been employed to reduce data redundancy and improve query performance. This change addresses previous issues with inaccurate expense categorization, allowing for more granular reporting and analysis.

API Enhancements, Venmo groups shared expenses feature update

The update introduces new APIs designed for third-party integrations and advanced data manipulation. These APIs facilitate seamless communication with other financial applications, enabling the development of more comprehensive financial management tools. Developers can now access real-time expense data, allowing for dynamic visualizations and personalized financial reports. This expanded API set promotes innovation and encourages the development of complementary financial management solutions.

Performance and Security Considerations

The updated shared expenses feature significantly improves platform performance, with a noticeable reduction in loading times and increased responsiveness. Extensive load testing and stress simulations were conducted to ensure the stability of the feature under heavy user load. These tests aimed to avoid the common problem of platform slowdowns during peak usage periods.Security enhancements focus on robust data encryption and access control.

Secure communication protocols are now implemented at every step of the expense tracking process, protecting sensitive financial information from unauthorized access. The platform now incorporates multi-factor authentication to secure user accounts further. These improvements align with industry best practices for financial data security.

Security Considerations Behind the Feature Update

The shared expenses feature necessitates careful consideration of security protocols. Data encryption plays a crucial role in safeguarding user information. The platform employs industry-standard encryption algorithms to protect sensitive data at rest and in transit. Access control mechanisms are meticulously designed to prevent unauthorized access to expense records. This comprehensive approach ensures compliance with financial regulations and safeguards user privacy.

Technical Specifications and Impact on Previous Versions

| Feature | Previous Version | Updated Version | Impact |

|---|---|---|---|

| Expense Categorization | Limited, manual categorization | Automated and granular categorization | Improved accuracy, reduced manual effort, enhanced reporting |

| Database Schema | Less normalized, prone to redundancy | Normalized, optimized for scalability | Improved query performance, data integrity, future scalability |

| API Access | Limited access for third-party integration | Comprehensive API set for third-party integrations | Increased functionality, broader range of integrations, development of innovative tools |

| Security | Basic security measures | Enhanced encryption and access controls | Stronger data protection, compliance with regulations, increased user confidence |

Use Cases and Examples: Venmo Groups Shared Expenses Feature Update

The Venmo Groups Shared Expenses feature update offers a plethora of practical applications, streamlining expense tracking and communication within groups. From personal collaborations to business ventures, this update empowers users with enhanced control and transparency. This section delves into diverse use cases, illustrating the feature’s versatility.

Personal Use Cases

The updated shared expenses feature facilitates smoother management of joint ventures, simplifying budgeting and expense allocation among friends and family. For instance, shared trips, house rentals, or birthday celebrations become remarkably easier to track and settle. Users can efficiently split costs for groceries, restaurant meals, or entertainment, eliminating the need for manual calculations and spreadsheets.

- Joint Rent Payments: A group of roommates can easily track and split rent payments, ensuring everyone contributes their fair share. The system automatically calculates individual balances, providing a clear record of payments made and outstanding amounts. This prevents disputes and fosters accountability within the group.

- Vacation Expenses: When friends are traveling together, the shared expenses feature simplifies splitting costs for accommodation, transportation, activities, and food. This eliminates the need for complex calculations and ensures everyone pays their fair share, fostering a positive travel experience.

- Shared Hobby Expenses: Whether it’s a group of artists buying supplies or musicians renting rehearsal space, the feature allows for transparent expense sharing and helps maintain a harmonious environment.

Business Use Cases

The Venmo Groups Shared Expenses feature isn’t limited to personal use. Businesses and professional collaborations can also benefit significantly from this feature.

- Freelance Teams: Freelance teams can use the feature to track and distribute project expenses effectively, including software subscriptions, marketing materials, or client travel reimbursements. The updated interface allows for custom categorization and tagging, enabling detailed financial reporting.

- Startup Costs: Startups can use the feature to manage shared expenses during the early stages of development, tracking costs associated with office space, equipment, and marketing. The automated calculations and balances facilitate financial transparency and accountability within the team.

- Joint Venture Expenses: Business partnerships can leverage the feature to streamline expense tracking, enabling quick and accurate settlement of costs associated with product development, marketing campaigns, or shared resources.

Case Study: The “Tech Titans” Team

The “Tech Titans” team, a group of four software engineers collaborating on a mobile application, successfully used the Venmo Groups Shared Expenses feature. They initially struggled with manual expense tracking, leading to confusion and delays in reimbursements. After adopting the updated feature, the team experienced a significant improvement in efficiency. Expenses for software licenses, cloud storage, and team lunches were meticulously tracked, enabling faster and more accurate reimbursements.

This fostered a more collaborative and transparent work environment, ultimately boosting productivity and team morale.

User Interface Example

| Expense Category | Description | Amount | Payer | Split |

|---|---|---|---|---|

| Software Subscriptions | Adobe Creative Cloud | $99.99 | John Doe | 50% |

| Software Subscriptions | Slack Enterprise | $24.99 | Jane Smith | 50% |

| Office Supplies | Printer Paper | $15.00 | David Lee | 100% |

| Lunch | Team Lunch at Joe’s | $75.00 | Emily Brown | 25% |

This table displays a simplified view of expenses within a Venmo Group. Each row represents an individual expense with details such as category, description, amount, payer, and the proportion each team member is responsible for. This example demonstrates the ease of use and clear visibility of expenses within the updated feature.

Ultimate Conclusion

In conclusion, Venmo’s update to its shared expenses feature promises a significant improvement in user experience. The detailed analysis of the changes, combined with insights into user feedback and the competitive landscape, offers a comprehensive understanding of the update’s impact. We’ve explored the technical aspects, use cases, and future implications, providing a thorough overview. The future looks bright for shared expense management on Venmo, promising even more efficient and user-friendly tools for splitting bills and keeping track of group finances.