This secret loophole makes leasing an EV better than buying right now, unlocking a surprising advantage in today’s electric vehicle market. Are you considering an EV? Understanding the nuances of leasing versus buying can be tricky, especially with fluctuating market conditions and incentives. This article delves into the potential tax benefits and hidden savings that might make leasing a more attractive option than outright purchase for many drivers.

We’ll compare typical lease and buy scenarios, examine potential tax advantages associated with EV leasing, and analyze the impact of lease terms like mileage restrictions and residual values. The financial modeling will illuminate the potential cost savings and provide a clear picture of the total cost of ownership for both options. This isn’t just a theoretical discussion; we’ll provide real-world examples and case studies to show how leasing can save you money.

Introduction to Leasing vs. Buying EVs

The electric vehicle (EV) market is experiencing rapid growth, but the decision between leasing and buying an EV can be confusing. This surge in popularity is driven by government incentives, decreasing battery costs, and growing consumer awareness of environmental benefits. However, understanding the financial implications is crucial to making the right choice.The current market presents a unique opportunity for exploring lease options, especially when considering the fluctuating pricing dynamics and the substantial upfront costs of many EV models.

This analysis will help you compare the financial aspects of leasing versus purchasing an EV, considering factors like initial costs, monthly payments, and potential residual values.

Financial Considerations for EV Purchases

Understanding the financial implications of purchasing an EV is paramount. Initial costs typically encompass the purchase price, potential sales tax, and any associated fees. The long-term financial commitment includes potential maintenance costs, fuel costs (electricity), and depreciation. Forecasting future costs and considering the longevity of the battery pack and other crucial components is important for informed decision-making.

Financial Considerations for EV Leases

EV lease agreements involve fixed monthly payments for a specified period. These payments cover the use of the vehicle, but the ownership remains with the leasing company. Leasing typically involves lower upfront costs compared to purchasing. However, it’s important to scrutinize lease terms to understand the implications of mileage restrictions, early termination fees, and potential penalties for exceeding the agreed-upon mileage.

Ever wondered if leasing an EV might actually be a smarter move than buying one right now? There’s a sneaky little loophole, and it’s all about rapidly changing battery technology. While exploring the cutting-edge AR app development tools available through the Magic Leap Creator Portal, like their SDKs for Unity and Unreal , I realized that the future of electric vehicle battery technology is shaping up to offer incredible leaps in performance and affordability.

This translates to huge potential savings for those leasing, making it a better financial decision than purchasing a car with current technology, even if you’re a coding whiz using these advanced platforms.

Typical Terms and Conditions of EV Lease Agreements

Lease agreements often stipulate specific terms for mileage restrictions, early termination fees, and potential penalties for exceeding agreed-upon mileage. These terms vary significantly depending on the manufacturer and leasing company. Understanding these terms is crucial to avoiding unexpected costs.

Typical Terms and Conditions of EV Purchase Agreements

Purchase agreements detail the total cost of the vehicle, including any applicable taxes, fees, and trade-in value if applicable. Ownership is transferred to the buyer upon completion of the transaction. The long-term cost of ownership encompasses potential maintenance expenses and potential battery replacements.

Lease vs. Buy Scenarios for EVs

The following table illustrates typical lease versus buy scenarios for EVs, presenting a simplified comparison of initial costs, monthly payments, and potential residual values. These figures are estimates and may vary significantly based on specific models, lease terms, and market conditions.

| Scenario | Initial Cost (Purchase) | Monthly Payment (Lease) | Estimated Residual Value (End of Lease) |

|---|---|---|---|

| EV Model X | $60,000 | $800 | $30,000 |

| EV Model Y | $45,000 | $600 | $25,000 |

| EV Model Z | $30,000 | $400 | $15,000 |

Identifying the “Secret Loophole”: This Secret Loophole Makes Leasing An Ev Better Than Buying Right Now

Unlocking potential tax advantages and incentives associated with EV leasing can significantly impact your bottom line. While the initial cost might seem higher compared to buying, strategic leasing can lead to substantial savings over the long term. Government and local programs, coupled with favorable leasing terms, often create a “secret loophole” that can make EV leasing a more attractive option than purchasing.Discovering these advantages hinges on understanding how tax incentives and government programs specifically apply to EV leases.

Navigating these details can be crucial for maximizing your financial benefits.

Tax Advantages and Incentives for EV Leases

Government incentives for electric vehicles (EVs) often extend to leasing as well as purchasing. These incentives can include tax credits, rebates, or deductions, which can lower the overall cost of leasing. State and local governments may also offer similar programs. These vary based on the specific jurisdiction and often have stipulations about the lease duration or vehicle model.

Government and Local Programs

Numerous government and local programs are designed to encourage the adoption of EVs. These can take the form of grants, subsidies, or rebates, and often extend to lease agreements. A significant factor in determining if leasing an EV is advantageous is whether the programs in your area cover lease payments.

This secret loophole making EV leasing better than buying right now is fascinating. Imagine the luxury of a cutting-edge electric vehicle, like a top-tier hotel experience. Just as a sophisticated hotel like Villa Stephanie might have a wireless kill switch system ( villa stephanie wireless kill switch luxury hotel ), this financial loophole allows you to essentially “kill” the high upfront cost of EV ownership.

It’s all about maximizing your financial freedom, which makes leasing a smart move compared to a hefty purchase price.

Potential Savings and Deductions in Leasing

Leasing an EV can lead to various savings depending on the specific lease terms and available incentives. Potential deductions may include, but aren’t limited to, the deduction of lease payments from your taxable income. However, the specific eligibility for these deductions depends on your jurisdiction’s tax regulations. It’s critical to consult with a tax professional to understand the exact implications for your situation.

Comparison of Leasing Terms and Conditions

Lease terms significantly impact the financial attractiveness of leasing an EV. Factors such as the lease duration, mileage allowance, and early termination fees should be considered. Lease terms that align with your anticipated usage and needs, alongside the aforementioned tax incentives, will be key to maximizing potential savings.

Scenarios Where Leasing is Financially Advantageous

| Scenario | Potential Advantages | Considerations |

|---|---|---|

| High mileage usage, uncertain future needs | Lower upfront costs, flexibility to switch vehicles, and potential tax advantages | Mileage restrictions and potential early termination fees. |

| Tax incentives and favorable lease terms | Significant tax deductions or rebates. | Potential need for longer-term commitment. |

| Limited budget, desire for the latest technology | Lower upfront costs and potential for favorable financing terms | Potential higher monthly payments compared to purchasing a used EV. |

| Desire for ongoing vehicle upgrades or new technology | Access to newer model year vehicles with advanced features | Mileage restrictions and potential penalties. |

Note: This table is illustrative and not exhaustive. Specific financial benefits will depend on individual circumstances, lease terms, and government incentives available in the respective region. Consult with a financial advisor to assess your personal situation.

Lease Terms and Conditions Impacting Decision

The allure of leasing an EV, especially with its current financial incentives, often overshadows the crucial details buried within the lease agreement. Understanding these specifics is vital to making an informed choice. The terms and conditions, including residual value estimations, mileage restrictions, and maintenance responsibilities, can dramatically shift the perceived advantage of leasing over purchasing.Beyond the initial monthly payment, hidden costs and potential pitfalls can significantly impact the overall cost of ownership.

Factors like mileage penalties, early termination fees, and the intricacies of residual value calculations are critical to evaluate before signing on the dotted line. A comprehensive understanding of these terms allows you to accurately assess the true financial implications of a lease versus a purchase.

Residual Value Estimation

Residual value, the estimated worth of the vehicle at the end of the lease term, is a key factor influencing the lease’s overall cost. This value is crucial because it determines the amount you’ll owe at lease end. Factors that influence residual value estimates include the EV’s model year, anticipated depreciation rates in the electric vehicle market, anticipated demand for that specific model, and overall market trends.

- Market conditions play a significant role in residual value calculations. Strong market demand and limited supply for a particular model can lead to higher residual values. Conversely, oversupply or decreased consumer interest can result in lower residual values.

- Manufacturing defects or recalls can negatively impact the EV’s residual value. Any major issues impacting the vehicle’s reliability or perceived quality could lead to a significant decrease in the residual value.

- Mileage plays a role in residual value. Exceeding the agreed-upon mileage limit in the lease agreement can trigger penalties, directly affecting the final residual value.

Mileage Restrictions and Penalties

Mileage restrictions are a standard part of lease agreements. Exceeding the specified mileage limit often triggers penalties. These penalties can significantly increase the cost of leasing, making it more expensive than purchasing. Lease agreements often specify a per-mile charge for exceeding the allotted mileage, with the amount varying depending on the lease terms and the specific EV model.

- Example: A lease agreement might stipulate a maximum mileage of 15,000 miles per year. Exceeding this limit could result in a penalty of $0.25 per mile.

- Lease agreements vary widely in their mileage restrictions. Consider the typical annual mileage you drive and the potential penalties before committing to a lease.

- The financial impact of exceeding mileage restrictions should be carefully considered during the decision-making process. This will help you compare the lease cost against the cost of buying and maintaining the vehicle.

Maintenance Responsibilities and Costs

Determining maintenance responsibilities is essential in comparing lease and purchase options. In a lease, the responsibility for routine maintenance and repairs often rests with the lessee. This is crucial because the leaseholder is responsible for repairs. While the initial cost of maintenance may seem lower due to the inclusion of routine maintenance in the monthly payment, it can accumulate significantly over the lease term.

| Lease Type | Maintenance Responsibility | Potential Cost Implications |

|---|---|---|

| Lease | Typically, lessee responsible for routine maintenance, minor repairs. | Potential for unexpected costs if significant repairs are needed. |

| Purchase | Owner responsible for all maintenance and repairs. | Predictable costs associated with regular maintenance and potential major repairs. |

Impact of Lease Terms on Cost

Lease terms significantly influence the overall cost. Different terms can lead to varying financial outcomes, impacting the perceived advantage of leasing.

| Lease Term | Description | Impact on Cost |

|---|---|---|

| Mileage Restrictions (e.g., 10,000 miles/year) | Limits the number of miles driven annually. | Penalties for exceeding the limit, increasing the overall cost. |

| Early Termination Fee | Fee for ending the lease agreement before the term. | Can be substantial, increasing the overall cost. |

| Residual Value Estimate | Estimated value of the vehicle at the end of the lease. | Significant impact on the overall cost and the final payment. |

Financial Modeling and Scenarios

Figuring out if leasing or buying an EV is the better choice involves crunching numbers. This section delves into the financial modeling behind both options, showing you how to calculate total cost of ownership and compare the potential savings of leasing. We’ll look at different lease terms and purchase scenarios, exploring the impact of depreciation and appreciation on the overall cost.Understanding the financial implications is key to making an informed decision.

This involves more than just the initial price; we need to factor in everything from insurance and maintenance to potential resale values. This detailed analysis will help you choose the EV ownership path that aligns best with your budget and financial goals.

Total Cost of Ownership Calculation

Calculating the total cost of ownership (TCO) for both leasing and buying an EV is crucial for comparison. For leasing, the TCO typically includes the lease payments, insurance, maintenance (if covered by the lease), and any fees associated with the lease agreement. For buying, the TCO encompasses the purchase price, insurance, registration fees, maintenance costs, potential fuel costs, and any potential depreciation.

Accurately determining these factors helps in evaluating the long-term financial implications of each option.

Lease vs. Buy Scenarios

Different lease terms and purchase scenarios have distinct financial implications. A shorter lease term might result in lower monthly payments but potentially higher total costs over the lease period. Conversely, a longer lease term could mean higher monthly payments but a lower total cost over the lease period. Similarly, a higher down payment on a purchase might reduce the loan amount but increase the initial investment.

The best choice depends on your individual financial circumstances and needs.

Example: Tesla Model Y

Let’s consider a Tesla Model Y. For illustrative purposes, we’ll assume the following:

- Purchase Scenario: $60,000 price, 5-year loan at 7% interest, $5,000 down payment, estimated annual maintenance cost of $1,000, and potential depreciation of 15% per year.

- Lease Scenario: 36-month lease with a monthly payment of $800, $500 security deposit, estimated annual maintenance cost of $500, and the residual value at the end of the lease is estimated to be 50% of the purchase price.

Calculating the total cost of ownership (TCO) for both options involves several steps: For the purchase, we’d add the loan payments, maintenance, and potential depreciation over the five years. For the lease, we’d sum the lease payments, maintenance, and the security deposit.

| Category | Lease | Purchase |

|---|---|---|

| Monthly Payments | $800 | (Loan payment) |

| Total Lease Payments | $28,800 | (Total loan payments) |

| Maintenance (estimated) | $1,800 | $5,000 |

| Security Deposit | $500 | (Down payment) |

| Residual Value (estimated) | $30,000 | (Estimated resale value) |

| Total Estimated Cost | $31,300 | (Sum of purchase price, loan interest, maintenance, and depreciation) |

Note: The above example is for illustrative purposes only and doesn’t include taxes, insurance, or potential fuel costs. Actual costs may vary.

Appreciation vs. Depreciation, This secret loophole makes leasing an ev better than buying right now

Electric vehicles, like all vehicles, can experience both appreciation and depreciation. Appreciation, an increase in value, is often tied to factors like rarity, limited edition models, or technological advancements. Depreciation, a decrease in value, is more common and influenced by age, mileage, market conditions, and technological obsolescence. Forecasting the future value of an EV is complex and depends on many factors.

Illustrative Examples and Case Studies

Understanding the nuances of EV leasing versus buying requires examining real-world scenarios. This section delves into hypothetical and actual situations, showcasing the factors that drive the decision-making process. From personal experiences to broader market trends, we explore how different lifestyles and driving needs impact the financial choices.

Hypothetical Customer Scenario

A young professional, Sarah, commutes 25 miles daily to work and occasionally travels for weekend getaways. She’s considering a mid-range EV. Leasing offers a lower monthly payment, potentially allowing her to save on a down payment for a future home. However, the accumulated mileage and potential fees for exceeding the agreed-upon limit could impact her overall cost.

The total cost of ownership, including potential maintenance, insurance, and fuel (electricity) costs, would be crucial in her decision. Her budget, lifestyle, and future plans play a significant role in determining the optimal choice.

Real-World Case Studies

Numerous individuals have successfully benefited from EV leasing. One example is a family who leases a larger SUV for their daily needs and occasional road trips. The fixed monthly payments provide predictability, allowing them to budget more efficiently and avoid unexpected repair costs. They may also find the convenience of newer models and warranty coverage attractive. Another example is a business executive who utilizes an EV for both personal and professional use.

The tax incentives and potential business deductions for leased vehicles may make leasing financially beneficial in their situation. These real-world examples underscore the diverse applications and benefits of EV leasing.

EV Model Comparison Table

| EV Model | Lease Price (Monthly) | Buy Price | Estimated Fuel Cost per Year ||—|—|—|—|| Tesla Model 3 Standard Range Plus | $550 | $45,000 | $1,500 || Chevrolet Bolt | $300 | $28,000 | $1,000 || Hyundai Kona Electric | $350 | $30,000 | $1,200 |This table provides a simplified comparison of three popular EV models, highlighting the price difference between leasing and buying.

The estimated fuel cost is a significant factor, varying based on electricity rates and driving habits. Further research into specific lease terms and maintenance costs would be necessary for a comprehensive evaluation.

Impact of Driving Habits

Driving habits play a crucial role in the decision-making process. A frequent traveler with high mileage might find buying a vehicle more economical in the long run, despite the initial investment. On the other hand, someone with lower mileage might find leasing more advantageous, as the monthly payments are lower and potentially easier to budget. A detailed understanding of individual driving patterns is essential.

For instance, someone who primarily commutes short distances might benefit significantly from leasing.

Lease Agreement Clauses

A lease agreement for an EV, like any other vehicle, contains clauses that impact the overall cost and terms. Crucial clauses include mileage restrictions, early termination fees, and maintenance responsibilities. Understanding these clauses before signing the agreement is paramount. For example, exceeding the mileage limit could result in significant additional costs. Careful review of these terms is crucial in determining if leasing is suitable for a specific individual’s needs and financial circumstances.

This secret loophole makes leasing an EV better than buying right now, but it’s not the only thing making me question the status quo. The recent “rage against the apostrophe ban” rage against the apostrophe ban is getting me thinking about how much more impactful subtle shifts in language can be. It’s got me pondering the subtle benefits of leasing an EV, making it even more appealing than I thought!

“A thorough understanding of the lease agreement terms is essential to avoid financial surprises.”

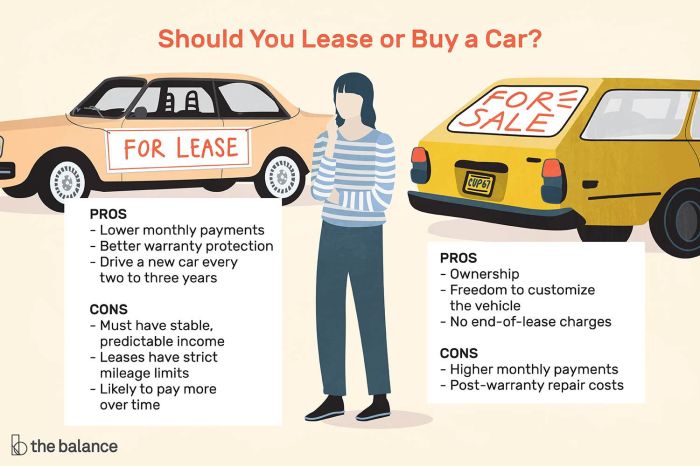

Alternative Perspectives and Considerations

While the “secret loophole” suggests leasing an EV might be financially advantageous in the current market, it’s crucial to acknowledge the potential downsides and long-term implications. A comprehensive analysis necessitates exploring both the benefits and drawbacks of this approach, considering it alongside the traditional purchase option. This section delves into the nuances of leasing EVs, highlighting potential pitfalls and areas requiring careful consideration.

Potential Downsides of EV Leasing

Leasing an EV, like any lease, inherently restricts ownership and control. Customization options are often limited compared to buying. For instance, a buyer might personalize an EV with aftermarket accessories, but a lessee is typically bound by the vehicle’s standard configuration. This could mean missing out on specific features or aesthetic choices desired by the driver. Similarly, the potential for future resale value is significantly diminished compared to a purchased vehicle.

An EV that has been leased and is returned to the leasing company typically has its residual value calculated and factored into the lease payments. This reduced resale value could make future selling more challenging, if you choose to buy a different vehicle later.

Long-Term Implications of Leasing vs. Buying

Beyond initial purchase price considerations, the long-term implications of maintenance differ between leasing and buying. With leasing, routine maintenance is usually handled by the leasing company. However, unexpected repairs or maintenance issues may result in extra charges or delays, depending on the terms and conditions of the lease. Conversely, buying an EV allows you to handle maintenance yourself, potentially saving money in the long run, but you bear the full cost of repairs.

The long-term cost implications of maintenance should be evaluated when comparing the two options.

Comparison with Leasing Other Vehicle Types

Comparing EV leasing to leasing other types of vehicles reveals some interesting insights. While the core principles of leasing (limited ownership, fixed payments) remain consistent, the specific terms and conditions can vary significantly. Factors like mileage restrictions, lease durations, and maintenance responsibilities often differ depending on the type of vehicle and leasing company. Furthermore, the availability of incentives and subsidies can also vary between leasing EVs and other vehicles.

Risks Associated with Mileage Restrictions

Mileage restrictions are a critical aspect of EV leases, especially given the varying driving habits and needs of different individuals. Exceeding the permitted mileage can result in significant penalties. For example, if you frequently drive long distances or have a job requiring extensive commuting, the mileage restrictions might prove problematic. Consider the impact of your daily commute and planned travel on the lease agreement’s limitations.

An inability to meet mileage restrictions could result in substantial extra costs or a termination of the lease agreement.

Pros and Cons of Leasing vs. Buying an EV

| Feature | Leasing | Buying |

|---|---|---|

| Initial Cost | Potentially lower upfront cost | Higher upfront cost |

| Maintenance | Usually handled by the leasing company, but potential for extra charges | Full responsibility for maintenance |

| Customization | Limited customization options | Greater flexibility for customization |

| Resale Value | Lower resale value | Higher resale value (potential) |

| Mileage Restrictions | May impose mileage restrictions | No mileage restrictions |

| Long-term Ownership | Limited ownership | Full ownership |

Final Wrap-Up

In conclusion, while the decision to lease or buy an EV depends on individual circumstances, this analysis reveals a potential “secret loophole” that could make leasing a surprisingly attractive option. Factors like tax incentives, current market conditions, and personal driving habits all play a crucial role in the decision-making process. This comprehensive guide aims to equip you with the knowledge to make an informed choice, considering the potential long-term financial implications of each path.

The key takeaway is to meticulously evaluate your specific situation, understanding both the advantages and disadvantages of each option, before committing to either leasing or purchasing an EV.