SEC companies greenhouse gas pollution climate change risks divulge the growing concern over the environmental impact of financial institutions. This reveals the significant emissions from data centers, transportation, and office operations, highlighting the various methodologies for measuring and reporting these emissions. Comparing different securities company types—investment banks, asset managers, and brokerage firms—shows diverse emission profiles. The article further explores the potential financial risks associated with climate change, including physical risks like extreme weather and transition risks from a shift to a low-carbon economy.

The vulnerabilities of specific sectors within the securities industry are also examined.

This in-depth look at disclosure practices and requirements for greenhouse gas emissions and climate-related risks reveals current standards and potential implications of increased regulations. The impact of climate change on investment portfolios and specific asset classes is assessed, along with the role of securities companies in managing these risks. Furthermore, the initiatives and strategies employed by securities companies to address climate change are detailed, including policies, practices for mitigation, and promotion of sustainable investments.

The potential for future regulations and policies, international agreements, and differing regulatory approaches across countries are also discussed, along with illustrative examples of climate-related risks.

Securities Companies and Greenhouse Gas Emissions

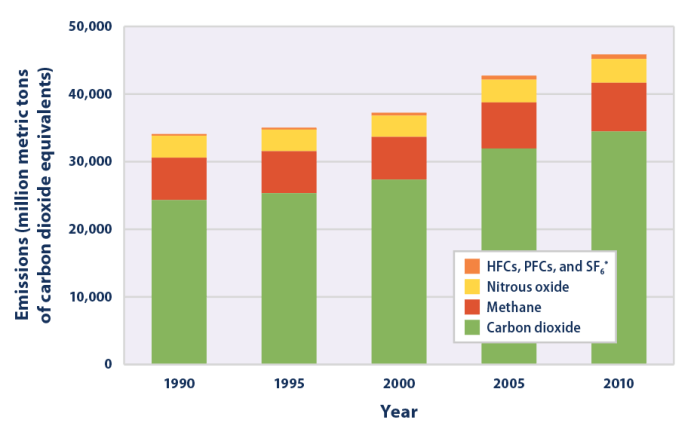

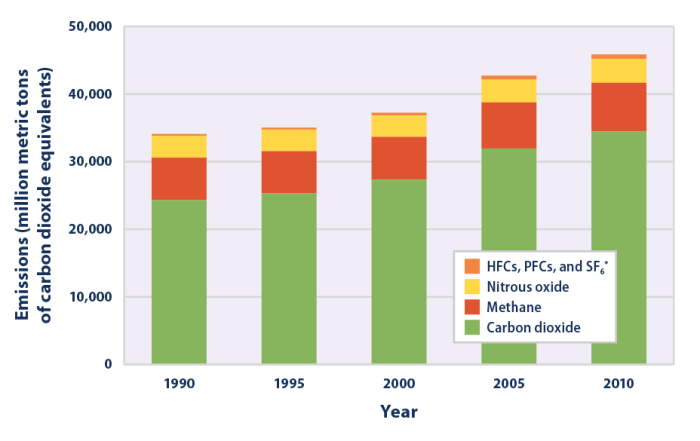

Securities companies, encompassing investment banks, asset managers, and brokerage firms, play a significant role in the global financial system. However, their operations, like any significant industry, contribute to greenhouse gas emissions. Understanding these emissions is crucial for assessing the industry’s environmental impact and developing strategies for mitigating its contribution to climate change. This analysis delves into the various sources of emissions within the securities industry, highlighting the methodologies used for measurement and reporting.

It also compares the emission profiles of different types of securities firms.The securities industry’s operations, spanning from data center functions to trading floor activities and office operations, generate greenhouse gas emissions. These emissions stem from a variety of sources, including energy consumption for data centers, transportation of personnel and assets, and energy usage in office buildings. Understanding and quantifying these emissions is critical for implementing sustainable practices and setting emission reduction targets.

Greenhouse Gas Emission Sources in Securities Companies

Securities companies’ emissions originate from multiple sources, each contributing to their overall carbon footprint. Data centers, critical for processing transactions and storing vast amounts of financial data, are significant energy consumers. Transportation, encompassing employee commutes, delivery of securities, and travel for business purposes, is another significant contributor. Office operations, including lighting, heating, cooling, and equipment use, also generate emissions.

- Data Centers: Data centers are essential for the functioning of modern securities firms, housing servers and other equipment for processing financial transactions and storing data. These facilities often rely heavily on energy-intensive cooling systems and require significant power to operate, thus contributing substantially to a company’s carbon footprint.

- Transportation: The movement of employees, securities, and other assets significantly contributes to emissions. Frequent business travel, vehicle use for deliveries, and employee commutes all release greenhouse gases. Efficient logistics and alternative transportation methods can substantially reduce these emissions.

- Office Operations: Office buildings consume substantial energy for lighting, heating, cooling, and running various office equipment. Energy-efficient building design, renewable energy adoption, and optimized energy usage within offices can dramatically reduce the emissions from this source.

Methodologies for Measuring and Reporting Emissions

Several methodologies exist for measuring and reporting greenhouse gas emissions from securities firms. These methodologies provide a framework for accurate accounting and comparison. The most common approaches include the Greenhouse Gas Protocol, which provides standardized frameworks for calculating emissions. The use of these methodologies allows for consistent and comparable reporting across the industry.

- Greenhouse Gas Protocol: The Greenhouse Gas Protocol, a widely recognized standard, offers a comprehensive framework for organizations to account for their greenhouse gas emissions. It provides standardized methodologies for calculating emissions from various sources, facilitating accurate measurement and reporting. This methodology is widely adopted by securities firms for compliance and transparency.

Comparison of Emission Profiles Across Securities Firms

The emission profiles of different types of securities companies vary depending on their specific operations. Investment banks, asset managers, and brokerage firms have different characteristics that impact their emission levels. Investment banks, with their extensive trading activities, may exhibit higher transportation emissions compared to asset managers who primarily focus on managing portfolios. Brokerage firms, with their focus on facilitating trades, may have a diverse emission profile depending on their operational infrastructure and the type of activities they support.

| Company Type | Primary Emission Sources | Potential Mitigation Strategies |

|---|---|---|

| Investment Banks | Data centers, extensive trading, frequent business travel | Improved data center efficiency, use of electric vehicles, and sustainable travel options. |

| Asset Managers | Data centers, office operations, limited trading activities | Energy-efficient data centers, renewable energy adoption, and optimized office operations. |

| Brokerage Firms | Data centers, office operations, transaction processing, client interactions | Energy-efficient infrastructure, sustainable transportation for clients, and reduced paper usage. |

Climate Change Risks and Financial Institutions

The financial sector is increasingly recognizing the profound implications of climate change, with securities companies facing a complex web of potential risks. These risks are not merely theoretical; they represent tangible threats to profitability, operational stability, and even the very survival of institutions. Understanding these risks is crucial for navigating the transition to a low-carbon economy and ensuring long-term resilience.Securities companies, acting as intermediaries in the financial system, are uniquely positioned to experience both physical and transition risks stemming from climate change.

The increasing frequency and intensity of extreme weather events, coupled with the evolving regulatory landscape, are transforming the operational landscape for these companies. These risks necessitate a proactive and integrated approach to risk management and investment strategies.

Potential Financial Risks

Securities companies face a multifaceted array of financial risks associated with climate change. These risks stem from both the direct impacts of climate-related events and the broader systemic shifts in the global economy. The inherent interconnectedness of the financial system means that risks impacting one sector can quickly ripple through others, requiring a holistic perspective on risk assessment and mitigation.

Impact of Climate-Related Physical Risks

Extreme weather events, such as floods, droughts, wildfires, and storms, can directly disrupt securities company operations and damage assets. For example, a major hurricane could severely impact a company’s physical infrastructure, including data centers and trading floors, leading to operational downtime and significant financial losses. Furthermore, climate-induced damage to assets held by the companies’ clients can trigger defaults and losses on investment portfolios.

These physical risks are not isolated events; they are increasingly becoming a regular feature of the financial landscape.

Securities companies are finally starting to disclose their greenhouse gas pollution and climate change risks, which is a positive step. This transparency is crucial, but it’s also interesting to see how companies are innovating in other areas. For example, Amazon’s new palm recognition payment technology in Seattle stores, amazon one seattle stores palm recognition payment technology , raises questions about data privacy and security.

Ultimately, though, the focus needs to return to the crucial issue of sec companies being transparent about their environmental impact.

Transition Risks

The shift towards a low-carbon economy necessitates a fundamental re-evaluation of investment strategies. Securities companies holding investments in fossil fuel-intensive industries face potential losses as governments and markets transition away from these sectors. Conversely, investments in renewable energy and sustainable technologies offer potential growth opportunities, but also require careful due diligence and a robust understanding of the evolving regulatory environment.

Transition risks highlight the need for companies to actively adapt their portfolios to align with a sustainable future.

Sector-Specific Vulnerabilities

Different sectors within the securities industry exhibit varying degrees of vulnerability to climate change impacts. For instance, investment banks and asset managers dealing with infrastructure projects face heightened risks due to potential disruptions in project timelines and cost overruns caused by climate-related events. Similarly, companies specializing in real estate and insurance face significant physical risks associated with rising sea levels and extreme weather events.

Table of Climate-Related Financial Risks

| Risk Category | Description | Examples |

|---|---|---|

| Physical Risks | Direct impacts of climate events on operations and assets. | Hurricane damage to data centers, disruption of supply chains, stranded assets |

| Transition Risks | Risks associated with the shift to a low-carbon economy. | Declining value of fossil fuel investments, stranded assets, increasing regulatory pressure |

| Reputational Risks | Damage to brand image due to perceived lack of climate action. | Negative publicity, loss of investor confidence, regulatory sanctions |

| Regulatory Risks | Changes in policies and regulations impacting business operations. | Carbon pricing mechanisms, stricter environmental regulations, new disclosure requirements |

Disclosure Practices and Requirements

The financial sector’s role in mitigating climate change is increasingly recognized, prompting a need for transparency in how securities companies manage and disclose their exposure to climate-related risks. This necessitates clear and consistent disclosure practices to allow investors, regulators, and the public to assess the climate-related financial risks of these companies. Robust disclosure frameworks will encourage better risk management and ultimately contribute to a more sustainable financial system.Current disclosure requirements for greenhouse gas emissions and climate-related risks for securities companies are still evolving and vary significantly across jurisdictions.

Sec companies are finally starting to divulge the greenhouse gas pollution and climate change risks they face. This is a huge step, but it’s also a chance for investors to better understand the true financial impact of these issues. Fortunately, there are tools like launch center pro ios icon customization shortcuts to help us manage our increasingly complex financial lives and make better-informed decisions.

Understanding these risks is crucial, and the SEC’s new transparency is a positive step forward for the future of responsible investment.

The lack of standardized reporting globally makes it difficult to compare performance and identify trends. However, the trend is towards greater stringency and detail in the coming years.

Current Disclosure Requirements

Global regulatory bodies are working to establish common standards for climate-related disclosures. These requirements cover various aspects, including greenhouse gas emissions, climate-related financial risks, and strategies to address those risks. Different jurisdictions are adopting various approaches, leading to diverse disclosure practices.

Examples of Current Disclosures

Some securities companies are already proactively disclosing their greenhouse gas emissions and climate-related risks. These disclosures often include data on emissions from their operations, investments, and portfolio companies. Furthermore, some firms are outlining their strategies for managing climate-related risks, such as transitioning to low-carbon investments or integrating climate considerations into their investment processes. This proactive approach demonstrates a commitment to sustainability and transparency.

Jurisdictional Comparisons

Disclosure practices vary widely across different jurisdictions and regulatory bodies. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) framework, though not legally mandated everywhere, provides a widely recognized framework for voluntary disclosure. The EU’s Sustainable Finance Disclosure Regulation (SFDR) is an example of a mandatory regulation impacting disclosures for financial institutions.

Key Differences in Disclosure Standards

| Country/Region | Key Disclosure Standards | Focus |

|---|---|---|

| United States | Voluntary disclosures, with some mandatory elements in certain jurisdictions. Growing emphasis on TCFD alignment. | Focus on transparency and consistent reporting methods |

| European Union | Mandatory disclosures under SFDR, focusing on ESG factors, including climate-related risks. | Mandatory compliance with EU-wide regulations |

| United Kingdom | Increasingly stringent disclosures, with strong focus on TCFD alignment. | Emphasis on aligned disclosure practices with international standards |

| Japan | Voluntary disclosures with growing emphasis on climate-related risks. | Transition towards more comprehensive disclosures, including climate-related risks |

Implications of Increasing Disclosure Requirements

Increasing disclosure requirements for securities companies will likely lead to several implications. These include greater transparency in the financial sector, which in turn fosters trust and confidence among investors. Furthermore, it may drive the development of new climate-focused investment products and strategies. Companies not complying could face reputational damage and potential legal challenges. Lastly, it may also encourage securities companies to improve their environmental performance and reduce their greenhouse gas emissions.

Analyzing the Impact of Climate Change on Securities Investments

Climate change is no longer a distant threat; its tangible effects are increasingly impacting global economies and investment portfolios. Understanding how climate change influences various asset classes is crucial for investors and securities companies alike. This analysis delves into the multifaceted ways climate change affects investments, outlining potential risks and strategies for mitigation.The financial sector is directly exposed to the physical and transition risks associated with climate change.

Physical risks, such as extreme weather events and rising sea levels, can directly damage assets and disrupt operations. Transition risks, arising from the shift to a low-carbon economy, can lead to stranded assets and changes in market dynamics. Securities companies must proactively address these risks to safeguard their investment portfolios and ensure long-term value.

Impact on Investment Portfolios

Climate change’s influence extends across diverse asset classes, impacting their intrinsic value and future profitability. Extreme weather events, such as hurricanes, floods, and wildfires, can cause substantial physical damage to real estate, infrastructure, and industrial facilities, leading to losses and disruptions in operations. These events are becoming more frequent and intense, increasing the frequency and severity of such losses.

Potential Effects on Asset Classes

The value of various asset classes is vulnerable to climate change impacts. For instance, real estate in coastal regions faces heightened risks from sea-level rise and storm surges. Similarly, agricultural assets are affected by changing weather patterns, impacting crop yields and livestock production. Energy companies, heavily reliant on fossil fuels, face significant transition risks as the global economy shifts towards renewable energy sources.

These shifts can lead to a decline in demand for certain assets, potentially affecting their market value.

Role of Securities Companies in Assessing and Managing Risks, Sec companies greenhouse gas pollution climate change risks divulge

Securities companies play a pivotal role in identifying, assessing, and mitigating climate-related risks within their investment portfolios. Comprehensive due diligence is crucial to evaluate the exposure of holdings to climate-related threats. This involves analyzing companies’ climate-related strategies, reporting practices, and resilience plans. Companies demonstrating strong sustainability practices and clear climate risk management strategies can be viewed as more resilient investments.

Securities firms should incorporate climate considerations into their investment research, risk management frameworks, and portfolio construction processes.

Strategies for Incorporating Climate Considerations

Incorporating climate considerations into investment decisions requires a multifaceted approach. This includes integrating climate-related financial disclosures into investment analysis. Portfolio diversification into companies with strong environmental, social, and governance (ESG) profiles can help reduce climate-related risks. Furthermore, engaging with companies on their climate strategies and promoting sustainable practices are vital components of responsible investment. Finally, actively seeking investments in companies that are developing and deploying climate solutions can be a key strategy.

Potential Impacts of Climate Change on Investment Sectors

| Investment Sector | Potential Impacts |

|---|---|

| Real Estate (Coastal Properties) | Decreased property values, increased insurance premiums, potential physical damage from sea-level rise and storms. |

| Agriculture | Decreased crop yields, livestock losses, increased input costs due to changing weather patterns. |

| Energy (Fossil Fuels) | Decreased demand, stranded assets, transition risks, higher compliance costs. |

| Infrastructure | Damage from extreme weather events, increased maintenance costs, potential disruption to supply chains. |

| Insurance | Increased claims frequency and severity, potential for substantial financial losses, disruption in pricing models. |

Securities Companies’ Response to Climate Change

Securities firms are increasingly recognizing the significant financial risks associated with climate change. This recognition translates into a growing commitment to incorporate climate considerations into their operations, investment strategies, and disclosures. Their responses range from adopting specific policies to promoting sustainable investments. This shift underscores a crucial role for the industry in mitigating the broader impact of climate change.Securities firms are taking a proactive approach to managing climate-related risks and opportunities.

They understand that neglecting these issues could expose them to substantial financial losses and reputational damage. This proactive stance reflects a growing understanding of climate change’s impact on asset values, operational efficiency, and overall market stability.

Climate-Related Risk Management Policies

Securities firms are implementing policies and practices to assess, manage, and mitigate climate-related financial risks. These policies cover a broad spectrum, from investment strategies to operational procedures. A key element is incorporating climate change into the firm’s overall risk management framework. This means actively monitoring and analyzing climate-related risks and opportunities across the entire investment portfolio.

Sustainable Investment Strategies

Securities companies are increasingly promoting and facilitating sustainable investments. This involves actively seeking out and supporting companies with strong environmental, social, and governance (ESG) profiles. They are also offering a wider range of sustainable investment products and services to meet investor demand. These initiatives are not merely altruistic; they are also driven by a recognition of the long-term financial value associated with sustainable practices.

Examples include green bonds, sustainable funds, and impact investing strategies.

Greenhouse Gas Emissions Reduction Initiatives

Securities firms are recognizing the need to reduce greenhouse gas emissions within their own operations. This includes energy efficiency measures, renewable energy adoption, and carbon offsetting programs. By reducing their own environmental footprint, they are setting an example for other businesses and investors. Quantifiable targets and ongoing reporting are crucial components of these initiatives. For example, some firms are setting specific goals for reducing energy consumption or transitioning to renewable energy sources.

Sec companies are finally starting to divulge their greenhouse gas pollution and climate change risks, a crucial step in holding them accountable. Meanwhile, the Nothing phone 1 design reveal gives us our best look yet at the device, showcasing a sleek and modern aesthetic. This transparency from corporations about environmental risks is vital for creating a more sustainable future, which ultimately helps everyone, including the creators of innovative tech like the Nothing phone 1.

Specific Policies and Practices

- Many firms are integrating climate-related factors into their investment analysis, incorporating ESG factors into portfolio construction and management decisions. This ensures that investments align with long-term sustainability goals.

- Specific policies for evaluating the climate-related risks and opportunities of potential investments, focusing on companies’ carbon emissions, resource use, and environmental compliance.

- Implementing strategies for divesting from companies with high carbon footprints or unsustainable practices, aligning portfolios with sustainability goals.

- Promoting sustainable finance by offering green bonds, sustainability-linked loans, and other climate-friendly investment products to investors.

Promoting Sustainable Investments

A growing number of securities companies are actively supporting sustainable investments. This commitment goes beyond simply including ESG factors in their investment analysis; it involves actively seeking out and supporting companies with strong environmental, social, and governance (ESG) profiles. This includes investing in renewable energy, sustainable agriculture, and other environmentally conscious industries.

Strategies for Reducing Greenhouse Gas Emissions

Securities companies are actively seeking to reduce their own greenhouse gas emissions. This involves implementing various strategies, including improving energy efficiency in their operations, transitioning to renewable energy sources, and implementing carbon offsetting programs. Such actions help demonstrate a commitment to environmental sustainability and set an example for the broader financial industry.

Summary Table of Initiatives

| Securities Company | Key Initiatives |

|---|---|

| Company A | Developed a comprehensive climate risk assessment framework; Implemented sustainable investment guidelines; Set targets for reducing operational emissions. |

| Company B | Integrated ESG factors into investment analysis; Launched a dedicated sustainable investment fund; Partnered with environmental organizations to promote sustainable practices. |

| Company C | Established a climate change task force; Developed a climate-related disclosure policy; Implemented energy efficiency measures within its offices. |

Potential for Future Regulation and Policies

The financial sector’s response to climate change is rapidly evolving, driven by increasing awareness of the risks associated with greenhouse gas emissions and the need for a more sustainable global economy. Securities companies are increasingly recognizing the need to adapt to future regulatory frameworks that will likely address climate change impacts on their operations and investment strategies. This evolution requires a proactive understanding of potential regulatory trends and the approaches different countries are taking.Future regulations are expected to encompass a wide range of actions, including mandatory disclosures, stricter standards for investment practices, and potentially even carbon pricing mechanisms.

This proactive approach will likely be globally coordinated, but national variations in implementation are also expected, leading to an intricate and nuanced regulatory landscape for securities companies.

Potential Regulatory Trends

The future regulatory landscape for securities companies concerning climate change is expected to feature a shift from voluntary disclosures to mandatory ones. This trend is driven by the growing understanding of climate change’s financial implications. Additionally, a heightened focus on environmental, social, and governance (ESG) factors is anticipated to influence investment strategies and portfolio allocations. This includes not just the environmental aspects but also social and governance implications of investments.

International Agreements and Initiatives

Numerous international agreements and initiatives are influencing the regulatory response to climate change. The Paris Agreement, for example, sets a global framework for reducing greenhouse gas emissions, and this framework is influencing national policies. Other international initiatives, such as the Task Force on Climate-related Financial Disclosures (TCFD), are also shaping disclosure requirements and standards for companies globally.

Comparison of Regulatory Approaches Across Countries

Regulatory approaches to climate change risks vary significantly across countries. Some nations, like the EU, have adopted comprehensive frameworks with mandatory disclosure requirements and incentives for sustainable investments. Other countries may adopt a more gradual approach, focusing on voluntary initiatives and industry best practices. The differences are partly due to varying levels of economic development, political priorities, and national regulatory traditions.

Differences in economic conditions, political agendas, and legal systems all play a role in how individual countries approach climate change regulation.

Potential Regulatory Actions Affecting Securities Companies

| Regulatory Action | Description | Potential Impact on Securities Companies |

|---|---|---|

| Mandatory Climate-Related Disclosures | Securities companies required to disclose their climate-related risks and opportunities. | Increased reporting burden, need for robust data collection and analysis, potential for increased transparency and investor trust. |

| Carbon Pricing Mechanisms | Implementation of carbon taxes or emissions trading schemes. | Potential for increased costs of operations and investments, need for adjustments to pricing models and risk assessments. |

| Sustainable Investment Requirements | Regulations incentivizing or mandating sustainable investments. | Shift in investment strategies, need for new product development and portfolio management approaches, potential for increased demand for sustainable investments. |

| Restrictions on High-Carbon Investments | Limits on investments in high-carbon industries. | Changes to investment portfolios, need for diversification strategies, and potentially reduced returns from certain sectors. |

| Climate-Change Stress Testing | Requiring companies to assess their vulnerability to climate change impacts. | Need for advanced risk management frameworks, potentially leading to higher capital requirements and revised financial models. |

Illustrative Examples of Climate-Related Risks: Sec Companies Greenhouse Gas Pollution Climate Change Risks Divulge

Climate change is no longer a distant threat; its effects are already being felt across various sectors, including the financial industry. Securities companies face a multitude of climate-related risks, from extreme weather events disrupting operations to the changing valuations of entire industries. Understanding these risks is crucial for navigating the challenges ahead and building resilience.

Impact of Extreme Weather Events on Securities Company Assets and Operations

Extreme weather events, like hurricanes, floods, and wildfires, can directly damage physical assets crucial to securities companies. For example, a major hurricane could severely disrupt trading operations in a coastal city, leading to significant downtime and lost revenue. Furthermore, damage to data centers, which are critical for maintaining trading systems and storing sensitive information, can lead to substantial financial losses.

Such disruptions can also affect the ability of securities companies to service their clients effectively. Consider the case of a major earthquake in a financial hub – the disruption of essential infrastructure could have cascading effects on the entire securities industry.

Climate Change Impacts on the Valuation of Particular Sectors

Climate change significantly impacts the valuation of various sectors. The insurance industry, for example, faces increasing claims related to climate-related disasters. Rising sea levels and increased frequency of extreme weather events could negatively affect the profitability and value of insurance companies, as well as other related financial institutions. Similarly, the energy sector is undergoing a fundamental shift.

The transition to renewable energy sources is impacting traditional fossil fuel companies’ valuations, potentially leading to significant losses for investors in these companies. A shift in government policies towards sustainability and decarbonization can also significantly alter valuations and market share in the energy sector.

Financial Risks Related to Climate Change

Climate change presents significant financial risks that securities companies need to assess and mitigate. For example, consider a company heavily invested in coal-fired power plants. A shift to renewable energy sources and stricter environmental regulations could severely impact the value of these investments, leading to losses for investors. Furthermore, the increasing frequency of extreme weather events could lead to significant claims against insurers, potentially impacting their financial stability and the stability of the entire financial system.

Another scenario involves a real estate company with properties in flood-prone areas. Increased flood risk could lead to significant losses from property damage and reduced property values, impacting the company’s profitability and overall value.

Conclusive Thoughts

In conclusion, the SEC companies greenhouse gas pollution climate change risks divulge a critical intersection of finance and environmental sustainability. The article demonstrates the multifaceted nature of climate-related risks and the need for greater transparency and proactive measures within the securities industry. The analysis underscores the potential for significant financial impacts and the importance of incorporating climate considerations into investment decisions.

The evolving regulatory landscape and the crucial role of securities companies in promoting a sustainable future are also highlighted. Further research is encouraged to understand the implications of these findings and their impact on investment strategies.