Save on food travel and more how to maximize the chase sapphire preferred card – Save on food, travel, and more with the Chase Sapphire Preferred Card. This guide dives deep into maximizing rewards, from understanding the card’s benefits to strategic travel planning and optimizing everyday spending. We’ll explore how to earn maximum value from this popular card, and even touch on the crucial elements of responsible credit card usage.

This comprehensive guide will walk you through maximizing the Chase Sapphire Preferred Card for travel, dining, and everyday spending. We’ll look at earning rates, redemption options, and strategies for getting the most out of this versatile credit card.

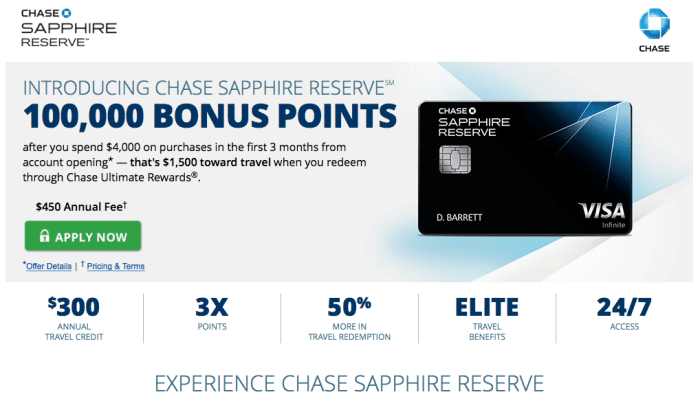

Understanding the Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card is a popular choice for travelers and those seeking robust rewards. It offers a compelling combination of travel benefits, flexible rewards, and excellent earning potential. Understanding its intricacies can help you maximize your rewards and make the most of your spending.The Chase Sapphire Preferred Card provides a broad range of benefits, including generous travel rewards, valuable dining and grocery earning rates, and potential for significant savings through smart spending and redemption strategies.

It’s designed to appeal to individuals who frequently dine out, shop for groceries, or travel. However, its annual fee should be carefully considered alongside potential benefits to ensure it aligns with your spending habits.

Rewards Structure and Travel Perks

The card’s rewards structure centers around earning points that can be redeemed for travel, merchandise, or statement credits. These points are typically earned at a fixed rate on various spending categories. Points earned on travel, dining, and grocery purchases can be redeemed for flights, hotels, or experiences.

Comparison with Similar Cards

Compared to other premium travel cards, the Chase Sapphire Preferred Card stands out for its balance of rewards, flexibility, and features. While some cards might offer higher earning rates on specific categories, the Sapphire Preferred’s broad earning potential across various spending areas makes it versatile. For example, its consistent earning rates on travel and dining provide a predictable reward system, unlike cards that focus on one particular spending category.

However, some competitors may offer exclusive perks or broader redemption options for certain travel partners.

Annual Fee and Redemption Options

The annual fee for the Chase Sapphire Preferred Card is a significant factor to consider. The cost should be weighed against the potential value of rewards earned and travel benefits. The fee is typically offset by strategic spending, maximizing rewards, and smart redemption choices. Points can be redeemed for travel through various portals, gift cards, or statement credits.

Saving on food and travel expenses? Maximizing your Chase Sapphire Preferred card rewards is key. But did you know a cool gadget like the Google Pixel 3 XL stand wireless charging assistant google pixel 3 xl stand wireless charging assistant can also help you save time and energy? While it’s great for charging your phone, you’ll want to consider how the card’s travel and dining perks can make your everyday life more efficient.

It’s all about making the most of your rewards and simplifying your routine, right? Focusing on maximizing your card’s potential will ultimately save you more in the long run.

The availability and value of redemption options are crucial factors in determining the card’s overall value.

Earning Rates and Spending Categories

The card’s earning rates vary based on spending categories. This provides flexibility for maximizing rewards. For instance, earning 3 points per dollar on travel and dining allows users to accumulate points rapidly when traveling or dining out. Earning 2 points per dollar on grocery purchases allows users to accumulate rewards on essential daily expenses. Understanding these rates is key to maximizing the card’s benefits.

Key Terms and Definitions

| Term | Definition |

|---|---|

| Rewards Points | Points earned on eligible spending that can be redeemed for travel, merchandise, or statement credits. |

| Travel Credits | A type of reward that can be used for travel expenses, such as flights or hotel stays. |

| Annual Fee | A yearly charge associated with the credit card. |

| Redemption Options | Methods for converting earned points into travel, merchandise, or other rewards. |

| Spending Categories | Specific types of spending that earn different reward rates. |

Maximizing Travel Benefits

Unlocking the full potential of your Chase Sapphire Preferred card for travel rewards requires strategic planning and smart booking techniques. This guide delves into actionable steps to maximize your travel rewards, ensuring you get the most bang for your buck on every trip.Understanding the intricacies of travel reward programs and utilizing the card’s benefits is key to transforming your travel experiences into more rewarding ones.

By applying the strategies discussed here, you can optimize your travel plans and potentially save substantial amounts of money.

Booking Strategies for Maximum Rewards

Strategic booking is crucial for maximizing travel rewards. Consider these tips to ensure you’re getting the best value. Look for travel portals that offer a wider array of options and potentially better deals, like the Chase travel portal, and compare them to other popular booking sites. Checking for discounts and promotions, particularly around popular travel dates, can significantly reduce your expenses.

Leveraging Travel Rewards Redemption Methods

The Chase Sapphire Preferred card offers flexibility in redeeming your travel rewards. You can redeem points for flights, hotels, or vacation packages through the Chase travel portal. Consider booking flights and hotels through the Chase portal to leverage any potential bonus points or discounts. Explore various redemption options to tailor your trip to your specific needs and preferences.

Resources for Finding the Best Travel Deals

Finding the best travel deals requires consistent effort and research. Utilize these resources to unearth hidden gems and maximize your savings:

- Travel comparison websites: Kayak, Skyscanner, Google Flights allow you to compare prices across multiple airlines and hotels, potentially saving you money on flights and accommodations.

- Travel blogs and forums: These platforms often feature insider tips and tricks for finding great deals, along with user reviews of destinations and hotels.

- Airline and hotel loyalty programs: If you frequently travel with specific airlines or stay in particular hotel chains, consider joining their loyalty programs. They often offer exclusive deals and benefits.

- Travel newsletters and alerts: Sign up for newsletters from travel agencies, airlines, and hotels to stay informed about exclusive deals and promotions.

Utilizing Travel Insurance and Protections

The Chase Sapphire Preferred card offers valuable travel insurance and protections. Be sure to understand the coverage offered, including trip cancellations, delays, and medical emergencies. Carefully review the terms and conditions of the insurance to ensure you’re fully protected for your specific needs.

Comparison of Travel Booking Platforms

Comparing different travel booking platforms is vital for optimal reward redemption. This table illustrates potential rewards programs and other features:

| Platform | Rewards | Pros | Cons |

|---|---|---|---|

| Expedia | Potentially integrates with Chase Ultimate Rewards, allowing for point redemption. | Wide selection of accommodations and flights. Often good deals on packages. | Rewards programs may be less comprehensive compared to dedicated travel portals. |

| Booking.com | Generally doesn’t directly integrate with Chase Ultimate Rewards, requiring extra steps to redeem. | Excellent selection of hotels, particularly boutique or smaller hotels. Excellent user interface. | Redemption process may not be as straightforward as using the Chase travel portal. |

Optimizing Food and Other Spending: Save On Food Travel And More How To Maximize The Chase Sapphire Preferred Card

Unlocking the full potential of your Chase Sapphire Preferred card goes beyond travel. Savvy spending habits in everyday categories like dining and groceries can significantly boost your rewards. This section delves into practical strategies to maximize your earnings in these areas.This section details how to strategically use your Chase Sapphire Preferred card for everyday purchases, focusing on maximizing rewards in key spending categories.

We’ll explore techniques for earning rewards on dining, takeout, groceries, and other everyday purchases, ultimately boosting your overall value from the card.

Dining Out Strategically

Restaurants frequently offer loyalty programs or discounts. Leveraging these alongside your Chase Sapphire Preferred card can significantly increase your rewards. Consider checking for restaurant partnerships with specific credit card programs. For instance, some restaurants may offer exclusive discounts or promotions to cardholders. If you’re a frequent diner at a particular establishment, look into their rewards programs.

Maximizing Takeout Rewards

Ordering takeout frequently? Use your Chase Sapphire Preferred card for these purchases to earn rewards. Many online food delivery platforms allow you to link your credit card for easy ordering and automatic reward application. This streamlined approach minimizes the risk of human error when entering payment information. Consider comparing the rewards programs of different delivery services.

Grocery Shopping Strategies

Grocery shopping is a significant expense. Utilize your Chase Sapphire Preferred card for these purchases to earn rewards on everyday essentials. Look for grocery stores that participate in credit card reward programs. Many grocery chains have their own reward programs that can be combined with the Chase Sapphire Preferred card. Some grocery stores offer exclusive discounts or promotions for cardholders.

Restaurant Rewards Comparison

| Restaurant | Rewards | Benefits |

|---|---|---|

| XYZ Restaurant | 5% back on all orders, points for each dollar spent. | Frequent diner discounts, birthday bonuses. |

| ABC Restaurant | 10% off on Tuesdays, rewards points for referrals. | Discounts for large groups, free appetizer on birthday. |

| Taco Loco | 1 point for every dollar spent, point multipliers on certain days. | Free drink with purchase of entree, early bird specials. |

Note that reward structures and benefits can change. Always check the latest details on the restaurant’s website or app.

Value Across Spending Categories

The Chase Sapphire Preferred card’s rewards program isn’t limited to dining. You can leverage it for various purchases like entertainment, shopping for household goods, and more. Consider your spending patterns and seek opportunities to apply the card in areas where you already spend regularly. This allows you to accumulate rewards incrementally on purchases you would make anyway.

Saving on food and travel is key, and maximizing the Chase Sapphire Preferred card is a great way to do it. But, if you’re currently experiencing issues with YouTube’s sidebar, settings, account switching, or sign-in, check out this helpful guide on youtube sidebar outage settings account switch sign in to get those issues resolved. Once you’ve got your YouTube sorted, remember those travel and dining rewards are still waiting to be unlocked with your Chase Sapphire Preferred card!

Sample Budget Plan for Reward Maximization

A well-structured budget can effectively guide your spending habits to maximize rewards.

Allocate a portion of your budget to specific categories where you can use your Chase Sapphire Preferred card. For example, designate a certain amount for dining out, groceries, and other eligible expenses. This allows you to proactively plan your spending and earn rewards on purchases you’re already making.

Responsible Credit Card Use

Maximizing the benefits of your Chase Sapphire Preferred card hinges not just on savvy spending but also on responsible credit card management. Understanding the potential pitfalls of credit card debt and the importance of building a strong credit history is crucial for long-term financial well-being. This section delves into the practical aspects of responsible credit card use, empowering you to leverage your card effectively without jeopardizing your financial future.

The Importance of Budgeting

Effective credit card management begins with a well-defined budget. A budget acts as a roadmap for your spending, ensuring that your credit card use aligns with your financial goals. Without a budget, it’s easy to overspend and fall into debt, hindering the ability to maximize rewards and benefits.

Strategies for Avoiding Credit Card Debt

One of the most significant risks associated with credit cards is the potential for accumulating debt. Uncontrolled spending can quickly lead to financial strain and damage your credit score. A proactive approach to avoiding debt involves careful spending habits, consistent monitoring of your spending, and the ability to prioritize needs over wants.

Building and Maintaining a Good Credit Score

A strong credit score is essential for various financial opportunities, including securing loans, renting an apartment, and even getting favorable interest rates on credit cards. A good credit score reflects responsible financial behavior, indicating to lenders that you are a reliable borrower. Paying your bills on time and keeping your credit utilization low are key components in maintaining a healthy credit score.

Effective Strategies for Managing Credit Card Spending

Effective credit card spending management requires a multi-faceted approach. This includes tracking spending meticulously, setting realistic spending limits, and establishing a system for categorizing your transactions. It’s essential to review your statements regularly to identify any unauthorized charges or errors, ensuring the accuracy of your transactions.

Creating a Personalized Spending Plan

A personalized spending plan acts as a customized strategy for managing your credit card spending. It takes into account your income, expenses, and financial goals, outlining how you’ll use your credit card responsibly. This plan should be flexible and adaptable to changes in your financial circumstances.

-

Income Analysis: Determine your monthly income from all sources. This includes salary, investments, and any other income streams.

-

Expense Categorization: Categorize all your expenses into essential (housing, utilities, food) and discretionary (entertainment, dining out, shopping). This helps you identify areas where you can cut back if needed.

Saving on food and travel expenses is key, and maximizing the Chase Sapphire Preferred card rewards is a great way to do it. While the recent NY State Senate approval of a crypto mining moratorium ( ny state senate approves crypto mining moratorium ) might seem unrelated, it highlights the ever-evolving financial landscape. Ultimately, understanding these trends and strategically using credit card perks like the Sapphire Preferred card will continue to help you save and get the most out of your money.

-

Credit Card Spending Limits: Establish a maximum spending limit for your credit card based on your budget. Avoid exceeding this limit to prevent overspending.

-

Debt Repayment Schedule: Create a plan for repaying any existing debt, prioritizing high-interest debts. This will minimize interest charges and reduce the overall debt burden.

-

Emergency Fund Allocation: Allocate a portion of your income to build an emergency fund. This provides a safety net for unexpected expenses and avoids using your credit card for emergencies.

-

Regular Review and Adjustment: Regularly review and adjust your spending plan to accommodate changes in income, expenses, and financial goals. Life circumstances often change, so a flexible approach is key.

Illustrative Scenarios

Putting the Chase Sapphire Preferred card to work isn’t just about understanding the terms; it’s about seeing how it can benefit your everyday life. Let’s look at some practical examples of how you can maximize rewards and save money.Using the card strategically can significantly boost your rewards, from travel perks to everyday savings. These examples highlight how to make the most of the card’s features.

Vacation Rewards

Planning a trip to the sunny beaches of Florida? Imagine booking a flight and hotel stay using the Chase Sapphire Preferred card. For a trip costing $3,000, you earn 3 points per dollar spent. This translates to 9,000 bonus points, which could be redeemed for travel. Assuming a travel partner, and an extra $500 spent on experiences (activities, restaurants), you would accumulate 8,500 points.

Total points earned: 17,500.

Maximizing Rewards on Shopping Trips

Grocery shopping doesn’t have to be a drag on your wallet. Use the card for your weekly supermarket runs to earn 3 points per dollar spent. Let’s say you spend $200 on groceries. That earns you 600 points. Combining this with a $50 purchase of household essentials, you earn an additional 150 points.

The total points for your shopping trip: 750.

Everyday Spending Savings

The Chase Sapphire Preferred card isn’t just for vacations; it can also save you money on everyday expenses. Let’s say you use the card for bills, gas, and other routine spending. If you pay your bills of $1,000 monthly using this card, you earn 3000 points. By combining this with your $50 weekly gas purchases, which amounts to 150 points per week (or 600 per month), your total monthly points earned: 3600.

Visual Representation of Rewards, Save on food travel and more how to maximize the chase sapphire preferred card

| Month | Points Earned (Groceries) | Points Earned (Travel) | Total Points Earned |

|---|---|---|---|

| June | 750 | 9,000 | 9,750 |

| July | 600 | 8,500 | 9,100 |

| August | 700 | 9,200 | 9,900 |

The bar graph visually represents the points accumulated in each month, showing a steady increase in rewards through strategic use of the card.

Large Purchase and Rewards

A large purchase like a new laptop or a high-end camera is often a big investment. Let’s imagine you purchase a new laptop for $1,500. Using the Chase Sapphire Preferred card, you earn 1,500 points for the purchase. Combine this with other purchases made throughout the month using the card to increase points. Let’s say you also spend $500 on other purchases.

That adds another 1500 points to your total, for a total of 3000 points.

Final Wrap-Up

In conclusion, maximizing your Chase Sapphire Preferred Card rewards hinges on understanding its benefits, strategically planning your spending, and prioritizing responsible credit card use. By implementing the tips and strategies Artikeld in this guide, you can significantly boost your rewards and save money on travel, dining, and more. Remember, responsible use is key to enjoying the benefits of this valuable card.