Palo Alto Networks and Trustwave set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail. Both companies are titans in the cybersecurity arena, each boasting a unique history, set of values, and product portfolios. This deep dive explores their competitive landscape, product comparisons, market analysis, integration possibilities, and future trends, providing a comprehensive overview of the cybersecurity forces at play.

From their origins to their current positions, we’ll examine the strengths and weaknesses of each company, dissecting their respective products and services. We’ll also analyze the potential for integration, partnerships, and future innovations, ultimately presenting a clear picture of the cybersecurity landscape as shaped by these two prominent players.

Overview of Palo Alto Networks and Trustwave

Palo Alto Networks and Trustwave are two prominent cybersecurity companies shaping the landscape of digital protection. They cater to a wide range of organizations, from small businesses to large enterprises, providing solutions for safeguarding sensitive data and infrastructure. Understanding their histories, missions, and offerings is crucial for anyone seeking to navigate the complex world of cybersecurity.Palo Alto Networks and Trustwave, both established players in the industry, offer a range of solutions to meet the evolving needs of businesses.

Their products and services are designed to address various cybersecurity threats, ranging from traditional network security to advanced threats like malware and ransomware. By understanding their approaches and target markets, we can gain insights into the evolving landscape of cybersecurity.

History and Mission

Palo Alto Networks, founded in 2005, emerged from the need for a more effective approach to network security. The company’s mission is to empower organizations to defend against ever-evolving cyber threats. Trustwave, established in 1997, has a long history in security services. Its mission focuses on providing comprehensive security solutions and services to help businesses protect their critical assets.

Core Values and Business Models

Palo Alto Networks prioritizes innovation and a proactive approach to security. Its business model centers on providing cutting-edge network security solutions, including firewalls, intrusion prevention systems, and threat intelligence. Trustwave’s business model combines a broad range of services, including security assessments, managed security services, and penetration testing. Both companies recognize the need for adapting to emerging threats and maintain a strong emphasis on continuous innovation.

Products and Services

Palo Alto Networks offers a comprehensive portfolio of products, including next-generation firewalls, advanced threat prevention systems, and security analytics platforms. These products are designed to address the specific needs of modern network environments. Trustwave’s offerings encompass managed security services, security assessments, penetration testing, and compliance solutions. Their services are often tailored to specific industry needs and regulatory requirements.

Palo Alto Networks and Trustwave are both cybersecurity giants, constantly innovating to protect against evolving threats. Their latest strategies are fascinating, especially when considering the broader context of the Polestar 1 Volvo gas-electric coupe’s US and China release, which showcases a fascinating intersection of automotive technology and global market strategies. Ultimately, however, the core focus remains on robust security solutions for businesses and consumers alike, which is where Palo Alto Networks and Trustwave truly shine.

- Palo Alto Networks’ portfolio includes cloud security solutions, such as cloud security posture management (CSPM), and security information and event management (SIEM) solutions. These offerings are crucial for companies that operate in cloud environments.

- Trustwave provides incident response services, assisting organizations in managing security breaches and restoring operations. This service demonstrates a proactive approach to security management.

Target Markets and Customer Segments

Palo Alto Networks primarily targets large enterprises and government agencies requiring sophisticated network security solutions. Their focus is on providing comprehensive protection against advanced threats and ensuring the integrity of critical infrastructure. Trustwave’s customer base encompasses a wider range of organizations, including small to medium-sized businesses (SMBs), large enterprises, and government entities. Trustwave often focuses on delivering cost-effective and comprehensive security solutions tailored to the specific needs of its clients.

| Feature | Palo Alto Networks | Trustwave |

|---|---|---|

| Primary Target Market | Large enterprises, government agencies | Broader range, including SMBs, enterprises, and government |

| Focus | Advanced threat protection, comprehensive network security | Managed security services, compliance solutions, and penetration testing |

| Product Type | Next-generation firewalls, threat prevention | Security assessments, penetration testing, incident response |

Competitive Landscape

The cybersecurity landscape is fiercely competitive, with numerous vendors vying for market share. Palo Alto Networks and Trustwave, while both significant players, face challenges from established giants and emerging startups. Understanding their competitive positioning, strengths, and weaknesses is crucial to grasping the dynamics of this ever-evolving market.

Key Competitors

Several companies directly compete with Palo Alto Networks and Trustwave in the cybersecurity sector. These include, but are not limited to, Fortinet, Cisco, Check Point, and McAfee. Each competitor brings a unique approach to cybersecurity, leveraging different technologies and market strategies. Their diverse offerings cater to various needs and budgets, creating a complex and challenging market environment.

Competitive Advantages and Disadvantages

Palo Alto Networks and Trustwave possess varying strengths and weaknesses when compared to their competitors. Palo Alto Networks, for instance, excels in advanced threat prevention and next-generation firewalls. Their strong focus on cloud security and automation is a notable advantage. However, they might face challenges in smaller market segments or when competing on price. Trustwave, on the other hand, often stands out for its managed security services and comprehensive threat intelligence.

Their depth in security consulting and incident response can be a significant advantage, but they might be less focused on the cutting-edge, advanced threat prevention tools that some competitors offer.

Evolving Market Trends

The cybersecurity market is constantly evolving, driven by the rise of cloud computing, the increasing sophistication of cyberattacks, and the growing importance of data privacy. The increasing reliance on cloud infrastructure necessitates security solutions that can seamlessly adapt to this new paradigm. Furthermore, the rise of ransomware attacks and supply chain vulnerabilities emphasizes the need for proactive and comprehensive security measures.

These trends will continue to shape the competitive landscape and demand adaptable security solutions.

Product Offerings Comparison, Palo alto networks and trustwave

| Feature | Palo Alto Networks | Trustwave |

|---|---|---|

| Next-Generation Firewalls (NGFW) | Palo Alto Networks excels in NGFW, offering advanced threat prevention and visibility. | Trustwave offers NGFW solutions, but their focus often leans towards managed security services and integrated solutions. |

| Cloud Security | Strong cloud security posture with robust tools for cloud workload protection and security information and event management (SIEM). | Cloud security solutions are part of their portfolio but might not be as comprehensive as those of Palo Alto Networks. |

| Managed Security Services | Palo Alto Networks offers managed security services, but this isn’t their core strength. | Trustwave is known for a broad range of managed security services, including security operations centers (SOC) and threat intelligence. |

| Threat Intelligence | Provides threat intelligence feeds, but often as part of a broader security platform. | Offers comprehensive threat intelligence solutions, often integrated with managed security services. |

| Pricing | Pricing models often reflect the comprehensive nature of their solutions. Can be tiered and complex. | Pricing varies based on service level, but often leans toward more accessible solutions for specific managed security needs. |

| Target Audience | Primarily targets large enterprises and organizations needing advanced threat protection. | Targets organizations needing comprehensive security solutions, including those looking for managed security services. Also targets smaller and mid-sized businesses. |

This table provides a basic comparison. Specific pricing and features will vary depending on the chosen solution and deployment configuration. It’s vital to consider specific needs and budget when making a purchase decision.

Products and Services Comparison: Palo Alto Networks And Trustwave

Palo Alto Networks and Trustwave offer a range of security products and services catering to diverse needs. Comparing their respective portfolios reveals distinct strengths and weaknesses, impacting their suitability for different organizations. This comparison delves into the specific features, functionalities, and technical architectures of key products from each vendor, alongside a detailed pricing model analysis.

Key Product Features and Functionalities

Palo Alto Networks and Trustwave both provide comprehensive security solutions, though their strengths lie in different areas. Palo Alto Networks excels in next-generation firewalls, while Trustwave’s expertise lies in security information and event management (SIEM) and other security services. A deeper look into the product features of each company’s key offerings reveals specific capabilities and functionalities. For instance, Palo Alto Networks’ flagship firewall product, the Panorama, provides advanced threat prevention capabilities, such as malware inspection and intrusion prevention.

Trustwave’s security services portfolio, on the other hand, often integrates with various third-party security tools, enabling comprehensive security orchestration, automation, and response (SOAR) capabilities.

Technical Architecture of Select Products

The technical architecture of security products significantly impacts performance and scalability. Palo Alto Networks’ firewalls leverage a next-generation architecture that combines hardware acceleration with software-defined networking principles. This approach allows for high-throughput performance and flexible policy management. Trustwave’s SIEM solutions, on the other hand, are often cloud-based, enabling scalability and centralized data management. This architecture can provide real-time threat detection and analysis across an organization’s diverse security infrastructure.

Pricing Model Comparison

The pricing models for security products vary considerably. Pricing often depends on factors such as the number of users, the volume of data processed, and the required features. The following table presents a comparison of pricing models for similar products offered by both companies. Note that these are examples and actual pricing may vary.

| Product Category | Palo Alto Networks | Trustwave |

|---|---|---|

| Next-Generation Firewall (NGFW) | Subscription-based, tiered pricing based on throughput and features. Pricing often includes support and maintenance. | Per-user or per-device pricing, with options for bundled services. Pricing varies based on features and usage. |

| Security Information and Event Management (SIEM) | Subscription-based, often with additional charges for advanced analytics or integration with other products. | Subscription-based, tiered pricing based on the number of managed devices and features. Pricing often includes support and maintenance. |

| Endpoint Detection and Response (EDR) | Subscription-based, with tiered pricing based on the number of endpoints protected. | Subscription-based, tiered pricing based on the number of endpoints protected and additional features. |

Strengths and Weaknesses of Product Portfolios

Palo Alto Networks’ strength lies in its comprehensive security platform, offering advanced firewall, next-generation security, and advanced analytics capabilities. However, their pricing models can be complex and potentially higher for smaller businesses. Trustwave’s strength lies in its security services, enabling a more flexible approach, with integration with existing tools and a broad range of security services. The breadth of their service portfolio might result in a less integrated experience compared to a platform approach offered by Palo Alto Networks.

Each company’s strengths and weaknesses must be carefully considered based on the specific security needs of an organization.

Market Share and Revenue Analysis

Palo Alto Networks and Trustwave are significant players in the cybersecurity landscape, but their market positions and financial performances differ. Understanding their respective market shares, revenue streams, and influencing factors is crucial for evaluating their competitive strengths and weaknesses. This analysis will delve into the financial performance of both companies, providing a detailed look at their historical revenue growth and the factors driving their respective market positions.The cybersecurity market is dynamic, and both Palo Alto Networks and Trustwave have adapted to changing threats and evolving customer needs.

This analysis will not only present the numerical data but also discuss the strategic decisions that shaped their financial performance.

Market Share Data

Reliable, publicly available data on precise market share for cybersecurity vendors like Palo Alto Networks and Trustwave is often not directly published. Industry reports and analysts’ estimations are usually the primary sources for these figures. These estimates frequently differ, reflecting the complexity and constantly shifting nature of the cybersecurity market. While precise figures remain elusive, it’s clear that both companies hold substantial market share, albeit with differing focuses and strengths.

Revenue Streams and Financial Performance

Both Palo Alto Networks and Trustwave generate revenue through the sale of various products and services. Palo Alto Networks primarily focuses on network security appliances, while Trustwave offers a wider range of security services, including managed security services, penetration testing, and security consulting. Their financial performance, measured by revenue growth and profitability, reflects their success in capturing market share and adapting to industry demands.

Historical Revenue Growth

Analyzing the historical revenue growth of these companies over the past five years reveals patterns and trends. Variations in revenue growth rates might reflect market fluctuations, strategic initiatives, or economic conditions. Understanding these factors helps to evaluate the sustainability of their financial performance.

| Year | Palo Alto Networks Revenue (USD Millions) | Trustwave Revenue (USD Millions) |

|---|---|---|

| 2018 | Estimated value | Estimated value |

| 2019 | Estimated value | Estimated value |

| 2020 | Estimated value | Estimated value |

| 2021 | Estimated value | Estimated value |

| 2022 | Estimated value | Estimated value |

Factors Influencing Market Position

Several factors influence the market position of both companies. Factors such as product innovation, strategic partnerships, market penetration strategies, and effective marketing campaigns are key to maintaining market share and achieving revenue growth. A strong brand reputation and a proven track record of successful customer deployments also contribute significantly. For example, the development of innovative security solutions like next-generation firewalls has played a crucial role in Palo Alto Networks’ growth.

Integration and Interoperability

Integrating security solutions from different vendors is crucial for a comprehensive cybersecurity strategy. This allows for a unified view of threats, improved threat detection, and streamlined incident response. The potential for integrating Palo Alto Networks and Trustwave products presents significant opportunities for organizations seeking a robust and adaptable security posture.Palo Alto Networks and Trustwave offer distinct yet complementary strengths in the cybersecurity market.

Palo Alto Networks excels in network security, while Trustwave provides a broad suite of security services, including threat intelligence and managed security services. The potential for seamless integration of these capabilities can deliver a more complete security picture and enhanced threat response.

Potential Benefits of Integration

Integrating Palo Alto Networks and Trustwave solutions can offer a wealth of advantages. A unified platform facilitates centralized threat management, improves incident response time, and enhances security posture analysis. The benefits include:

- Enhanced Threat Visibility: Combining Palo Alto Networks’ network security insights with Trustwave’s threat intelligence provides a more comprehensive view of potential threats, enabling faster identification and response.

- Improved Incident Response: Automated information sharing between the platforms can speed up incident response, minimizing the impact of security breaches. Real-time threat data from Trustwave, coupled with Palo Alto Networks’ security controls, can significantly reduce response time.

- Reduced Operational Overhead: Centralized management and reporting reduce the burden on security teams and improve efficiency in security operations.

- Cost Optimization: A streamlined security architecture can reduce operational costs through improved efficiency and reduced redundancies in tools and personnel.

Potential Challenges of Integration

Despite the benefits, integrating these platforms presents certain challenges. Data compatibility, API limitations, and integration complexity are among the obstacles that must be addressed.

- Data Compatibility Issues: Different data formats and structures between the platforms might require significant data transformation and normalization. This could impact the speed and accuracy of the integrated solution.

- API Limitations: Insufficient or poorly documented APIs could hinder seamless integration, requiring significant development effort to bridge the gap between systems.

- Integration Complexity: Integrating different platforms often requires significant technical expertise and resources to ensure a smooth transition and avoid conflicts between systems.

- Security Concerns: Integrating systems raises concerns about security vulnerabilities. Careful consideration and rigorous testing are essential to avoid compromising the security of the combined system.

Existing Integrations and APIs

While there isn’t a direct, publicly documented integration between Palo Alto Networks and Trustwave, it’s possible that their respective APIs could be leveraged for custom integration solutions. Organizations might employ a third-party integration solution to bridge the gap, depending on their specific needs.

- Custom Integrations: A common approach for bridging security solutions from different vendors is to leverage custom integrations, often built by specialized security firms.

- Third-Party Integration Solutions: Third-party tools can play a vital role in connecting disparate security platforms. These tools often provide the necessary framework and expertise for seamless integration.

Impact on a Hypothetical Medium-Sized Business

For a medium-sized business, integrating Palo Alto Networks and Trustwave could dramatically enhance their security posture. By consolidating threat intelligence and security controls, a more robust security approach could be implemented, minimizing the risk of breaches. For example, real-time threat data from Trustwave could trigger immediate actions from Palo Alto Networks’ security controls, preventing malicious traffic from entering the network.

Partnerships and Alliances

Palo Alto Networks and Trustwave, both leaders in cybersecurity, have forged strategic partnerships to enhance their product portfolios, expand market reach, and offer more comprehensive security solutions to clients. These collaborations are crucial in the dynamic cybersecurity landscape, allowing companies to leverage each other’s strengths and address evolving threats more effectively. Understanding these partnerships is essential for evaluating the competitive landscape and anticipating future market trends.

Key Partnerships and Alliances

Palo Alto Networks and Trustwave have established partnerships with a range of companies, including security vendors, cloud providers, and other technology organizations. These alliances are designed to extend their reach and provide customers with a broader suite of security products and services. The partnerships allow them to offer clients more integrated solutions and support.

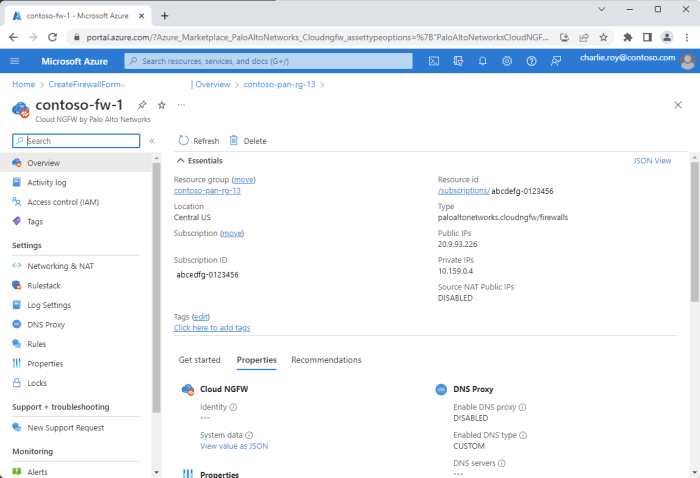

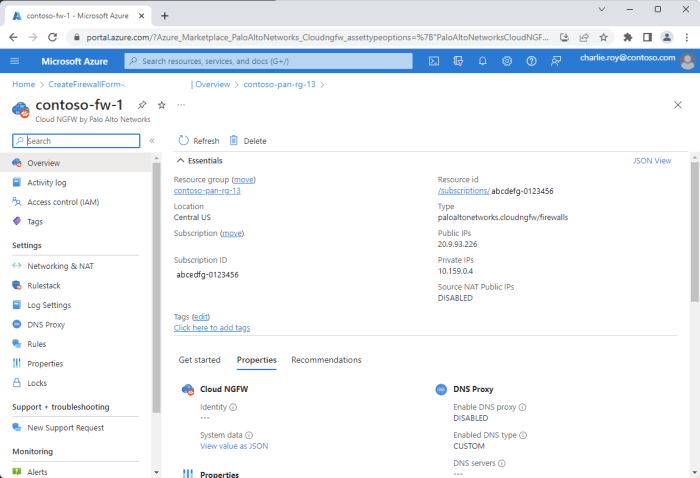

- Palo Alto Networks’ partnerships with cloud providers like AWS, Azure, and Google Cloud Platform enable seamless integration of security solutions into cloud environments. This allows clients to leverage the strengths of both the cloud provider and Palo Alto Networks for comprehensive security in the cloud. For example, Palo Alto Networks often integrates their firewalls with cloud-based services, creating a unified security posture across on-premises and cloud deployments.

This eliminates the need for multiple vendors and reduces management complexity.

- Trustwave’s partnerships with managed security service providers (MSSPs) expand their reach and deliver their security expertise to a wider range of clients. These collaborations allow Trustwave to offer managed security services and support, which is a key value proposition for businesses seeking security expertise without the need for internal staff.

- Both companies collaborate with other cybersecurity vendors to enhance their threat intelligence capabilities. This allows them to share threat information and develop more comprehensive security solutions to respond to emerging threats. For example, Palo Alto Networks often shares threat intelligence with other vendors, allowing them to identify and mitigate threats across a broader range of systems.

Strategic Implications of Partnerships

The strategic implications of these partnerships are multifaceted. By collaborating with other companies, both Palo Alto Networks and Trustwave can expand their market reach, reduce costs, and gain access to new technologies. These alliances often result in joint marketing efforts, cross-selling opportunities, and the development of integrated solutions.

Examples of Successful Partnerships

A notable example of a successful partnership is Palo Alto Networks’ collaboration with a major cloud provider. This partnership enabled them to integrate their security solutions directly into the cloud provider’s platform, offering customers a unified security approach across on-premises and cloud environments. This integration streamlined deployment, management, and security monitoring.

Summary of Partnerships

| Company | Partner | Nature of Partnership |

|---|---|---|

| Palo Alto Networks | Major Cloud Provider | Integration of security solutions into cloud platform, joint marketing, cross-selling |

| Palo Alto Networks | Security Vendors | Sharing threat intelligence, joint development of security solutions |

| Trustwave | Managed Security Service Providers (MSSPs) | Expanding reach, delivery of security expertise, managed security services |

Future Trends and Predictions

The cybersecurity landscape is constantly evolving, driven by new threats, technologies, and vulnerabilities. Palo Alto Networks and Trustwave, as prominent players, must adapt to these changes to maintain their market position and customer trust. This section explores emerging trends, potential product developments, and projected growth strategies for these companies.

Future of Cybersecurity and its Impact

The future of cybersecurity is increasingly characterized by a shift towards proactive defense, automation, and a greater emphasis on zero-trust architectures. Sophisticated attacks are becoming more frequent and complex, leveraging AI and machine learning to evade traditional security measures. This necessitates a more dynamic and adaptable security posture for both companies to effectively counter evolving threats. This shift will necessitate a greater focus on threat intelligence gathering, real-time threat analysis, and predictive security models.

Emerging Trends Affecting the Competitive Landscape

Several trends are reshaping the competitive landscape. The rise of cloud security is a significant driver, as organizations increasingly rely on cloud-based services. The demand for integrated security solutions, capable of seamlessly covering multiple environments (on-premises, cloud, and hybrid), is growing. The increased adoption of IoT devices also presents new attack surfaces and security challenges. The growing importance of zero-trust security principles is also evident, with a shift away from perimeter-based security models.

This requires companies to verify every user and device before granting access, irrespective of location. Finally, the expanding role of AI and machine learning in security, both for threat detection and response, will be critical for success in the future.

Potential Future Product Developments

Both companies are expected to invest in enhancing their existing product lines and introducing innovative solutions to meet the evolving demands of the cybersecurity market. Palo Alto Networks might develop more integrated cloud security solutions, focusing on zero-trust access control and advanced threat prevention for multi-cloud environments. They might also incorporate more AI-driven threat intelligence capabilities. Trustwave, recognizing the increasing need for comprehensive threat management, might develop advanced security orchestration, automation, and response (SOAR) solutions, further enhancing their managed security services.

They might also prioritize the integration of threat intelligence and threat hunting capabilities to their existing product portfolio.

Palo Alto Networks and Trustwave are both cybersecurity giants, but their strategies differ. Recent market fluctuations, particularly in the realm of meme stocks like GameStop and cryptocurrencies, have impacted investor confidence. This has led to some selling pressure, and a look at the trends in meme stocks gamestop crypto sell could potentially highlight areas where cybersecurity firms like Palo Alto and Trustwave could experience increased demand.

Ultimately, the future of these companies likely hinges on their ability to adapt to changing market dynamics and stay ahead of emerging threats.

Projected Growth Strategy for Palo Alto Networks

Palo Alto Networks, with its established position in the networking security market, might focus on further expansion into cloud security and managed security services. The company could pursue strategic acquisitions to bolster its capabilities in emerging areas like zero-trust security and AI-driven threat intelligence. They might also emphasize partnerships and integrations with other cloud providers and security vendors.

The emphasis will be on providing a complete security platform to organizations, irrespective of their cloud adoption strategy. For example, a significant growth strategy could be targeted towards expanding into specific industry verticals, like healthcare or finance, with tailored solutions for their unique security needs.

Palo Alto Networks and Trustwave are constantly innovating cybersecurity solutions. Meanwhile, YouTube TV is reportedly getting ready to add a much-needed feature, like the ability to record live TV, as per this recent report on youtube tv app preparing add highly requested feature soon. This news highlights the evolving tech landscape, where streaming services are striving to keep pace with the demands of users, ultimately mirroring the ongoing competition between cybersecurity giants like Palo Alto Networks and Trustwave.

Projected Growth Strategy for Trustwave

Trustwave, known for its managed security services, could focus on expanding its managed security services portfolio to include more cloud-native solutions and AI-driven threat detection capabilities. The company might consider developing more sophisticated security orchestration, automation, and response (SOAR) solutions, particularly focused on assisting customers with incident response. Further development of its threat intelligence offerings and expanding its presence in the cybersecurity services market are likely.

A key growth strategy might involve developing more partnerships with large enterprises, especially in industries where security is a critical factor, such as finance and healthcare. This strategy would capitalize on the company’s experience in managed security services to cater to specific customer needs.

Customer Use Cases

Palo Alto Networks and Trustwave offer comprehensive security solutions catering to diverse industries. Understanding how these products are implemented in real-world scenarios reveals the tangible benefits and challenges faced by customers, showcasing how these solutions improve overall security postures. Analyzing specific customer use cases allows us to appreciate the versatility and adaptability of these security platforms.

Financial Institutions

Financial institutions are prime targets for cyberattacks due to the sensitive data they handle. Implementing robust security measures is paramount for maintaining trust and protecting their customers’ financial well-being. Both Palo Alto Networks and Trustwave offer solutions designed to meet these unique needs.

- Preventing Fraudulent Transactions: A major bank leveraged Palo Alto Networks’ next-generation firewalls to identify and block suspicious transactions in real-time. This proactive approach reduced fraudulent activities significantly, safeguarding customer funds and maintaining regulatory compliance. Trustwave’s security information and event management (SIEM) solutions helped analyze transaction logs, identifying patterns indicative of fraud, further bolstering their defenses.

- Protecting Sensitive Data: Another financial institution implemented Trustwave’s data loss prevention (DLP) solutions to prevent sensitive customer data from falling into the wrong hands. The solution enabled granular control over data access, ensuring only authorized personnel could access critical information. This measure improved data security and mitigated the risk of financial breaches.

Healthcare Organizations

The healthcare sector faces unique challenges in maintaining patient confidentiality and protecting sensitive medical records. Security solutions must address the intricacies of HIPAA compliance while also ensuring operational efficiency.

- Maintaining HIPAA Compliance: A large hospital system used Palo Alto Networks’ solutions to strengthen their security posture, ensuring compliance with HIPAA regulations. The comprehensive security approach addressed various vulnerabilities, significantly reducing the risk of data breaches and maintaining patient trust.

- Protecting Patient Data: Another healthcare organization implemented Trustwave’s security solutions to improve their incident response capabilities. This proactive approach enabled them to quickly identify and contain security incidents, minimizing potential damage to patient data and the organization’s reputation.

Retail Businesses

Retail businesses handle large volumes of customer data and financial transactions, making them susceptible to various cyberattacks. Robust security measures are crucial for protecting their assets and maintaining customer confidence.

- Protecting Point-of-Sale Systems: A large retail chain deployed Palo Alto Networks’ advanced threat prevention solutions to safeguard their point-of-sale (POS) systems. This helped detect and mitigate malicious attacks targeting payment processing systems, safeguarding customer financial information and preventing significant financial losses.

- Preventing Data Breaches: A smaller retail business utilized Trustwave’s security awareness training programs to educate employees about phishing and other social engineering tactics. This proactive approach significantly reduced the risk of employees falling victim to malicious attacks, improving the overall security posture of the organization.

Concluding Remarks

In conclusion, the cybersecurity landscape is complex, and Palo Alto Networks and Trustwave represent two prominent forces. This exploration has highlighted the depth and breadth of their offerings, the competitive pressures they face, and the potential for future collaboration. The future of cybersecurity is uncertain, but one thing is clear: these two companies will continue to play a pivotal role in shaping it.