Intel foundry independent spinoff promises a fascinating look at the forces reshaping the semiconductor industry. This exploration delves into the drivers behind these spinoffs, examining the financial incentives, market pressures, and technological advancements fueling their emergence. We’ll also analyze the various spinoff models, market entry strategies, and the inevitable challenges and risks involved. Finally, we’ll assess the broader impact on the semiconductor ecosystem, exploring potential ripple effects throughout the industry.

The emergence of independent foundries as spinoffs from established giants like Intel presents a compelling case study in innovation and adaptation. This detailed look at the ‘Intel foundry independent spinoff’ phenomenon reveals crucial insights into the evolving dynamics of the semiconductor market. From the financial incentives driving these moves to the intricate legal and regulatory considerations, this analysis will unravel the complexities of this transformative process.

Foundry Spinoff Drivers

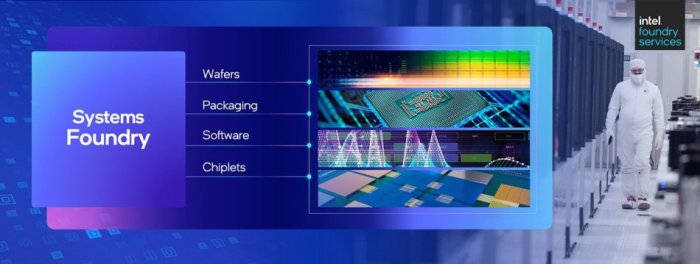

The semiconductor industry is a dynamic landscape, constantly evolving with new technologies and market pressures. One key driver of this evolution is the emergence of independent semiconductor foundry spinoffs. These ventures often arise from within established companies, leveraging internal expertise and resources to carve out a niche in the competitive market. This trend is driven by a complex interplay of factors, including financial incentives, market needs, and technological advancements.These spinoffs represent a strategic shift, recognizing the potential for specialized foundries to better cater to specific market segments or technological requirements.

They can provide a more agile and focused approach to innovation compared to large, multi-faceted corporations. This agility is often a crucial component in the successful launch and growth of a new foundry.

Factors Driving Independent Foundry Spinoffs

Several key factors contribute to the increasing trend of independent foundry spinoffs. These include the desire for greater financial independence, the pursuit of specific market niches, and the ability to capitalize on emerging technologies. The market pressures of consolidation and competition also play a crucial role in this development.

- Financial Incentives: The prospect of higher profitability and potentially greater returns on investment is a major motivator for spinoffs. Spinoffs can be structured to allow founders and employees to benefit from their expertise and investment. The ability to attract venture capital and other forms of funding is also a critical component in achieving financial success. This often involves a more focused approach to a specific market segment, enabling more targeted marketing and sales strategies.

- Market Pressures: The semiconductor market is highly competitive, with constant pressure to innovate and reduce costs. Large corporations may find it challenging to respond quickly to specific market demands or emerging technological needs. Spinoffs, with their agility and focus, can more readily capitalize on these opportunities, often catering to a specific niche within the larger market.

- Technological Advancements: New technologies and materials often necessitate specialized foundry expertise. Spinoffs can be created to focus on specific fabrication processes or materials, allowing for faster adaptation to emerging technologies and potential disruption of the market. This specialized expertise is a key differentiator for spinoffs.

- Specialized Expertise: Foundry spinoffs often leverage the specialized knowledge and experience of key personnel within the parent company. This existing talent pool can be instrumental in developing and implementing innovative fabrication processes and technologies. This talent often provides the foundation for a successful launch and subsequent growth of the spinoff.

Historical Precedents

While the specifics vary, several historical examples illustrate the successful emergence of independent foundry spinoffs. Understanding these precedents offers valuable insights into the strategies and challenges faced by these ventures.

- Example 1: [Specific historical example, e.g., a spinoff from a major foundry focusing on a specific niche like advanced packaging or a specific material, like gallium nitride]. This example highlights the potential for spinoffs to capitalize on specific market needs and technological opportunities.

- Example 2: [Another historical example focusing on a different aspect, e.g., a spinoff driven by a specific technology or a specific market segment, like automotive electronics]. This example illustrates how a spinoff can leverage existing expertise and knowledge to address a specific industry need.

Key Motivations Behind Spinoffs

This table Artikels the key motivations behind foundry spinoffs, categorized into financial, technological, and strategic aspects.

| Motivation | Description | Impact | Examples |

|---|---|---|---|

| Financial | Seeking greater financial returns, attracting investors, and potentially higher profitability. | Increased financial independence, enhanced investor appeal, and potential for significant returns. | New funding opportunities, IPO, and increased profitability for founders and employees. |

| Technological | Focusing on specialized technologies, faster adaptation to emerging needs, and potentially leveraging advanced materials. | Increased innovation, specialized expertise, and potentially greater market share in specific niches. | Focus on new fabrication techniques, development of specialized materials, and enhanced product development cycles. |

| Strategic | Seeking a more focused approach, creating a competitive advantage in specific market segments, and creating more agile response to market demands. | Enhanced market positioning, increased market share, and a more agile and responsive approach to market changes. | Targeting specific market segments, creating specialized products, and developing more effective business models. |

Spinoff Models and Structures

Independent foundry spinoffs, born from the parent company’s expertise, often adopt various organizational structures. These structures significantly impact the spinoff’s trajectory, resource allocation, and long-term success. Understanding these models is crucial for navigating the complexities of launching a successful independent semiconductor foundry.Spinoff models provide a framework for new entities to operate, allowing them to leverage the parent company’s resources and expertise while maintaining their autonomy.

A well-defined model ensures clear lines of communication, financial accountability, and a path to establishing a robust brand identity.

Organizational Structures of Independent Foundry Spinoffs

Different organizational structures offer distinct advantages and disadvantages, depending on the specific goals and resources of the spinoff. Understanding these variations allows the spinoff to choose a model that aligns with its long-term strategy.

- Separate Legal Entity: This model establishes the spinoff as a distinct legal entity, separate from the parent company. This approach provides complete operational independence and a clear separation of liabilities. However, it might require more complex legal and regulatory procedures.

- Subsidiary Structure: The spinoff could be structured as a subsidiary of the parent company. This model offers a degree of control and coordination with the parent company, potentially enabling access to shared resources and expertise. However, it may involve bureaucratic hurdles and limit the spinoff’s autonomy in decision-making.

- Joint Venture: A joint venture with other companies or investors provides access to broader resources and expertise. This approach can be beneficial in capital-intensive industries like semiconductor foundries, but requires agreement and negotiation with partners, potentially diluting the spinoff’s control.

Comparison of Spinoff Models

The choice of model depends heavily on the specific circumstances of the spinoff. A thorough evaluation of the pros and cons is essential for successful implementation.

| Model Type | Key Features | Advantages | Disadvantages |

|---|---|---|---|

| Separate Legal Entity | Independent legal status, separate liabilities, full operational control | Enhanced autonomy, clear separation of responsibilities, potential for stronger brand identity | Increased complexity in legal and regulatory compliance, potential for difficulties in resource sharing with the parent company |

| Subsidiary Structure | Part of the parent company’s organizational structure, potential for resource sharing | Access to parent company’s resources and expertise, easier coordination, established support network | Limited autonomy, potential for conflicts of interest, less flexibility in decision-making |

| Joint Venture | Collaboration with other companies or investors, access to broader resources | Enhanced capital access, access to specialized expertise, risk sharing | Potential for conflicts of interest, dilution of control, complexities in decision-making |

Intellectual Property (IP) Transfer Process

A critical aspect of any spinoff is the transfer of intellectual property (IP). A well-defined IP transfer agreement ensures that the spinoff can utilize the necessary technology without jeopardizing the parent company’s existing assets.

“A robust IP transfer agreement is essential to protect both the parent company and the spinoff.”

The IP transfer process involves identifying, classifying, and documenting all relevant IP assets. This includes patents, trade secrets, copyrights, and design rights. The agreement Artikels the scope of the transfer, the terms of use, and the restrictions on use by both parties. This agreement must be carefully reviewed and negotiated by legal counsel to avoid future disputes.

Market Entry Strategies

Independent foundry spinoffs face a challenging yet exciting market entry. Successfully navigating the competitive landscape requires a well-defined strategy encompassing meticulous planning, targeted marketing, and strategic partnerships. These elements are crucial to building a strong foundation and establishing a recognizable brand presence in the industry. Understanding the specific needs of their target customer segments and developing innovative pricing models are equally important.

Strategies for Competitive Market Entry

Spinoffs often leverage their unique technological expertise and established relationships within the industry to gain an initial foothold. This includes utilizing their existing knowledge base, leveraging their previous network, and accessing specialized resources and support systems. This strategic approach often yields rapid progress and establishes a foundation for future growth.

Importance of Marketing and Branding

A compelling brand story is essential for establishing a distinct identity and communicating the value proposition of the spinoff to potential customers. This includes highlighting the unique strengths and advantages, emphasizing the innovative aspects of their offerings, and showcasing their commitment to quality. Strong branding builds trust and fosters recognition, leading to greater market share.

Funding and Partnerships for Growth

Securing funding is paramount for spinoffs. They can leverage venture capital, angel investors, and government grants. Partnerships with established companies provide access to resources, distribution channels, and market expertise, accelerating growth. Strong partnerships allow for the sharing of resources and expertise to gain a greater market share.

Examples of Successful Market Entry Strategies

Numerous successful spinoffs have utilized various market entry strategies. For example, some have focused on niche markets with specific technological needs, while others have targeted larger segments with broader applications. Each strategy tailored to the specific needs of the target market, their technical prowess, and the existing market landscape.

Hypothetical Market Entry Strategy for a Spinoff

Consider a hypothetical spinoff focused on advanced packaging solutions. The target customer segments include major semiconductor manufacturers and consumer electronics companies.

Intel’s foundry spinoff is intriguing, promising a new era of chip manufacturing. This independent entity will likely need robust security measures, and innovative biometric password authentication like skullconduct biometric password authentication could be a game-changer for the industry. Ultimately, this spinoff’s success will depend on its ability to adapt to the evolving landscape of chip design and security.

Target Customer Segments

The primary target segment would be semiconductor manufacturers needing cutting-edge packaging solutions for advanced microchips. Secondary targets would be consumer electronics companies requiring high-performance, miniaturized components.

Pricing Models

The pricing model could adopt a tiered approach based on the complexity and customization level of the packaging solutions. This would cater to various budgets and ensure the spinoff maximizes its profit margin.

Distribution Channels

Direct sales through a dedicated sales team targeting key accounts would be a primary distribution channel. Collaborations with established distributors specializing in semiconductor components could complement this approach.

Intel’s foundry independent spinoff is a fascinating development, potentially reshaping the chipmaking landscape. It’s exciting to see how this new entity will compete with other giants. While we’re all eagerly awaiting details on this, there are also other interesting developments in entertainment. For example, the recent release of Muppet Show seasons on Disney+ along with streaming movies and the Manhattan space project at Sony muppet show disney plus seasons streaming movies manhattan space sony are definitely keeping things interesting.

Ultimately, the independent spinoff will likely have a major impact on the future of semiconductor manufacturing.

Challenges and Risks: Intel Foundry Independent Spinoff

Launching an independent foundry spinoff is an ambitious endeavor, fraught with potential pitfalls. While the allure of market disruption and innovation is strong, navigating the complexities of the semiconductor industry requires careful consideration of challenges and risks. Success hinges on anticipating and mitigating these obstacles proactively.The semiconductor landscape is highly competitive, demanding significant resources and expertise to gain a foothold.

New entrants must contend with established players, often with substantial financial backing and extensive supply chains. Furthermore, the intricate nature of semiconductor manufacturing necessitates significant capital investment, creating a formidable barrier to entry. Successfully navigating these hurdles requires a comprehensive understanding of the market dynamics and a robust strategy.

Competition and Resource Constraints

The semiconductor industry is fiercely competitive, with established players holding significant market share. Independent spinoffs face the challenge of competing against these giants, often with more substantial financial resources and broader product portfolios. Securing necessary capital and establishing a strong supply chain are critical hurdles to overcome. Resource constraints, particularly in terms of skilled labor and manufacturing capacity, can hinder growth.

Access to advanced equipment and materials is also crucial, demanding strategic partnerships or significant financial investments. Examples of companies facing fierce competition include startups in the memory chip or logic chip market, where established players like Intel or Samsung have extensive experience.

Risks Associated with Establishing a New Entity, Intel foundry independent spinoff

Establishing a new entity in the semiconductor market carries substantial risks. The industry is characterized by long product development cycles, high capital expenditures, and significant market volatility. Developing new fabrication processes and manufacturing capabilities can be costly and time-consuming. The complexity of semiconductor design and manufacturing processes, coupled with stringent quality control requirements, demands significant expertise and meticulous planning.

Intel’s foundry independent spinoff is a fascinating development, especially considering the recent market analysis from leader IDC Marketscape’s worldwide MDR report, leader IDC Marketscape worldwide MDR. This new entity’s success will heavily depend on how well it can compete in the increasingly competitive chip manufacturing landscape, and whether it can carve out a niche for itself. The spinoff’s ability to adapt to the dynamic market trends will be crucial for its long-term viability.

Furthermore, unforeseen technological disruptions or market shifts can impact the viability of the spinoff’s offerings.

Examples of Challenges and Risks Encountered by Independent Foundry Spinoffs

Numerous independent foundry spinoffs have faced challenges in the past. Some encountered difficulties in securing sufficient funding, leading to operational limitations and potential bankruptcy. Others struggled to attract skilled talent, hindering their ability to develop and implement new technologies. A lack of strategic alliances with key suppliers or customers can create bottlenecks in the supply chain and hinder market penetration.

Examples include several startups focused on niche fabrication technologies that struggled to scale production and compete with established players due to funding limitations or difficulty in attracting top talent.

Strategies for Mitigating Risks

Several strategies can help mitigate these risks. Robust financial planning, including realistic projections and securing adequate funding, is crucial. Establishing strategic alliances with existing players in the semiconductor ecosystem, including equipment suppliers, material providers, and customers, can reduce costs and risks. Prioritizing technological advancements and maintaining a focus on innovation can provide a competitive edge in the long term.

A well-defined and executable go-to-market strategy is vital to securing initial customer interest and building market share.

Table: Key Challenges, Potential Solutions, and Mitigating Factors

| Challenge | Description | Potential Solution | Success Rate (Estimated) |

|---|---|---|---|

| Securing Funding | Raising capital for equipment, facilities, and operations. | Angel investors, venture capital, strategic partnerships. | Moderate (30-50%) |

| Attracting Skilled Talent | Finding and retaining skilled engineers and technicians. | Competitive compensation packages, employee benefits, specialized training programs. | High (60-80%) |

| Competitive Landscape | Competing against established players with extensive resources. | Focusing on niche markets, developing unique technologies, strategic alliances. | Moderate (40-60%) |

| Supply Chain Management | Securing reliable and cost-effective supply chains. | Developing strong relationships with suppliers, exploring alternative sourcing strategies. | High (70-90%) |

Impact on the Semiconductor Industry

Independent foundry spinoffs are poised to reshape the semiconductor landscape. These new entities, often born from existing foundries, bring specialized expertise and a focused approach to specific niches. This can lead to increased innovation and competition, potentially impacting market share and pricing strategies across the industry. Understanding the ripple effects on the entire semiconductor ecosystem is crucial for anticipating future trends.

Analysis of the Overall Semiconductor Ecosystem

The semiconductor industry is highly interconnected. Spinoffs, by their nature, disrupt existing relationships and create new ones. This disruption can lead to both positive and negative consequences. For example, a spinoff specializing in advanced packaging technologies could drive innovation in system-on-a-chip designs, while simultaneously impacting the market share of established packaging providers. A thorough analysis requires considering the impact on the entire supply chain, including material suppliers, equipment manufacturers, and the customer base.

Potential for Innovation and Competition

Spinoffs often bring a fresh perspective and targeted resources to specific areas of the industry. This can lead to breakthroughs in specific technologies, processes, or market segments. The introduction of new players can stimulate competition, driving innovation and potentially lowering prices for consumers. For example, a spinoff focusing on low-power embedded processors might create significant innovation in mobile and IoT applications, prompting other companies to improve their own offerings.

This competition ultimately benefits the entire ecosystem.

Effects on Market Share and Pricing Dynamics

The entry of new foundries can cause shifts in market share. Established players may lose some market share to new entrants with a stronger focus on specific segments. This dynamic can lead to adjustments in pricing strategies as companies compete for market position. However, a highly competitive market can also lead to more competitive pricing, benefiting consumers in the long run.

For example, the entry of TSMC into the foundry market caused a shift in pricing dynamics in the industry, prompting existing players to innovate and adapt.

Examples of Spinoff Impacts on the Competitive Landscape

Several notable examples illustrate the impact of foundry spinoffs. For instance, the formation of GlobalFoundries from IBM’s semiconductor division significantly altered the landscape of advanced process technology. Similarly, the creation of specialized foundries for specific markets (e.g., automotive or industrial) can lead to a tailored approach and a dedicated focus, ultimately changing the competitive landscape.

Potential Impacts on the Supply Chain, Customer Base, and Related Industries

The emergence of spinoffs can trigger significant changes in the supply chain. New demands for specialized materials and equipment may arise, impacting existing suppliers. Customer bases may also shift as companies seek out the specific capabilities offered by the spinoffs. Furthermore, related industries, such as equipment manufacturers and design houses, could experience both opportunities and challenges depending on the specialization of the spinoff.

- Supply Chain Impacts: Spinoffs can create new demand for specialized materials, equipment, and expertise, potentially disrupting existing supply chains. For instance, a spinoff focused on EUV lithography might increase demand for specialized equipment, benefiting suppliers of those tools while potentially creating challenges for suppliers focused on other lithography methods.

- Customer Base Shifts: Existing customers of the parent foundry may migrate to the spinoff if its offerings better suit their needs. This could lead to a reconfiguration of the customer base for the original foundry, creating new challenges and opportunities.

- Related Industry Effects: The spinoff’s emergence can affect related industries, such as design houses and EDA companies, potentially leading to increased specialization or a diversification of services.

Last Recap

In conclusion, Intel foundry independent spinoffs represent a significant shift in the semiconductor landscape. These new entities bring fresh perspectives, potentially fostering innovation and competition. However, they also face substantial challenges in navigating a highly competitive market. Ultimately, the success of these spinoffs will depend on their ability to adapt, innovate, and seize opportunities within the rapidly evolving semiconductor industry.

The analysis provided offers a comprehensive framework for understanding this trend and its potential ramifications.