France tax air travel climate change ecotax is a complex issue, examining the current air travel tax system in France, its impact on climate change, and the potential of an ecotax. The system’s history, components, and revenue generation will be explored, alongside comparisons with other European countries. This post will also dive into the environmental impact of air travel, looking at emissions and regulations, and analyzing the potential of an ecotax to reduce these impacts.

We’ll investigate how the ecotax might affect air travel demand and prices, and discuss potential revenue streams for environmental initiatives. The relationship between the tax system and broader environmental policies will be examined, as well as alternative transportation options and their environmental footprint. Public perception and acceptance of such taxes, potential economic impacts, and the role of government support for sustainable transportation will also be considered.

France’s Air Travel Tax System

France’s air travel tax system, a crucial component of its environmental and economic policies, has evolved significantly over time. Initiated to address environmental concerns and fund infrastructure improvements, the system now encompasses a range of levies, each with distinct applications and revenue streams. Understanding its nuances is key to comprehending the broader implications for both French citizens and international travelers.

Overview of the Tax System

The French air travel tax system is a multifaceted structure, incorporating various levies applied at different stages of the air travel process. These levies aim to generate revenue for environmental initiatives, and contribute to the development of sustainable transportation alternatives. Understanding the diverse components and their application is essential to grasping the overall impact on air travel in France.

Components of the Air Travel Tax

The French air travel tax system comprises multiple components, each designed to address specific aspects of air travel. These include a departure tax, a potential eco-tax, and possible surcharges based on factors such as flight distance or class of travel. This complexity reflects the government’s attempt to address a multitude of factors influencing air travel.

Application of the Tax to Different Flights

The application of the French air travel tax varies based on several criteria. Domestic flights are often subject to different rates compared to international flights, while the exact amount may fluctuate based on the specific airline and route. Business class travelers might be subject to different tax rates than economy class passengers. The precise application often involves intricate rules and regulations.

Revenue Generation and Allocation, France tax air travel climate change ecotax

The revenue generated from France’s air travel taxes is substantial, and is a vital part of the French government’s funding mechanisms. A portion of the revenue is allocated to environmental projects and initiatives. A considerable amount of revenue is also used to improve and develop sustainable transportation infrastructure. The exact allocation percentages vary depending on the specific tax and its purpose.

Comparison with Other European Countries

France’s air travel tax system is comparable to those of other European countries, though there are variations in the specific types of taxes, rates, and the use of the revenue generated. Some countries focus more on environmental levies, while others emphasize funding for aviation infrastructure. A direct comparison of the revenue generated and the allocation processes in various European nations is challenging due to the complexity of the systems and the varying reporting structures.

Tax Breakdown Table

| Tax Type | Application | Revenue (Estimated) | Allocation |

|---|---|---|---|

| Departure Tax | Applied to all departing flights, varying based on origin and destination. | €X Million (2023) | Environmental initiatives, sustainable transportation development, and possibly infrastructure improvements. |

| Eco-Tax (Potential) | Could be applied to flights based on carbon emissions or flight distance. | €X Million (Estimated) | Dedicated funding for climate change mitigation and research. |

| Surcharges (Possible) | Applied to specific flight segments based on distance or class of travel. | €X Million (2023) | May be allocated to specific airports or to fund infrastructure projects. |

Impact of Air Travel on Climate Change: France Tax Air Travel Climate Change Ecotax

Air travel, while undeniably convenient, significantly contributes to global climate change. The sheer volume of flights, coupled with the energy-intensive nature of aircraft, releases substantial amounts of greenhouse gases, primarily carbon dioxide (CO2), into the atmosphere. Understanding this impact is crucial for developing sustainable aviation strategies and mitigating the effects of global warming.The contribution of air travel to climate change is multifaceted.

France’s ecotax on air travel is a big deal, impacting climate change efforts. While pondering the environmental impact of flights, I also found myself comparing phones. The OnePlus 6 versus the iPhone XR is a fascinating tech comparison, especially considering battery life and camera quality. oneplus 6 vs iphone xr Ultimately, these taxes are a crucial step towards sustainable travel, making a difference in the fight against climate change.

It’s not simply the number of flights, but also the types of aircraft used, the routes flown, and even the altitude at which planes operate. These factors all play a role in determining the environmental footprint of each flight. Understanding these factors is essential for implementing effective mitigation strategies.

CO2 Emissions from Air Travel

Air travel is a major source of CO2 emissions, a potent greenhouse gas that traps heat in the Earth’s atmosphere. The combustion of jet fuel, the primary energy source for aircraft, directly releases CO2 into the atmosphere. The amount of CO2 emitted varies greatly depending on the type of aircraft and the distance of the flight. Larger aircraft, like Boeing 747s, inherently generate higher emissions than smaller, more fuel-efficient planes.

Furthermore, long-haul flights typically have a greater carbon footprint compared to shorter trips.

Impact of Different Aircraft Types

Different aircraft types have varying levels of fuel efficiency, directly impacting their carbon footprint. Smaller, more fuel-efficient aircraft like the Airbus A320 series contribute less to emissions than larger, heavier aircraft like the Boeing 777. This difference is a crucial consideration when evaluating the environmental impact of air travel. Fuel efficiency and design play a significant role in minimizing emissions.

Flight Routes and Emissions

Flight routes significantly influence CO2 emissions. Long-haul flights across vast distances require more fuel, resulting in higher emissions. Similarly, flight patterns that involve significant altitude changes or extended periods of time at high altitudes can also contribute to a greater carbon footprint. Optimizing flight routes and altitude management can contribute to a reduction in fuel consumption and subsequent emissions.

Air Travel and Global Warming

Air travel is a significant contributor to global warming. The release of greenhouse gases, particularly CO2, from aircraft engines leads to the enhanced greenhouse effect. This, in turn, contributes to rising global temperatures and the observed climate change phenomena, such as more frequent and intense heat waves, droughts, and floods. This connection between air travel and global warming underscores the urgent need for sustainable solutions.

Environmental Regulations in France

France has implemented various environmental regulations to address the impact of air travel on climate change. These regulations often focus on emissions standards for aircraft, fuel efficiency, and the development of alternative aviation fuels. These measures reflect a commitment to mitigating the environmental impact of air travel within the country’s borders.

Comparison of Carbon Footprints

| Air Travel Option | Estimated CO2 Emissions (kg per passenger) |

|---|---|

| Short-haul flight (within Europe) | ~100-150 |

| Medium-haul flight (Europe to North Africa) | ~200-300 |

| Long-haul flight (Europe to North America) | ~500-800 |

| Business class flight (same route as Economy) | ~20-30% higher |

Note: These figures are estimates and can vary depending on specific flight routes, aircraft types, and other factors. The table provides a general comparison.

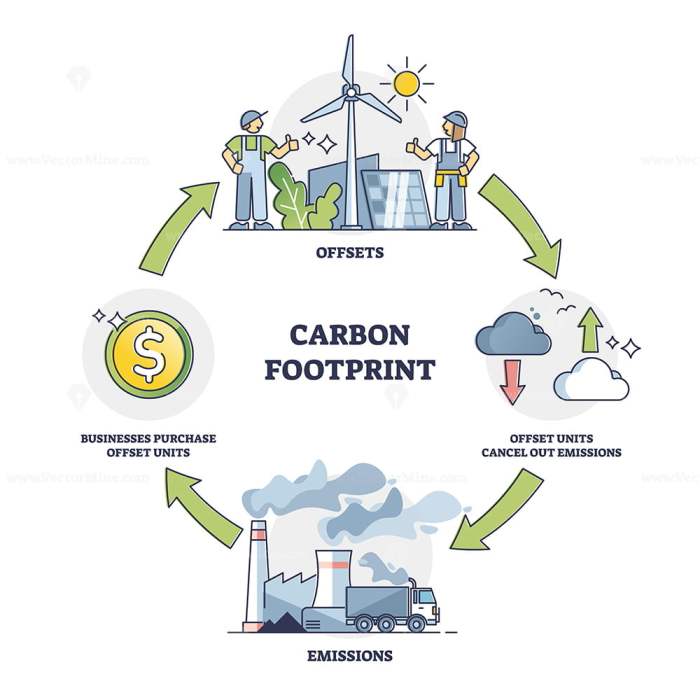

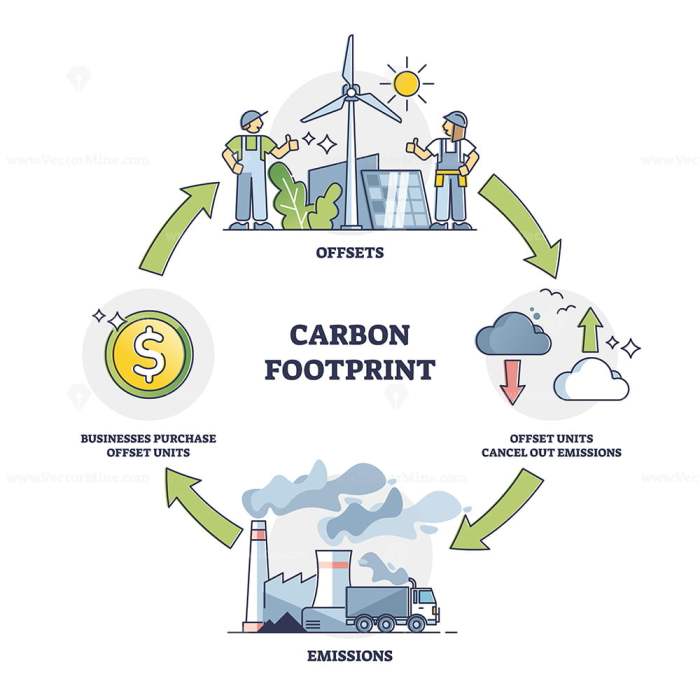

Ecotax on Air Travel in France

France, a global leader in environmental initiatives, has a complex relationship with air travel. While air travel facilitates commerce and tourism, its impact on climate change is undeniable. This necessitates a nuanced approach, including measures to mitigate the environmental footprint of air travel. One such measure is an ecotax, which aims to internalize the environmental costs of air travel, making it more sustainable.

Current Ecotax Levied on Air Travel

Currently, France levies an ecotax on air travel. This tax, known as the “éco-contribution aéronautique,” is designed to fund environmental initiatives related to aviation. The tax is not a simple flat fee; its structure is more intricate and based on various factors.

Purpose and Rationale Behind the Ecotax

The purpose of the ecotax is to encourage sustainable air travel practices. By making air travel more expensive, the tax aims to disincentivize unnecessary flights and promote alternative modes of transport where possible. The rationale is to shift the burden of the environmental impact of air travel onto the users, aligning economic incentives with environmental responsibility.

Structure and Calculation of the Ecotax

The ecotax is calculated based on several factors, including the distance of the flight, the type of aircraft used, and the number of passengers. This nuanced approach ensures that the tax reflects the true environmental impact of each flight. The exact calculations and rates are subject to change based on government regulations and updated environmental assessments.

Potential Impacts on Air Travel Demand and Prices

The introduction of an ecotax on air travel is likely to influence both demand and prices. Initially, air travel demand may decrease as the price of tickets increases. Airlines may absorb some of the cost, but it’s also likely that they will pass some of the cost onto consumers, leading to higher ticket prices. However, the ecotax is intended to encourage sustainable practices, leading to a gradual shift towards alternative transportation options and improved efficiency in the long run.

This change could be measured through market research and tracking of ticket prices over time.

France’s new tax on air travel, aimed at tackling climate change, is definitely a hot topic. It’s an interesting counterpoint to inspiring stories like this is bearsun an instagram teddy bear walking 400 miles for charity , showcasing how individuals can contribute to a greener future. Ultimately, these ecotaxes are part of a broader discussion about the responsibility of air travel in the face of environmental concerns.

Revenue Streams and Use for Environmental Initiatives

The revenue generated from the ecotax is intended to fund various environmental initiatives. These initiatives could include supporting research into sustainable aviation fuels, investing in infrastructure for alternative transportation, or implementing policies to improve the efficiency of airports. The revenue streams would likely be transparently allocated, and the specific projects funded would be clearly defined.

Tax Structure, Revenue Estimates, and Potential Environmental Benefits

| Factor | Description | Revenue Estimate (Example) | Potential Environmental Benefit (Example) |

|---|---|---|---|

| Flight Distance | Longer flights incur a higher tax | €5-15 per passenger, depending on distance | Reduces emissions from long-haul flights |

| Aircraft Type | Larger aircraft generate higher emissions | €2-8 per passenger, depending on aircraft type | Discourages use of large, less fuel-efficient planes |

| Number of Passengers | More passengers means more emissions | €1-3 per passenger, depending on number of passengers | Encourages using trains for some journeys |

| Total Estimated Annual Revenue | Total expected revenue for the year | €100 million – €500 million (estimate) | Funding for research and development of sustainable aviation fuels |

Note: Revenue estimates and environmental benefits are examples and may vary based on specific tax structures and implementation.

Relationship Between Taxes and Environmental Policies

France’s commitment to mitigating climate change is multifaceted, and its air travel tax system plays a crucial role within this broader strategy. The ecotax, if implemented, is not an isolated measure but rather a component of a larger framework designed to reduce the environmental impact of air travel and encourage sustainable alternatives. This interconnectedness requires a careful examination of the synergies and potential conflicts between the tax and other environmental initiatives.The French government likely views the air travel tax as a lever to incentivize behavioral changes, reduce carbon emissions, and potentially fund investments in greener technologies.

This aligns with the broader national climate change strategy, which aims to reduce greenhouse gas emissions and transition to a low-carbon economy. However, the interplay between the tax and other environmental policies warrants careful consideration to ensure effective and comprehensive action.

Connections Between the Air Travel Tax and Broader Environmental Policies

The French air travel tax system is intricately linked to the country’s broader environmental policies, primarily concerning climate change mitigation. This tax is designed to internalize the external costs of air travel, including the contribution to greenhouse gas emissions, thereby aligning economic incentives with environmental goals.

Integration of the Ecotax within the National Climate Change Strategy

The ecotax, if implemented, should align with the overall national climate change strategy. This alignment could involve using tax revenue to fund research and development of sustainable aviation technologies, or to support alternative modes of transportation. It could also include provisions for carbon offsetting programs, encouraging travelers to compensate for the emissions generated by their flights. Furthermore, the strategy could incorporate measures to reduce demand for air travel, such as promoting teleconferencing and virtual meetings.

Potential Synergies and Conflicts Between Air Travel Taxes and Other Environmental Initiatives

The air travel tax can potentially create synergies with other environmental initiatives. For example, it could complement policies promoting sustainable aviation fuels (SAFs) by making air travel with SAFs more economically attractive. Conversely, there could be potential conflicts if the tax disproportionately burdens low-income travelers or if it discourages necessary business travel, thereby impacting economic activity. A well-designed tax system would need to consider such factors and implement mechanisms to mitigate negative impacts.

Examples of Similar Taxes in Other Countries

Several countries have implemented similar taxes on air travel to address environmental concerns. The UK’s carbon tax on aviation fuels and the European Union’s Emissions Trading System (ETS) provide examples of international approaches. The UK’s system, in particular, focuses on taxing the carbon content of aviation fuels, while the EU’s ETS applies to a wider range of emissions from various sectors.

| Country | Tax/Policy | Connection to Environmental Policy |

|---|---|---|

| United Kingdom | Carbon tax on aviation fuels | Aims to increase the cost of carbon-intensive fuels, incentivizing the use of cleaner alternatives. |

| European Union | Emissions Trading System (ETS) | Covers emissions from various sectors, including aviation, aiming to reduce overall emissions through market-based mechanisms. |

| France | Potential ecotax on air travel | Designed to reduce the environmental impact of air travel, aligning economic incentives with climate goals. |

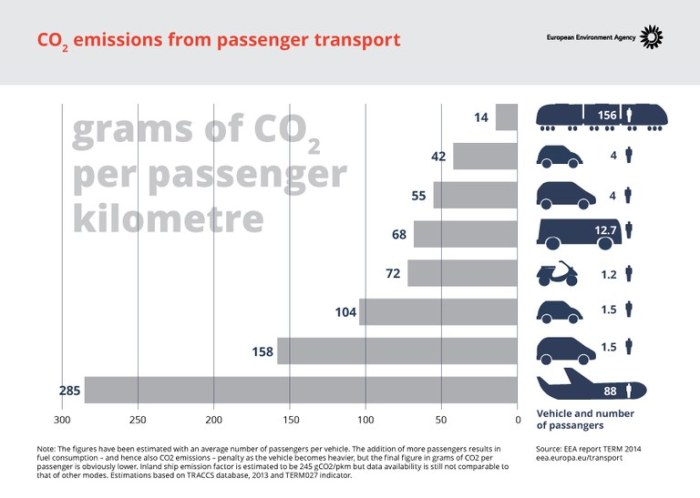

Alternative Transportation Options and Their Environmental Impact

France offers a compelling array of alternative transportation methods, significantly reducing the environmental footprint compared to air travel. These options, particularly high-speed rail, demonstrate the feasibility of sustainable travel within the country and beyond. Understanding the environmental impact of these alternatives and government support for their adoption is crucial to understanding France’s commitment to mitigating climate change.High-speed rail, a prominent alternative, boasts a considerably lower carbon footprint than air travel for shorter to medium distances.

The efficiency of this mode of transportation, combined with the renewable energy sources increasingly powering French rail networks, makes it a sustainable choice for many journeys.

High-Speed Rail and its Environmental Impact

High-speed rail, exemplified by the TGV network in France, is a key component of the country’s sustainable transportation strategy. The reduced energy consumption per passenger kilometer compared to air travel is a significant factor in its environmental advantage. Electrification of the rail network contributes to lower emissions, particularly when coupled with renewable energy sources like hydropower or nuclear power.

France’s ecotax on air travel is a fascinating example of how governments are trying to address climate change through economic incentives. It’s a complex issue, and while some argue it’s a good way to curb emissions, others point to potential negative economic impacts. Interestingly, the recent lifting of the ZTE trade ban by the US Commerce Department under Trump, as detailed in this article , highlights a different kind of approach to environmental concerns.

Ultimately, the impact of these policies on air travel and the environment is still being debated, and more data is needed to fully assess the situation.

Comparing Air Travel and Alternative Modes

The environmental impact of air travel is substantial, primarily due to the high energy consumption and emissions from jet aircraft. Alternatives like high-speed rail, buses, and even cycling can drastically reduce carbon emissions. The choice between air travel and alternative modes is often determined by factors like distance, travel time, and cost.

Government Support for Sustainable Transportation

The French government actively promotes sustainable transportation through various initiatives. These include significant investments in high-speed rail infrastructure, subsidies for public transport, and incentives for the adoption of electric vehicles. This multifaceted approach underscores the government’s commitment to fostering a greener transportation landscape.

Role of Public Transport in Mitigating Air Travel Impact

Public transport, encompassing buses, trams, and metro systems, plays a crucial role in reducing the environmental impact of air travel. Encouraging the use of public transport for shorter and medium-distance journeys can significantly diminish the overall carbon footprint. Furthermore, integrating public transport networks with high-speed rail facilitates a seamless and environmentally conscious travel experience.

Carbon Footprint Comparison

| Transportation Mode | Scenario 1: Short Distance (100 km) | Scenario 2: Medium Distance (500 km) | Scenario 3: Long Distance (1500 km) |

|---|---|---|---|

| Air Travel (Economy) | High (approx. 150 kg CO2e) | High (approx. 500 kg CO2e) | Very High (approx. 1200 kg CO2e) |

| High-Speed Rail | Moderate (approx. 50 kg CO2e) | Moderate (approx. 150 kg CO2e) | Moderate (approx. 400 kg CO2e) |

| Bus | Low (approx. 25 kg CO2e) | Moderate (approx. 100 kg CO2e) | Moderate (approx. 300 kg CO2e) |

| Electric Car | Very Low (approx. 10 kg CO2e) | Moderate (approx. 50 kg CO2e) | Moderate to High (approx. 150 kg CO2e) |

Note: CO2e represents carbon dioxide equivalent. Values are approximate and can vary based on factors such as vehicle efficiency, route, and passenger load.

Public Perception and Acceptance of Ecotaxes

Public opinion on environmental taxes, particularly those levied on air travel, is a complex issue. The acceptance of such taxes often hinges on the perceived fairness, effectiveness, and transparency of the implementation process. Understanding the factors that shape public opinion is crucial for the successful implementation of environmental policies.

Public Opinion on Air Travel Taxes in France

While concrete, readily available data on public opinion regarding a specific French air travel tax is not readily accessible, general trends in European public opinion on environmental taxes can offer insight. Studies indicate that public acceptance of environmental taxes is often influenced by factors such as perceived fairness, effectiveness, and transparency. For example, if the public believes that the tax is disproportionately affecting low-income households, it may lead to resistance.

Conversely, if the tax revenue is clearly earmarked for environmental improvements, such as sustainable transport infrastructure, or if the tax is coupled with measures that reduce the burden on those with limited means, acceptance is more likely.

Factors Influencing Public Acceptance

Several key factors contribute to public acceptance of ecotaxes. Perceived fairness is paramount. If the tax is seen as disproportionately impacting specific groups, such as low-income travelers, opposition is more likely. Furthermore, transparency in how the tax revenue is utilized is crucial. Public confidence in the intended use of the funds, whether for investments in renewable energy, infrastructure improvements, or environmental programs, directly correlates with acceptance.

The effectiveness of the tax in achieving its environmental goals is another important consideration. If the public perceives that the tax is insufficient to achieve the desired environmental outcomes, or that alternative, more impactful measures are available, it may lead to skepticism or opposition. Finally, the overall economic climate and the perceived burden of the tax relative to other costs can influence public opinion.

Public Awareness and Understanding of Air Travel’s Impact

Public awareness and understanding of the environmental impact of air travel are key to garnering support for ecotaxes. A clear and accessible explanation of the link between air travel emissions and climate change is essential. Information campaigns that effectively communicate the environmental consequences of air travel, alongside the benefits of ecotaxes in mitigating these impacts, can significantly influence public opinion.

Evidence-based communication, including data on the environmental footprint of air travel compared to other forms of transportation, is crucial. The use of compelling visual aids, such as infographics or short videos, can effectively convey complex information to a broader audience.

Public Consultations and Debates

Public consultations and debates surrounding environmental taxes play a critical role in shaping public opinion and fostering a more informed discussion. These consultations provide platforms for stakeholders to express their views, concerns, and suggestions. Examples of such consultations in other countries can offer valuable lessons for France. Careful consideration of the diversity of perspectives, and the incorporation of feedback into the policy-making process, is vital for successful implementation.

The process should be inclusive and transparent, ensuring that all segments of society have a voice in the decision-making process.

Arguments for and Against the Ecotax

Proponents of ecotaxes on air travel often emphasize their role in reducing carbon emissions, thereby mitigating climate change. They highlight the economic benefits of investment in sustainable transport infrastructure and the potential for revenue generation to fund environmental projects. Proponents might also emphasize the fairness of taxing activities that have a demonstrable environmental impact. Conversely, opponents often express concerns about the potential for the tax to disproportionately affect low-income travelers, making air travel less accessible.

Concerns regarding the economic impact on the tourism sector and the potential for the tax to deter international travel are frequently raised.

Summary of Arguments for and Against Ecotax

| Argument | Category |

|---|---|

| Reduces carbon emissions, mitigating climate change. | For |

| Funds investment in sustainable transport infrastructure. | For |

| Fairness in taxing activities with a demonstrable environmental impact. | For |

| Disproportionately affects low-income travelers, making air travel less accessible. | Against |

| Negative economic impact on the tourism sector. | Against |

| Potential to deter international travel. | Against |

Potential Impacts of Air Travel Taxes on the Economy

Implementing air travel taxes in France, like any significant economic policy change, presents a complex interplay of potential benefits and drawbacks. The impact on the aviation industry, tourism, and the overall French economy requires careful consideration. Understanding these potential effects is crucial for crafting a policy that balances environmental goals with economic realities.

Impact on the Aviation Industry

The aviation industry is a significant employer and contributor to the French economy. Air travel taxes directly affect airlines’ operating costs, potentially leading to price increases for passengers. This, in turn, could reduce demand for air travel, impacting airline profitability and potentially leading to job losses in the sector. The industry’s response might include cost-cutting measures, such as reduced staff or fleet modernization.

Related industries, like airport management and ground handling services, would also be affected. The impact will vary depending on the specific tax structure and its implementation.

Impact on Tourism and the French Economy

Tourism is a cornerstone of the French economy. Air travel is essential for many tourists visiting France. Increased air travel taxes could discourage tourists, potentially leading to a decrease in visitor numbers and revenue for hotels, restaurants, and other tourism-related businesses. This reduction in tourist spending could negatively affect the wider economy. The magnitude of this impact would depend on the level of the tax and how it is perceived by tourists.

Potential Need for Economic Adjustments or Support

To mitigate potential negative impacts on the tourism sector and related businesses, various economic adjustments and support measures could be implemented. These could include subsidies for businesses that are directly affected by the tax or training programs for workers in affected industries. Targeted support for small and medium-sized enterprises (SMEs) within the tourism sector would be essential. Furthermore, the tax could be structured in a way that incentivizes alternative forms of transportation, potentially creating new economic opportunities.

Economic Modeling and Analysis

Economic modeling plays a crucial role in analyzing the potential impacts of air travel taxes. Various econometric models, such as input-output models, can be used to simulate the ripple effects of the tax on different sectors of the economy. These models would take into account factors such as the elasticity of demand for air travel, the degree of substitutability between different forms of transportation, and the sensitivity of tourism to price changes.

For example, models can project the impact of a 10% tax on air travel on airline revenue, the number of tourists visiting France, and GDP growth. A thorough economic impact assessment, incorporating diverse scenarios, is critical.

“A 2019 study by the European Commission estimated that a 10% increase in air passenger charges would decrease air travel by 5%.”

Table of Potential Economic Impacts

| Impact | Description |

|---|---|

| Positive | Reduced emissions and potential health benefits. Incentivizes investment in alternative transport. |

| Increased revenue for the French government, which can be used to fund green initiatives. | |

| Negative | Reduced air travel demand, impacting airline profitability and related sectors. |

| Potential decrease in tourism revenue and economic activity in the tourism sector. | |

| Increased prices for air travel, potentially reducing accessibility. |

Concluding Remarks

In conclusion, France tax air travel climate change ecotax presents a multifaceted challenge. The interplay between environmental concerns, economic realities, and public opinion will be crucial in shaping the future of air travel in France. While the potential benefits of an ecotax are undeniable, careful consideration of its potential drawbacks and alternative solutions is paramount. Ultimately, the success of such a policy will depend on a thoughtful and comprehensive approach that balances environmental protection with economic viability and public acceptance.