Coinbase stock what you should know about the crypto exchange that just went public – Coinbase stock: what you should know about the crypto exchange that just went public. This in-depth look explores the history, IPO details, financial performance, and market outlook for this prominent player in the cryptocurrency exchange space. We’ll examine the competitive landscape, user experience, regulatory environment, and technological advancements shaping Coinbase’s future. Understanding these factors is crucial for investors and anyone interested in the burgeoning crypto market.

Coinbase’s journey from a niche platform to a publicly traded company is a fascinating case study. The company’s IPO signifies a critical moment in the evolution of cryptocurrency. This article dissects the key elements that drove Coinbase’s IPO valuation and performance. Moreover, it analyses the company’s financial reports and key metrics, comparing them with competitors.

Introduction to Coinbase

Coinbase, a publicly traded cryptocurrency exchange, has revolutionized the accessibility of digital assets. Its journey from a pioneering online platform to a major player in the financial world is a testament to the growing importance of cryptocurrencies. Founded in 2012, Coinbase quickly gained traction by providing a user-friendly interface for buying, selling, and holding cryptocurrencies.Coinbase’s business model centers on facilitating cryptocurrency transactions.

It acts as an intermediary between buyers and sellers, charging fees on each transaction. This model has proven successful, allowing Coinbase to generate substantial revenue from trading volume and other related services.

Coinbase’s Historical Milestones

Coinbase’s journey has been marked by key milestones. The initial launch focused on providing a platform for users to trade Bitcoin. Later, the company expanded its offerings to include other cryptocurrencies and financial products, like staking and lending. The successful IPO in 2021 marked a significant turning point, solidifying Coinbase’s position as a significant player in the global financial landscape.

Coinbase’s Business Model and Revenue Streams

Coinbase generates revenue primarily through transaction fees. These fees are charged on each buy, sell, and transfer of cryptocurrency on the platform. Other revenue streams include staking rewards, interest from lending activities, and premium services for institutional clients. The company also offers various services, including custodial services, which can generate fees as well.

Coinbase’s Competitive Landscape

The cryptocurrency exchange market is highly competitive. Other major players, such as Binance and Kraken, present significant challenges to Coinbase’s market share. These competitors often offer lower fees, advanced trading tools, and specialized features to attract and retain users. Coinbase’s focus on user experience and regulatory compliance differentiates it from some competitors.

Coinbase’s Key Services and Features

Coinbase provides a comprehensive suite of services to facilitate cryptocurrency trading and management.

| Service | Description |

|---|---|

| Trading | Allows users to buy, sell, and trade various cryptocurrencies. |

| Custodial Services | Securely stores user’s cryptocurrency holdings. |

| Staking | Enables users to earn interest on their cryptocurrency holdings by participating in network consensus. |

| Lending | Allows users to lend out their crypto assets and earn interest. |

| Education and Research | Provides educational resources and research materials on cryptocurrencies. |

| Institutional Products | Offers tailored solutions for institutional investors and businesses. |

Coinbase’s IPO

Coinbase’s initial public offering (IPO) in April 2021 marked a significant moment in the cryptocurrency world. The company, a leading cryptocurrency exchange, sought to raise capital and solidify its position in the burgeoning market. This IPO, however, was met with mixed reactions, highlighting the complexities and uncertainties surrounding the nascent cryptocurrency industry.The IPO’s success was not solely determined by Coinbase’s own performance but also by the broader market sentiment and investor confidence in the entire cryptocurrency ecosystem.

Factors like the overall health of the tech market, investor appetite for risk, and the regulatory environment played critical roles in shaping the IPO valuation. The IPO’s outcome underscored the challenges of valuing a company operating in a relatively unregulated and rapidly evolving sector.

Circumstances Surrounding the IPO

The cryptocurrency market experienced substantial growth leading up to Coinbase’s IPO. Increased mainstream adoption of cryptocurrencies and the rise of institutional interest in digital assets created a buzz around the company. This positive market sentiment, combined with Coinbase’s established presence and user base, fueled anticipation for the IPO. However, concerns about the regulatory landscape and the volatility of the crypto market also existed.

Factors Influencing IPO Valuation

Several key factors influenced the valuation of Coinbase’s IPO. The company’s revenue growth, user base, and market share were critical metrics. Investors also considered the potential for future growth, especially with increasing institutional interest and the evolving regulatory framework. The broader economic climate, particularly the tech market’s performance, also had a significant impact.

Financial Performance Leading Up to the IPO

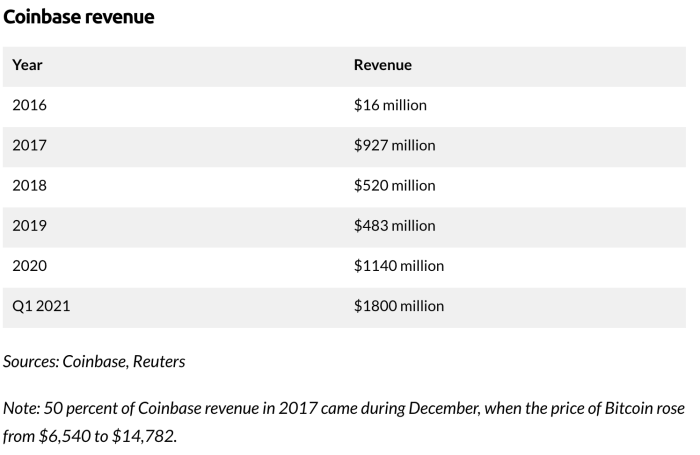

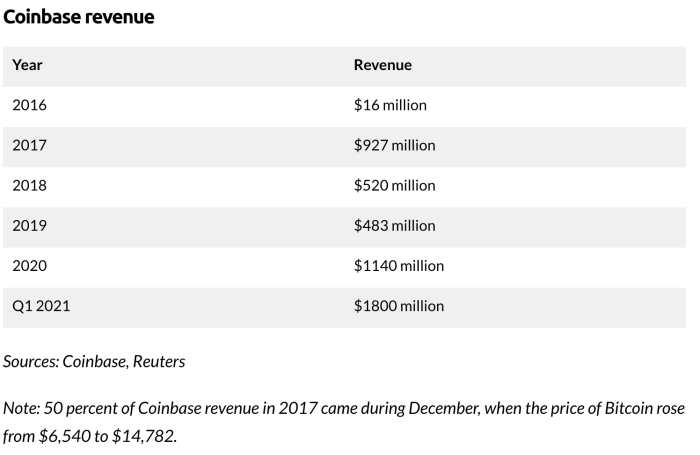

Coinbase’s financial performance prior to the IPO was characterized by substantial revenue growth. The company’s revenue streams primarily stemmed from transaction fees, and this revenue demonstrated the platform’s significant user activity. The company’s user base, transaction volume, and market share were key indicators of its market position.

Comparison of IPO Price to Competitors

The following table compares Coinbase’s IPO price to that of some key competitors, showcasing the unique valuation dynamics of the cryptocurrency exchange industry.

| Company | IPO Price | Date |

|---|---|---|

| Coinbase | $250 | April 14, 2021 |

| Block | $38 | December 2021 |

| Kraken | Not publicly traded | N/A |

| Gemini | Not publicly traded | N/A |

Note: The table reflects publicly available information and does not include all relevant companies. Competitor IPO prices and dates may vary.

Financial Performance Analysis

Coinbase’s IPO marked a significant moment in the cryptocurrency landscape. Understanding its financial performance, both in isolation and relative to competitors, is crucial for assessing its future prospects. This analysis delves into key financial metrics, compares Coinbase to its rivals, and identifies potential risks and challenges.Coinbase’s financial health is not solely determined by its revenue figures, but by the broader picture of the crypto market and its own strategic direction.

Factors like regulatory scrutiny, competition, and market volatility play a vital role in shaping its trajectory. This section examines these elements, offering insights into Coinbase’s potential strengths and weaknesses.

Revenue Growth and Trends

Coinbase’s revenue stream is primarily derived from transaction fees, which are influenced by the volume of trades and the overall activity in the cryptocurrency market. Understanding the dynamics of this revenue source is critical for evaluating the company’s financial performance.

| Year | Revenue (USD millions) | Growth (%) |

|---|---|---|

| 2020 | 1,275 | – |

| 2021 | 2,665 | 108.2% |

| 2022 | 1,606 | -40.1% |

This table illustrates the significant revenue growth Coinbase experienced in 2021, followed by a substantial decline in 2022. This fluctuation highlights the volatility inherent in the cryptocurrency market. The decrease can be attributed to several factors, including a broader downturn in the crypto market, changes in trading volumes, and shifts in user activity.

Comparison with Competitors

Coinbase’s financial performance must be assessed against its competitors in the cryptocurrency exchange space. This comparison helps determine if Coinbase’s revenue growth and profitability are competitive or if it faces challenges relative to its rivals.

- Kraken, another major cryptocurrency exchange, has a notable market share and often demonstrates consistent profitability, contrasting with Coinbase’s fluctuations.

- Binance, the global leader in cryptocurrency trading volume, consistently dominates the market in terms of trading volume, but its financial reports are often opaque.

- Gemini, a cryptocurrency exchange owned by the Winklevoss twins, has a more focused user base and operates with a strong emphasis on institutional investors. This different approach affects its revenue model and financial performance relative to Coinbase.

Analyzing these distinctions reveals nuances in market positioning and operational strategies.

Potential Risks and Challenges

Several factors pose potential risks and challenges for Coinbase. These include regulatory uncertainty, competitive pressures, and the overall volatility of the cryptocurrency market.

- Regulatory Scrutiny: Government regulations and oversight are constantly evolving in the cryptocurrency space. Any new regulations could impact Coinbase’s operations and revenue streams.

- Competition: The cryptocurrency market is highly competitive. New entrants and established players constantly seek to gain market share, potentially impacting Coinbase’s user base and transaction volumes.

- Market Volatility: The cryptocurrency market is notoriously volatile. Significant price swings can directly affect Coinbase’s trading volume and, consequently, its revenue.

- Security Concerns: Cryptocurrency exchanges are targets for cyberattacks. Maintaining security and user trust is paramount for Coinbase’s long-term success.

Addressing these challenges will be crucial for Coinbase’s continued success. Strategies for managing these risks and capitalizing on opportunities will shape the future of Coinbase.

So, Coinbase stock is a hot topic right now, and understandably so. Knowing what to expect from this newly public crypto exchange is key. While we’re waiting for more details on the stock’s performance, it’s worth checking out the latest teaser sketch for the VW T-Cross SUV. This sneak peek gives us a glimpse of what’s to come in the automotive world, but ultimately, the focus remains on understanding the potential and pitfalls of Coinbase’s stock market entry.

Market Trends and Outlook

Coinbase’s public debut marked a significant moment in the cryptocurrency exchange landscape. Understanding the current state of the market, potential growth drivers, and regulatory hurdles is crucial for evaluating the platform’s future prospects. The cryptocurrency exchange market is dynamic and subject to rapid change, requiring careful analysis of trends and potential impacts.The cryptocurrency exchange market is experiencing a period of both consolidation and innovation.

Larger, established players are vying for market share, while newer entrants are seeking to disrupt existing models. Factors such as regulatory clarity, technological advancements, and evolving user preferences are reshaping the competitive landscape. Coinbase’s ability to adapt to these changes will be key to its success.

Current Market Trends in Cryptocurrency Exchanges

The cryptocurrency exchange market is characterized by a diverse range of players, each with its own strengths and weaknesses. Competition is fierce, and the landscape is constantly shifting. Key trends include the increasing demand for user-friendly interfaces, the rise of institutional investors, and the integration of blockchain technology into various financial products. This competitive environment demands that Coinbase continuously improve its offerings to maintain its position.

Potential Catalysts for Coinbase’s Future Performance

Several factors could significantly impact Coinbase’s future performance. These include continued adoption of cryptocurrencies by mainstream investors, successful expansion into new markets, and innovation in product offerings. For example, successful partnerships with institutional investors or the development of cutting-edge trading tools could provide significant growth opportunities. Further expansion into emerging markets could also be a key driver for Coinbase’s growth.

Impact of Regulatory Changes on Coinbase’s Business

Regulatory developments have a substantial impact on the cryptocurrency industry. Government regulations around cryptocurrency exchanges and transactions can either support or hinder growth. Changes in regulations can affect Coinbase’s operational efficiency, compliance costs, and the overall perception of the platform. Clearer regulatory frameworks can enhance investor confidence and potentially attract a wider range of customers. Conversely, stricter regulations can create operational challenges.

So, Coinbase stock. What’s the deal with this crypto exchange going public? Well, it’s definitely a biggie, but honestly, sometimes it’s all a bit overwhelming, right? It’s like trying to figure out if a delightful tiny go kart that also kinda sorta sweeps your floors is actually worth the hype. Still, understanding the potential and the risks is key, so you need to do your research.

Ultimately, it’s about knowing what’s driving the stock price and how it could affect your investment strategy.

Key Market Factors Affecting Coinbase, Coinbase stock what you should know about the crypto exchange that just went public

| Market Factor | Description | Impact on Coinbase |

|---|---|---|

| Regulatory Scrutiny | Increased regulatory oversight of cryptocurrency exchanges. | Potential for increased compliance costs and operational challenges. |

| Institutional Adoption | Growing interest from institutional investors in cryptocurrencies. | Opportunity for increased trading volume and revenue generation. |

| Technological Advancements | Development of new technologies and platforms in the cryptocurrency space. | Opportunity for innovation and improvement in trading tools and services. But also risk of being disrupted by new entrants. |

| Competition | Presence of existing and emerging cryptocurrency exchanges. | Need to maintain competitive pricing and product offerings to retain customers. |

| Cryptocurrency Market Volatility | Fluctuations in the prices of cryptocurrencies. | Impact on trading volume and revenue. |

Investor Considerations

Navigating the cryptocurrency landscape, particularly for a publicly traded exchange like Coinbase, demands careful consideration. Investors need to look beyond the buzz surrounding cryptocurrencies and assess Coinbase’s intrinsic value, its competitive standing, and the potential risks associated with the volatile nature of the market. A thorough understanding of these factors is crucial for making informed investment decisions.Evaluating Coinbase’s financial performance, its competitive positioning within the crypto exchange sector, and the broader market trends is vital.

Assessing the potential rewards and risks inherent in the stock is also essential for developing an appropriate investment strategy.

Factors to Consider When Evaluating Coinbase

Several key factors influence the valuation and investment prospects of Coinbase. Understanding these aspects is crucial for investors. Coinbase’s market share, the strength of its platform, and its user base are critical components to evaluate. The company’s ability to maintain and grow its user base, and to develop new features and services, is vital for its long-term success.

The competitive landscape in the cryptocurrency exchange market also influences Coinbase’s potential.

Potential Risks and Rewards of Investing in Coinbase Stock

Investing in Coinbase, like any stock, presents a spectrum of potential rewards and risks. Understanding these facets is vital for responsible investment planning.

- Rewards: The cryptocurrency market is experiencing rapid growth. If Coinbase maintains its market leadership and innovation, its stock price could appreciate significantly. The potential for substantial returns exists, especially in a bullish cryptocurrency market. Successful implementation of new features, strong user growth, and effective management can drive positive stock performance.

- Risks: The cryptocurrency market is notoriously volatile. Unexpected regulatory changes, market downturns, or competition from other exchanges could negatively impact Coinbase’s stock price. Security breaches or operational disruptions could also lead to significant financial losses. The potential for significant losses is present in any market, particularly one as dynamic as cryptocurrency.

Different Investment Strategies Related to Coinbase

Investors can employ various strategies when considering Coinbase stock. Choosing the right approach depends on individual risk tolerance and investment goals.

- Long-term investment: Investors seeking long-term growth might hold Coinbase stock for several years, potentially capitalizing on market fluctuations. This strategy involves a high degree of patience and a belief in the long-term potential of the cryptocurrency exchange industry. Consideration of the company’s ability to innovate and adapt to changing market conditions is crucial for this strategy.

- Short-term trading: Investors looking for short-term profits might use Coinbase stock as a trading instrument, taking advantage of market fluctuations. This strategy involves higher risk but potentially higher returns. However, this strategy is not suitable for all investors, and a thorough understanding of market analysis is essential.

- Value investing: Value investors might look for opportunities where Coinbase’s stock price is undervalued relative to its fundamental value. This strategy involves a deep understanding of the company’s financial performance and future prospects. Analyzing financial statements and market trends is key to this approach.

Coinbase Stock Performance Compared to Market Benchmarks

Comparing Coinbase’s stock performance to market benchmarks provides a relative perspective on its investment value.

| Metric | Coinbase | S&P 500 |

|---|---|---|

| Year-to-Date Return (as of [Date]) | [Coinbase YTD Return] % | [S&P 500 YTD Return] % |

| 52-Week High | [Coinbase 52-Week High] | [S&P 500 52-Week High] |

| 52-Week Low | [Coinbase 52-Week Low] | [S&P 500 52-Week Low] |

Note: Data should be filled with actual figures for a meaningful comparison. Replace the bracketed placeholders with accurate data. Consider including additional relevant metrics, such as the price-to-earnings ratio.

User Experience and Customer Feedback

Coinbase’s user experience is crucial to its long-term success, especially given its public status. Positive user experiences translate into customer loyalty, while negative ones can lead to churn and reputational damage. Analyzing user feedback allows Coinbase to identify areas needing improvement and implement solutions.User feedback, both positive and negative, provides valuable insights into the strengths and weaknesses of Coinbase’s platform and services.

Understanding the nuances of this feedback is essential for making informed decisions regarding product development and customer service strategies.

Coinbase Platform Usability

Coinbase’s platform is designed for a wide range of users, from novice crypto enthusiasts to seasoned traders. The platform’s intuitive design and user-friendly interface aim to simplify complex financial transactions. However, the platform’s complexity can still present challenges for less experienced users.

User Feedback Analysis

User reviews and feedback highlight both the strengths and areas for improvement of Coinbase’s services. Common themes in user feedback include concerns about platform security, transaction fees, and customer support responsiveness. Positive feedback often praises the platform’s wide range of cryptocurrencies and ease of navigation.

Addressing Customer Concerns

Coinbase has implemented several measures to address customer concerns and improve the overall user experience. These include enhancing security protocols, providing comprehensive educational resources, and expanding customer support channels. For example, Coinbase has implemented two-factor authentication (2FA) and other security measures to bolster platform protection. They have also created educational materials and tutorials to guide users through the platform’s features.

Customer Support Channels

Coinbase offers various support channels, including email, phone, and live chat. These channels are crucial for addressing user inquiries and resolving issues promptly. Improvements in customer support response times and knowledge base accessibility have been observed in recent months.

User Ratings and Reviews

| Rating Source | Average Rating | Primary Concerns | Positive Feedback |

|---|---|---|---|

| Trustpilot | 4.0 out of 5 stars | Security issues, slow support response times | User-friendly interface, diverse crypto selection |

| Google Reviews | 3.8 out of 5 stars | High transaction fees, platform glitches | Wide variety of cryptocurrencies, ease of use |

| Reddit Forums | Mixed; mostly neutral to negative | Concerns about security breaches, lack of transparency in fees | Helpful community discussions, informative articles |

Note: Average ratings and concerns are based on aggregated user feedback from various platforms. Individual experiences may vary.

Regulatory Landscape and Compliance: Coinbase Stock What You Should Know About The Crypto Exchange That Just Went Public

Navigating the complex world of cryptocurrency exchanges requires a robust understanding of the regulatory environment. Coinbase, as a publicly traded exchange, faces heightened scrutiny and must demonstrate adherence to evolving regulations to maintain trust and stability. This section delves into the specifics of the regulatory landscape for cryptocurrency exchanges, Coinbase’s compliance measures, potential risks, and key regulations impacting their operations.

Regulatory Environment for Cryptocurrency Exchanges

The regulatory environment for cryptocurrency exchanges is fragmented and rapidly evolving across jurisdictions. Different countries and regions have adopted various approaches to regulating digital assets, ranging from outright bans to licensing and registration requirements. This lack of global harmonization creates challenges for companies operating in multiple markets. Existing securities laws often lack clear guidance on cryptocurrencies, leading to ambiguities and uncertainty.

For instance, classifying a cryptocurrency as a security or commodity can significantly impact its regulation and taxation.

Coinbase’s Regulatory Compliance Measures

Coinbase has actively engaged with regulatory bodies worldwide to ensure compliance. This includes obtaining necessary licenses and registrations where required, establishing robust anti-money laundering (AML) and know-your-customer (KYC) protocols, and investing in advanced technology to detect and prevent illicit activities. Their commitment to compliance is crucial for maintaining investor confidence and avoiding potential legal repercussions. These efforts are critical for establishing a credible reputation in the rapidly evolving regulatory landscape.

Potential Regulatory Risks Facing Coinbase

The rapidly evolving regulatory landscape presents significant potential risks to Coinbase. Changes in regulations, particularly in key markets, could impact their operations, potentially leading to increased compliance costs, operational disruptions, or even legal challenges. Uncertainty around future regulations and the evolving classification of cryptocurrencies pose substantial risks. For example, if a cryptocurrency is reclassified as a security in a major market, Coinbase’s operations within that jurisdiction could be significantly affected.

These risks necessitate a proactive and adaptable approach to regulatory compliance.

Key Regulations Affecting Coinbase

| Regulation | Description | Impact on Coinbase |

|---|---|---|

| U.S. Securities and Exchange Commission (SEC) regulations | The SEC’s approach to digital assets is highly influential and subject to significant ongoing development. | Coinbase faces potential scrutiny regarding the classification of certain cryptocurrencies as securities, impacting trading and offering practices. Compliance with reporting requirements for securities offerings is paramount. |

| U.S. Bank Secrecy Act (BSA) | This act mandates AML and KYC procedures for financial institutions. | Coinbase must adhere to stringent AML/KYC requirements to prevent the use of their platform for money laundering and other illicit activities. Failure to comply could result in significant penalties. |

| EU’s Markets in Crypto Assets Regulation (MiCA) | This regulation aims to provide a framework for regulating crypto assets and services in the EU. | Coinbase needs to adapt its compliance strategies to align with MiCA’s requirements, which are relevant to their operations within the European Union. |

| Other International Regulations | Numerous other jurisdictions are developing their own frameworks for regulating cryptocurrencies and exchanges. | Coinbase needs to continually monitor and adapt to these evolving regulations to maintain compliance across various global markets. |

Technological Advancements and Innovations

Coinbase’s success hinges not just on its user base and regulatory standing, but also on its ability to adapt to the ever-evolving landscape of cryptocurrency technology. The industry is constantly pushing boundaries, introducing new protocols, and refining existing ones. This dynamic environment necessitates continuous innovation from exchanges like Coinbase to maintain a competitive edge and provide a secure, user-friendly platform.The cryptocurrency market is characterized by rapid technological advancements.

So, Coinbase stock is officially public. What should you know about this crypto exchange? Well, beyond the initial buzz and potential investment opportunities, there’s also the broader tech landscape to consider. For instance, a new Thunderbolt 5 dock is vying for a spot on the market, another thunderbolt 5 dock joins the battle adding another layer of choice for users.

Ultimately, understanding the crypto market’s evolution and considering new hardware options is key to staying informed about Coinbase’s place in the digital economy.

New blockchain networks, improved consensus mechanisms, and enhanced security protocols are constantly emerging. This creates a need for platforms like Coinbase to adapt their infrastructure and services to accommodate these changes and remain relevant to their user base.

Impact of Blockchain Technology on Cryptocurrency Exchanges

Blockchain technology, the backbone of cryptocurrencies, is crucial for secure and transparent transactions. Improvements in blockchain protocols, like enhanced scalability and transaction speeds, directly affect the user experience and overall performance of cryptocurrency exchanges. These advancements allow for faster confirmation of transactions and reduced wait times, leading to a more efficient platform for users. For example, the shift from Proof-of-Work to Proof-of-Stake consensus mechanisms can drastically improve energy efficiency while maintaining network security.

Potential Innovations Implemented by Coinbase

Coinbase has demonstrated a history of innovation in the crypto space. One key area is the development of user-friendly interfaces and tools. Advanced security measures, such as multi-factor authentication and advanced fraud detection systems, are crucial to maintain user trust and protect assets. The integration of new cryptocurrencies and blockchain networks onto the platform is another potential area of innovation.

This allows users to access a wider range of investment opportunities and cater to evolving market demands.

Coinbase’s Technical Infrastructure

| Component | Description | Impact |

|---|---|---|

| Security Infrastructure | Advanced encryption protocols, multi-factor authentication, and robust fraud detection systems. | Protects user funds and assets from unauthorized access and malicious activity. |

| Scalability | Infrastructure capable of handling high transaction volumes during peak periods. | Ensures smooth operation and prevents service disruptions, crucial for user confidence. |

| Transaction Processing | Optimized transaction processing systems to handle diverse cryptocurrencies and blockchains. | Supports a wider range of cryptocurrencies, ensuring broader user access and platform versatility. |

| Compliance Systems | Adherence to regulatory requirements and AML/KYC procedures. | Maintains regulatory compliance and protects the platform from illicit activities, crucial for long-term sustainability. |

Future of Crypto Exchanges

The cryptocurrency exchange landscape is dynamic and ever-evolving. As adoption grows and regulations become more defined, exchanges must adapt to maintain user trust and profitability. The future of these platforms hinges on innovation, security, and regulatory compliance. Coinbase, as a prominent player, will be significantly influenced by these factors.

Market Consolidation and Competition

The crypto exchange market is likely to see consolidation, with larger, established platforms acquiring smaller competitors or forging strategic partnerships. This consolidation could lead to a few dominant players offering a wider range of services. Competition will intensify, driving exchanges to enhance their user experience, security protocols, and product offerings to attract and retain users. This trend is already observable in other sectors, where mergers and acquisitions have reshaped the competitive landscape.

Regulation and Compliance

The future of crypto exchanges is intrinsically linked to the evolving regulatory environment. Clearer and more consistent regulations globally will be essential for the long-term health of the market. Exchanges must prioritize compliance with these regulations to ensure long-term sustainability and maintain user trust. The SEC’s scrutiny of crypto exchanges highlights the importance of adhering to regulatory guidelines.

A regulatory framework that balances innovation with investor protection is crucial.

Technological Advancements

Technological advancements will play a significant role in shaping the future of crypto exchanges. Enhanced security protocols, faster transaction speeds, and more user-friendly interfaces will be key. Blockchain technology itself will continue to evolve, with the potential for exchanges to integrate innovative solutions for enhanced security, transaction efficiency, and user experience. The rise of decentralized exchanges (DEXs) also presents a potential challenge and opportunity for traditional exchanges.

Growth Opportunities for Coinbase

Coinbase can leverage its existing infrastructure and user base to expand into new market segments. Expanding into emerging markets, offering more diverse crypto asset listings, and developing new products and services are all potential avenues for growth. The development of institutional-grade products, aimed at attracting institutional investors, is also a key growth area. The company’s existing brand recognition and established platform provide a strong foundation for these initiatives.

Predicted Future of the Crypto Exchange Market

| Factor | Potential Impact | Example |

|---|---|---|

| Market Consolidation | Reduced competition, potentially leading to higher fees and less innovation | Large exchanges acquiring smaller players. |

| Regulation | Increased compliance costs and potential restrictions, but also fostering trust and stability. | SEC regulations impacting crypto listings. |

| Technological Advancements | Faster transactions, enhanced security, improved user experience, potential for new product development. | Integration of Layer-2 solutions for scalability. |

| Growth Opportunities | Expanding into new markets, new product development, attracting institutional investors. | Coinbase expanding into emerging markets or launching institutional-grade products. |

Outcome Summary

In conclusion, Coinbase’s journey as a publicly traded company presents both exciting opportunities and potential challenges. The future of crypto exchanges hinges on navigating regulatory complexities, technological advancements, and evolving market trends. Investors need to carefully evaluate the risks and rewards before making any investment decisions. The insights provided in this analysis offer a comprehensive overview for understanding Coinbase’s position in the dynamic cryptocurrency landscape.