Charter Spectrum debt forgiveness letter reporting credit agencies is a crucial topic for anyone navigating financial hardship. This in-depth guide explores the intricacies of Charter Spectrum’s debt forgiveness programs, examining how these programs affect credit scores and providing a sample letter template to help you navigate the process effectively.

We’ll delve into the specifics of different debt forgiveness options, eligibility criteria, and the crucial role credit agencies play in reporting this information. Understanding the potential positive and negative impacts on your credit score is essential, and we’ll provide actionable strategies for handling these reports and improving your credit standing.

Charter Spectrum Debt Forgiveness

Charter Spectrum, like many telecommunications providers, offers debt forgiveness programs to assist customers facing financial hardship. These programs can provide a fresh start and prevent further financial strain. Understanding the specifics of these programs is crucial for navigating the process effectively.Debt forgiveness programs from Charter Spectrum are designed to help customers resolve outstanding balances on their accounts. These programs often involve restructuring the payment terms or potentially eliminating the debt altogether, depending on the specific program and eligibility.

Careful consideration of these options is vital for those facing difficulties in meeting their financial obligations.

Debt Forgiveness Program Types

Charter Spectrum’s debt forgiveness programs often fall into several categories. These categories may vary in terms of eligibility, required documentation, and the amount of debt that can be forgiven. It is crucial to understand the differences between these programs to determine which best suits individual circumstances.

- Payment Plan Restructuring: This program allows customers to renegotiate their payment schedule to more manageable monthly installments. This is often the first step for those struggling to meet their current payment obligations. For example, a customer with a $500 balance could potentially restructure their payment to $100 monthly payments.

- Debt Consolidation: This option involves combining multiple debts into a single, lower monthly payment. This can simplify financial management and potentially lower the overall interest burden, especially if multiple services are involved. For example, a customer owing on internet, phone, and cable could consolidate these into one payment.

- Debt Waiver/Forgiveness: This program completely eliminates the outstanding balance under specific circumstances. Eligibility is typically stricter than other programs. This option is generally reserved for situations with extenuating circumstances or significant financial hardship. For instance, a customer facing job loss or a significant medical emergency might be eligible for this program.

Eligibility Criteria

Eligibility for debt forgiveness programs at Charter Spectrum depends on several factors. Understanding these factors is essential for a successful application. Documentation requirements often include proof of income, expenses, and the reason for the financial hardship.

- Financial Hardship: Documented financial struggles, such as job loss, medical emergencies, or significant life changes, are typically required to qualify. For example, a recent layoff or a significant increase in medical expenses can demonstrate financial hardship.

- Account History: A consistent payment history, even with occasional missed payments, might still allow a customer to qualify for a payment plan. The key is to show a history of attempting to meet obligations.

- Verification of Income and Expenses: Proof of income and expenses is often needed to demonstrate the financial hardship and the customer’s ability to make a payment plan. This might include pay stubs, tax returns, or other relevant documentation.

Application Process

The application process for Charter Spectrum’s debt forgiveness programs usually involves submitting specific documentation and completing an application form. This is a crucial step to ensure the program is the best fit for the customer.

- Documentation Submission: Gathering and submitting necessary documentation is essential for a successful application. This includes proof of income, expenses, and the reason for the financial hardship. For example, the customer might submit pay stubs, bank statements, and medical bills.

- Application Form Completion: Completing the application form accurately and providing all required information is critical. This form will likely request detailed information about the customer’s financial situation.

- Review and Approval: Charter Spectrum reviews the submitted documentation and application to assess eligibility for the chosen program. The timeline for this process varies.

Timeline and Appeals

The timeline for debt forgiveness programs at Charter Spectrum varies depending on the program and the complexity of the case. Appeals processes may exist for those whose applications are denied.

- Processing Time: The time it takes to process an application can vary significantly. It is recommended to contact Charter Spectrum directly to inquire about the expected processing time.

- Appeals Process: Customers whose applications are denied may have the opportunity to appeal the decision. The specific steps for appealing a denial are Artikeld in the program’s terms and conditions.

Comparison Table

| Debt Forgiveness Option | Number of Payments | Interest Rates | Eligibility Requirements |

|---|---|---|---|

| Payment Plan Restructuring | Variable, based on agreement | May be adjusted | Demonstrable financial hardship |

| Debt Consolidation | Fixed, lower monthly payments | Potentially reduced | Multiple outstanding balances |

| Debt Waiver/Forgiveness | None (balance eliminated) | Eliminated | Severe financial hardship, extenuating circumstances |

Common Reasons for Denial

| Reason | Explanation |

|---|---|

| Insufficient Documentation | Failure to provide necessary financial records or supporting evidence. |

| Inadequate Financial Hardship | Insufficient evidence of significant financial difficulties to qualify. |

| Violation of Terms and Conditions | Non-compliance with program guidelines or requirements. |

Impact on Credit Agencies

Debt forgiveness, while often a relief for individuals, can have a complex impact on credit reports. Understanding how credit agencies handle these reports is crucial for anyone navigating this process. This section will explore the effects of debt forgiveness reporting on credit scores, comparing agency practices, and illustrating potential outcomes.

Figuring out Charter Spectrum’s debt forgiveness letter reporting to credit agencies can be tricky, but thankfully, there are resources available. While you’re looking into that, you might also want to check out some amazing deals on smart home devices. For example, snag up to 46% off Aqara smart home devices in Amazon’s Black Friday sales! save up to 46 off aqara smart home devices in amazons black friday sales Knowing how these sales can impact your finances, it’s important to stay informed about how these debt forgiveness letters affect your credit report when dealing with Charter Spectrum.

How Debt Forgiveness Affects Credit Scores

Reporting debt forgiveness to credit agencies is a significant factor in determining creditworthiness. Credit bureaus view debt forgiveness as a resolution to a debt that was once outstanding. The effect on a credit score depends on several factors, including the amount of the forgiven debt, the length of the debt history, and the overall credit history of the individual.

Generally, debt forgiveness can lead to a temporary dip in a credit score, although the severity varies greatly. The impact is more pronounced for larger amounts of forgiven debt and for individuals with a shorter or less stable credit history.

Comparing Credit Agency Reporting Practices

Different credit agencies may handle debt forgiveness reporting differently. Some agencies may report the forgiven debt as a settled debt, while others may report it as a zero balance. This difference in reporting can influence the impact on credit scores. For instance, reporting as a settled debt may show the debt as having been paid off, which can potentially improve the credit score, but the actual amount forgiven could still affect it.

This varied treatment by agencies highlights the importance of understanding each agency’s specific approach.

Potential Scenarios

Debt forgiveness can positively or negatively impact credit scores depending on the individual circumstances. A small amount of forgiven debt on a long-established credit history might not significantly impact a credit score. However, significant debt forgiveness, especially if it involves multiple accounts or debts, can lead to a noticeable decline. Furthermore, the specific reasons for the debt forgiveness (e.g., financial hardship, restructuring) may not be immediately clear to the credit bureaus, potentially leading to a negative interpretation.

Length of Time Debt Forgiveness Remains on a Credit Report

The length of time a debt forgiveness record remains on a credit report varies by agency and the specific details of the forgiveness. Generally, the record stays on the report for several years, depending on the reporting agency’s policies and the specific agreement related to the forgiveness. It’s crucial to understand the specific timeframe for each agency and the debt forgiveness to properly assess the long-term implications.

Impact on Credit Scores: A Table Example

| Scenario | Potential Impact on Credit Score | Explanation |

|---|---|---|

| Small amount of debt forgiven on a long-established credit history with a stable payment record | Minor or no change | The forgiven debt is a relatively small part of the overall credit history. |

| Significant amount of debt forgiven on a short or unstable credit history | Moderate to significant decline | The forgiven debt represents a large portion of the overall credit history, and the instability can affect the score. |

| Debt forgiven due to financial hardship and reported as a zero balance | Potential for a temporary decline, depending on the severity of the hardship and the history | Zero balance reporting might not reflect the original debt history as accurately. |

| Debt forgiven through a debt consolidation program and reported as settled | Potential for improvement or minor decline, depending on the terms of the consolidation and the debt history | Settled debt reporting indicates the debt has been resolved, potentially boosting the score if the consolidation is handled appropriately. |

Letter Regarding Debt Forgiveness

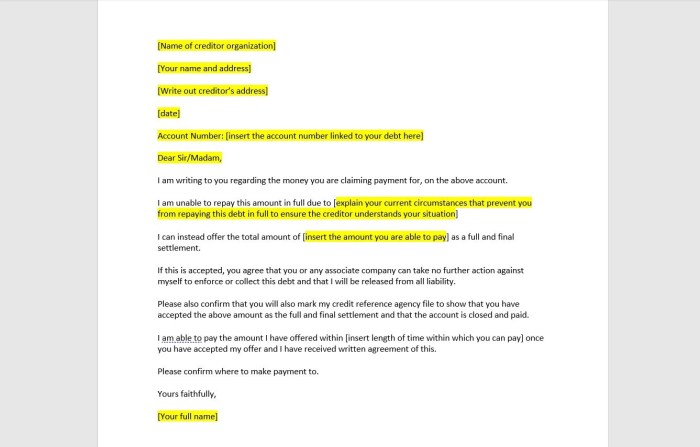

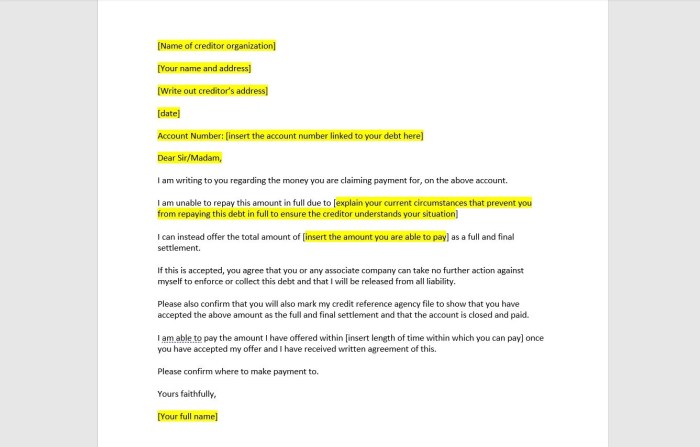

Debt forgiveness requests, especially from large companies like Charter Spectrum, can feel daunting. Knowing how to structure a compelling letter is crucial for increasing your chances of success. This guide provides a framework for crafting a letter that clearly articulates your situation and justifies your request.A well-written letter is more than just a pleading document; it’s a concise and persuasive presentation of your financial hardship.

It acts as a formal communication outlining the specific reasons why you deserve consideration for debt relief. The letter should be meticulously crafted to highlight your financial struggles while adhering to a professional tone.

Format and Structure of a Debt Forgiveness Letter

A formal letter follows a standard format. Start with a clear salutation addressing the appropriate recipient. Concisely state the purpose of the letter: requesting debt forgiveness for your Charter Spectrum account. Clearly identify your account number and provide contact information for verification. Thoroughly detail the reasons behind your request, emphasizing financial hardship.

Conclude with a request for a specific resolution and a call to action, outlining your preferred method of communication. End with a courteous closing and your signature.

Charter Spectrum’s debt forgiveness letter reporting to credit agencies is definitely a complex issue. However, it’s interesting to consider how this might impact the adoption of electric vehicles, like the Ford F-150 Lightning Pro electric pickup truck, within commercial fleets. Ford F-150 Lightning Pro electric pickup truck commercial fleets are gaining traction, but financial hurdles like this could still present a significant barrier.

Ultimately, the long-term impact on credit reporting for these types of situations remains to be seen.

Compelling Arguments for Debt Forgiveness

Demonstrating genuine financial hardship is key. Provide concrete evidence of your current financial situation. This might include pay stubs, proof of recent job loss, medical bills, or other relevant documents. Highlight any significant life events that have negatively impacted your ability to meet financial obligations. Examples include significant medical expenses, job loss, or unforeseen family emergencies.

Quantify the financial strain, showcasing how the debt impacts your ability to cover essential expenses.

Importance of Accurate and Complete Information

Accuracy and completeness are paramount in a debt forgiveness letter. Inaccurate information or omissions can severely undermine your case. Ensure all details are accurate and verifiable, avoiding any misrepresentation. Provide supporting documentation for all claims. The inclusion of pertinent information enhances the credibility and persuasiveness of your request.

Sample Letter Template, Charter spectrum debt forgiveness letter reporting credit agencies

| Section | Content Example |

|---|---|

| Contact Information | Your Name, Address, Phone Number, Email Address |

| Account Details | Charter Spectrum Account Number, Account Opening Date, Outstanding Balance |

| Reasons for Requesting Forgiveness | Detailed explanation of financial hardship, supporting documentation, and a specific request for debt forgiveness. |

Persuasive Letter Emphasizing Financial Hardship

“Due to unforeseen circumstances, including a job loss in [Month, Year], I have experienced significant financial hardship. This has severely impacted my ability to meet my monthly financial obligations, including the outstanding balance on my Charter Spectrum account. Attached are supporting documents, including my most recent pay stubs and proof of job loss.”

Present your situation clearly and concisely, using quantifiable examples to demonstrate the financial strain. Explain how the debt negatively affects your ability to meet basic needs, including housing, food, and healthcare. Demonstrate a proactive approach to resolving the issue by proposing a payment plan or alternative resolution.

Methods for Handling Debt Forgiveness Reporting

Debt forgiveness, while often a relief, can significantly impact your credit report. Understanding how this impacts your credit and how to navigate the process is crucial for maintaining a healthy financial future. This section delves into strategies for handling debt forgiveness reports to credit agencies, providing tools for resolving inaccuracies and maximizing your credit score recovery.Handling debt forgiveness reports to credit agencies requires a proactive and informed approach.

Ignoring the situation won’t make the issue disappear; instead, it can lead to further complications and potentially damage your creditworthiness. The key is to understand your rights and responsibilities, and act accordingly.

Strategies for Handling Debt Forgiveness Reports

Debt forgiveness reporting can sometimes lead to inaccurate or incomplete information on your credit reports. These reports, if not addressed promptly, can have a lasting negative impact on your credit score. Proactive management is vital for protecting your financial standing.

- Dispute Inaccuracies: If your credit report shows incorrect information about the debt forgiveness, immediately dispute it. Contact the credit reporting agency and provide documentation proving the debt has been forgiven. This documentation may include letters from the creditor confirming the debt forgiveness, or court records if applicable. Be specific and detail the errors in the report.

- Monitor Your Credit Reports Regularly: Regularly checking your credit reports is crucial for identifying potential errors or inconsistencies. Knowing the current status of your credit report allows you to address any issues promptly. Most importantly, this practice enables you to detect any potential fraud or identity theft attempts. Use the free annual credit reports from each agency to stay informed.

- Contact Creditors: Maintaining open communication with the creditor is important. Request confirmation of the debt forgiveness in writing and follow up on the status of the report to ensure accurate updates.

Methods for Disputing Inaccurate Information

A dispute process is available for inaccuracies or incompleteness on your credit report. It’s essential to follow the correct procedures to ensure your dispute is processed efficiently and effectively.

- Gather Supporting Documentation: Collect all relevant documentation, such as letters from the creditor confirming the debt forgiveness or court documents, and include them with your dispute. This documentation is crucial for supporting your claim.

- Follow the Dispute Process: Each credit reporting agency has a specific process for handling disputes. Carefully follow the instructions provided by the agency to ensure your dispute is processed correctly. This often involves filling out a specific form and providing all necessary supporting documents.

- Stay Organized: Keep copies of all correspondence, including letters, emails, and dispute forms, for your records. This record-keeping will be invaluable if you need to follow up or escalate your dispute.

Improving Credit Scores After Debt Forgiveness

Debt forgiveness can have a negative impact on your credit score. However, several steps can help you improve your credit standing after this event.

- Establish New Credit Lines: Apply for new credit accounts, such as credit cards or store accounts, responsibly. This shows a positive financial activity and builds your credit history. However, avoid taking on too much debt.

- Make Timely Payments: Consistently making timely payments on all your accounts is essential for improving your credit score. This demonstrates responsible financial management and builds a positive credit history.

- Maintain a Healthy Debt-to-Income Ratio: Keeping your debt-to-income ratio low can significantly improve your credit score. This ratio reflects the proportion of your income that goes towards debt payments.

Monitoring Credit Reports After Debt Forgiveness

Regular monitoring of your credit reports is essential for tracking the progress of your credit score recovery.

- Review Your Reports Regularly: Review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) regularly to ensure accuracy and identify any further issues.

- Verify Accuracy: Carefully scrutinize each report for any inconsistencies or inaccuracies. Look for the debt forgiveness and confirm that the information reported aligns with the agreement or court documents.

- Report Any Discrepancies: If you find any errors, immediately dispute them with the appropriate credit reporting agency.

Flowchart: Disputing Inaccurate Information

This flowchart Artikels the process for disputing inaccurate information on your credit report.

| Step | Action |

|---|---|

| 1 | Identify inaccurate information on your credit report. |

| 2 | Gather supporting documentation (letters, court records). |

| 3 | Complete the dispute form provided by the credit reporting agency. |

| 4 | Mail or submit the dispute form and supporting documentation to the credit reporting agency. |

| 5 | Keep copies of all correspondence and dispute forms for your records. |

| 6 | Monitor the status of your dispute and follow up with the agency if needed. |

Illustrative Scenarios: Charter Spectrum Debt Forgiveness Letter Reporting Credit Agencies

Debt forgiveness, while often a positive step for struggling individuals, can have a complex interplay with credit scores and financial well-being. Understanding the potential positive and negative outcomes is crucial for navigating this process effectively. This section explores various scenarios to illustrate the different impacts of debt forgiveness.

Positive Impact on Financial Situation

Debt forgiveness can significantly improve a customer’s financial situation by removing a substantial burden. Imagine a single parent with two children struggling to make ends meet, burdened by mounting credit card debt. Charter Spectrum, recognizing the hardship, forgives a portion of their outstanding debt. This immediate reduction in monthly payments frees up a considerable amount of disposable income.

The freed-up funds can be allocated to essential expenses, like housing and food, or used to invest in educational opportunities or create a financial cushion for emergencies. This relief leads to improved financial stability, reduced stress, and the potential for long-term financial growth.

Negative Impact on Credit Score

Debt forgiveness, while offering immediate financial relief, often has a detrimental effect on a customer’s credit score. A scenario involving a homeowner with a significant mortgage and numerous credit card debts is a prime example. If Charter Spectrum forgives a portion of the credit card debt, this act will be reported to the credit agencies. The reduction in the total amount owed and the presence of a forgiven debt can negatively impact their credit history.

Figuring out Charter Spectrum’s debt forgiveness letter reporting to credit agencies can be tricky, but finding the right workout routine doesn’t have to be! If you’re looking for some fantastic free workout videos, check out some of the top channels on YouTube, like the ones listed on this page: best youtube channels for free workouts. Once you’ve got your fitness routine sorted, remember to keep a close eye on how those debt forgiveness letters affect your credit report.

It’s all about balance, really!

This negative mark on their credit report will remain visible for several years, potentially affecting their ability to secure loans, rent an apartment, or obtain favorable interest rates on future financial products.

Dispute Over Debt Forgiveness Reporting

Disputes over the reporting of debt forgiveness to credit agencies are common. Consider a scenario where a customer believes the amount forgiven is inaccurately reported. If Charter Spectrum reports a larger amount than agreed upon, or if the forgiveness was not properly documented, the customer may dispute the accuracy of the reported data. This disagreement may involve lengthy communication with Charter Spectrum and the credit reporting agencies to rectify the incorrect information.

The process of resolving this dispute may involve providing supporting documentation and proof of the agreed-upon terms of the debt forgiveness agreement.

Successful Debt Forgiveness Appeal

A successful appeal of a debt forgiveness denial involves demonstrating compelling reasons for the denial’s reversal. A scenario where a customer was denied debt forgiveness due to alleged violations of service agreements, but could provide evidence of extenuating circumstances, such as a natural disaster, illustrates this point. Documentation, such as official disaster declarations or certified letters, could significantly bolster the customer’s case and influence a favorable outcome.

By presenting substantial evidence, the customer successfully persuades Charter Spectrum to reconsider the denial, potentially leading to a positive impact on their financial well-being.

Financial Journey After Successful Forgiveness

A successful debt forgiveness process can pave the way for a significant improvement in a customer’s financial journey. Imagine a customer who had been struggling with mounting debt for years. Following the debt forgiveness, they proactively develop a budget, track their expenses, and explore options for building a savings plan. They also actively monitor their credit score and take steps to rebuild it.

They enroll in financial literacy courses and explore opportunities to improve their creditworthiness. Over time, this commitment to financial responsibility results in improved credit scores, increased savings, and the ability to pursue future financial goals with confidence.

Legal Considerations

Navigating debt forgiveness, especially for large companies like Charter Spectrum, involves a complex web of legal rights and responsibilities. Understanding these intricacies is crucial for both customers and the provider to ensure fair and compliant practices. This section delves into the legal framework surrounding debt forgiveness, covering customer and provider rights, relevant documents, potential ramifications of inaccurate reporting, and avenues for dispute resolution.

Customer Rights and Responsibilities

Customers have specific rights regarding debt forgiveness. These rights often stem from the terms and conditions of their service agreements and applicable consumer protection laws. These laws generally aim to protect consumers from unfair or deceptive practices. A customer’s responsibilities include adherence to the terms of their service agreement, timely payment if possible, and clear communication with Charter Spectrum when disputes arise.

Provider Rights and Responsibilities

Charter Spectrum, as the provider, also has legal obligations. These obligations include maintaining accurate records of debt, complying with reporting requirements to credit agencies, and adhering to fair debt collection practices. Failure to meet these responsibilities can expose the company to legal action and reputational damage.

Relevant Legal Documents

Various legal documents underpin debt forgiveness processes. These documents might include service agreements, contracts, and notices of debt forgiveness. These documents Artikel the terms of the agreement, the conditions for debt cancellation, and the procedures for reporting to credit agencies.

Ramifications of Inaccurate Reporting

Inaccurate reporting to credit agencies regarding debt forgiveness can have serious consequences for both customers and Charter Spectrum. Inaccurate reporting can negatively impact a customer’s credit score, potentially affecting their ability to secure loans, rent an apartment, or obtain credit cards. Conversely, inaccurate reporting can lead to legal challenges for Charter Spectrum, potentially resulting in fines or lawsuits.

Accurate reporting is essential to maintain transparency and avoid any misrepresentation.

Recourse Options for Customers

Customers feeling unfairly treated during the debt forgiveness process have recourse options. These might include filing a complaint with Charter Spectrum’s customer service department, contacting regulatory agencies, or engaging with a consumer protection attorney. Thorough documentation of the interaction and relevant contractual agreements will be vital in this process.

Filing a Complaint

Filing a complaint regarding debt forgiveness typically involves several steps. First, the customer should document all communication with Charter Spectrum, including dates, times, names of representatives, and the substance of the conversations. Second, they should carefully review their service agreement and other relevant documents. Third, the customer should contact Charter Spectrum’s customer service department to escalate the issue and attempt to resolve it through internal channels.

If internal resolution proves unsuccessful, the customer can then escalate the complaint to relevant regulatory bodies or consult legal counsel.

Conclusion

In conclusion, understanding Charter Spectrum’s debt forgiveness policies and their impact on your credit report is paramount. By carefully reviewing eligibility criteria, crafting a persuasive letter, and proactively managing the reporting process, you can navigate this complex situation effectively. Remember to prioritize accurate information and seek legal counsel if needed. This guide equips you with the knowledge to make informed decisions about your financial well-being.