Turbo tax credit karma intuit purchase competitor credit checks are crucial for understanding the tax landscape. This in-depth look dives into the specifics of TurboTax’s credit system, comparing it to Karma and other competitors. We’ll explore Intuit’s acquisition history, the role of credit checks in tax preparation, and ultimately, the overall customer experience and future trends in this dynamic market.

Intuit’s strategic moves and the competitive landscape will be examined, along with how these factors impact your tax preparation choices.

The analysis delves into the nitty-gritty of each product, including pricing models, user interfaces, and support systems. We’ll also look at the various credit types, their eligibility requirements, and how credit checks factor into the process. This is a crucial aspect of tax preparation for anyone looking to maximize their tax benefits.

Turbo Tax Credit Overview

TurboTax, a popular tax preparation software, offers various tax credits to help individuals and families reduce their tax burden. These credits, often substantial, can significantly impact your financial situation. Understanding these credits and how they work is crucial for maximizing your tax refund or minimizing your tax liability. This overview will explore the different types of credits available and their eligibility requirements.

Types of TurboTax Credits

Understanding the different types of credits available through TurboTax is essential for maximizing your tax savings. Each credit has specific eligibility criteria, and understanding these will allow you to determine which credits you may qualify for. The credits offered can vary depending on individual circumstances and income levels.

| Credit Type | Description | Eligibility Requirements |

|---|---|---|

| Child Tax Credit | A significant credit for taxpayers who have qualifying children. This credit helps offset the costs associated with raising children. | The child must be under age 17 at the end of the tax year and be claimed as a dependent on the taxpayer’s return. Specific income limits apply. For example, a family earning less than $400,000 per year might qualify for this credit. |

| Earned Income Tax Credit (EITC) | A credit for low-to-moderate-income working individuals and families. It’s designed to encourage work and reduce the tax burden for those with limited income. | The taxpayer must have earned income, have a qualifying child or other dependent, and meet specific income thresholds. For example, a single parent with a child earning $30,000 annually might qualify for this credit. |

| Child and Dependent Care Credit | This credit helps offset expenses for childcare or dependent care so taxpayers can work or look for work. | The taxpayer must have paid childcare expenses to allow them to work or look for work. Specific income limitations and other requirements apply. For example, if a taxpayer spends $3,000 on childcare, they may qualify for this credit. |

| Adoption Tax Credit | A credit for qualified adoption expenses. This credit can help offset the costs associated with adopting a child. | The taxpayer must have legally adopted a child. Specific requirements regarding the adoption process and expenses apply. For example, the costs of legal fees, travel, and other adoption-related expenses are considered. |

| Residential Energy Credits | This credit helps offset expenses for energy-efficient home improvements. | The taxpayer must have made qualified energy-efficient improvements to their home. Examples include installing solar panels or energy-efficient windows. |

Eligibility Criteria for Each Credit

The eligibility criteria for each tax credit vary. Careful review of the specific guidelines is crucial to determine eligibility. Taxpayers must carefully review the criteria for each credit to understand the requirements. It is important to note that specific rules and requirements are subject to change. Consult tax professionals for specific guidance, as rules and requirements can be complex and vary based on the specific circumstances.

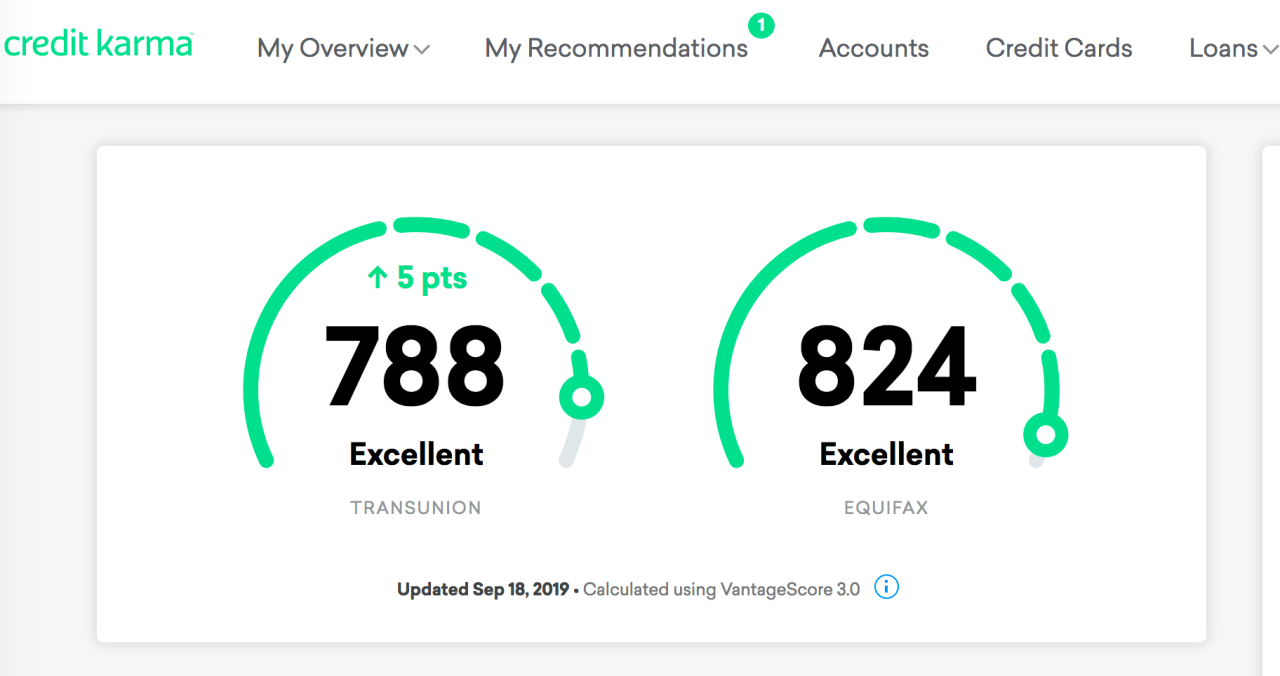

Karma Tax Software Comparison: Turbo Tax Credit Karma Intuit Purchase Competitor Credit Checks

Navigating the tax software landscape can be daunting, especially with the rise of online alternatives. TurboTax, a well-established name, faces competition from newer entrants like Karma. Understanding the features, pricing, and user experiences of these platforms is crucial for informed decision-making. This comparison will delve into the specifics of Karma Tax Software, highlighting its strengths and weaknesses relative to TurboTax and other competitors.Karma, a relatively recent player in the tax preparation market, aims to offer a streamlined and user-friendly experience.

Its approach to tax preparation differs from traditional methods, and it’s essential to assess whether this approach aligns with individual needs.

Key Features Comparison

This section Artikels the core functionalities of Karma and TurboTax, emphasizing the key differentiators. Karma focuses on simplicity and ease of use, while TurboTax boasts a broader range of features. Understanding these distinctions is important when choosing the right software.

- Karma’s core strength lies in its intuitive interface and simplified tax calculations. It prioritizes a streamlined experience for users, particularly those with straightforward tax situations.

- TurboTax, conversely, offers a more comprehensive suite of features, including advanced tax planning tools and resources for complex tax scenarios. This broader scope can be beneficial for users with intricate financial situations.

Pricing Models and Accessibility

Comparing the pricing models of tax software is crucial for budgeting. This section examines the cost structure of Karma and TurboTax and contrasts them with other options. Knowing the price points can assist in making a well-informed decision.

- Karma’s pricing structure often involves a tiered approach, with varying costs depending on the complexity of the tax return. A free version might exist for simpler filings, with a subscription model for more complex scenarios.

- TurboTax offers a range of pricing options, typically including a premium version with more comprehensive features. The availability of various subscription levels allows users to choose based on their specific needs.

User Interface and Support

A user-friendly interface and readily available support are critical for a positive tax preparation experience. This section explores the interface design and support options for Karma and TurboTax.

- Karma’s interface is designed for ease of use, with a focus on simplicity and clarity. The navigation should be intuitive for most users.

- TurboTax’s interface is comprehensive and provides a broad range of tools and resources. However, the interface may be more complex for less experienced users.

Competitive Analysis Table, Turbo tax credit karma intuit purchase competitor credit checks

This table provides a comparative overview of Karma, TurboTax, and other prominent tax software competitors. It highlights key features, pricing, and user reviews, aiding in the selection process.

| Software | Features | Pricing | User Reviews |

|---|---|---|---|

| TurboTax | Comprehensive features, advanced tools | Various tiers, potentially higher cost | Generally positive, but some user complaints about complexity |

| Karma | Simplified interface, streamlined process | Potentially tiered, varied pricing models | Limited user reviews available; early indicators suggest a positive trend |

| H&R Block | Established brand, extensive network | Various tiers, potentially higher cost | Generally positive, but some complaints about user experience |

| TaxAct | Affordable pricing, straightforward process | Competitive pricing, varied plans | Generally positive, known for ease of use |

Intuit’s Purchase and Competitors

Intuit, a powerhouse in financial technology, has a rich history of acquisitions, particularly in the tax software sector. Understanding these acquisitions sheds light on Intuit’s strategies and its position within the competitive landscape. This section delves into Intuit’s acquisition history, its primary competitors, and the evolving dynamics of the tax preparation software market.Intuit’s acquisition strategy has been instrumental in shaping its current dominance in the tax software industry.

Through strategic purchases, Intuit has expanded its product offerings and broadened its customer base. This expansion has also meant facing fierce competition, forcing Intuit to adapt its approach and strategies.

Intuit’s Acquisition History

Intuit has a history of acquiring tax software companies. These acquisitions have often been key to expanding their product line, customer base, and market share. For instance, the acquisition of TurboTax in the past solidified Intuit’s position as a major player. This acquisition was a significant move to consolidate their market presence and strengthen their position against competitors.

Intuit’s Primary Competitors

Several companies compete with Intuit in the tax preparation software market. Direct competitors include H&R Block, TaxAct, and others. The competitive landscape is characterized by a mix of established players and newer, innovative companies.

TurboTax, Credit Karma, and Intuit’s purchase of competitor credit check services are all in the news lately. It got me thinking about the whole efficiency of these systems, especially given the current headlines about the potential for federal employees to be asked to justify their positions, as highlighted in this article. Ultimately, these credit check companies are trying to streamline the tax process, but with these types of questions coming up, perhaps we need to consider a deeper look into the impact on efficiency in other areas too.

Maybe the whole tax preparation landscape needs a refresh.

Competitive Landscape Analysis

The tax preparation software market is highly competitive. Competition stems from both established players like H&R Block and new entrants seeking to disrupt the market. The competitive landscape is marked by differentiation in pricing models, product features, and customer service approaches.

Intuit’s Strategies in Response to Competition

Intuit has adapted its strategies to address the challenges posed by competitors. For example, continuous product development and feature enhancements have been critical to maintaining customer satisfaction. Intuit has also focused on expanding its service offerings, including online assistance and financial planning tools, to attract and retain users. Furthermore, Intuit’s strategies have involved continuous innovation to maintain its competitive edge.

Market Share Analysis

The tax preparation software market is highly concentrated, with Intuit holding a significant portion of the market share. A comprehensive analysis of market share requires detailed data, which is not readily available in a public format.

| Company | Estimated Market Share (approximate) |

|---|---|

| Intuit (TurboTax) | ~40-50% |

| H&R Block | ~20-30% |

| TaxAct | ~10-15% |

| Other Competitors | ~10-20% |

Note: Market share figures are approximate and can vary based on the source and methodology. These estimates provide a general overview of the market distribution.

Credit Checks in Tax Preparation

Tax preparation software, from established players like TurboTax to newer entrants like Karma, often employs credit checks. These checks aren’t always visible or obvious, but they play a crucial role in determining eligibility for various tax credits and deductions. Understanding how these checks function, the reasons behind them, and the potential privacy concerns is vital for informed decision-making.

While credit checks aren’t universally applied in all tax software, they are becoming increasingly common, particularly for complex tax situations. Their use is often tied to accessing specific tax credits, such as those for homebuyers, or for those claiming student loan interest deductions. This approach allows the software to more accurately determine a taxpayer’s eligibility for such credits and avoid potential errors or fraudulent claims.

Types of Credit Checks Used

Tax preparation software often leverages different types of credit checks to verify a taxpayer’s financial information. These checks can range from simple credit reports to more extensive inquiries, depending on the complexity of the situation and the credits being claimed.

Thinking about turbo tax credit options, and how Karma and Intuit’s purchase of competitor credit check services might impact the market? It’s interesting to consider how these kinds of financial decisions relate to larger issues like the TSA union and government shutdowns impacting airport security, as discussed in this article on tsa union government shut down airport security trump.

Ultimately, these purchasing decisions could influence pricing strategies and consumer choices for turbo tax credit services, making it an area to watch closely.

- Credit reports: These reports typically include information about a taxpayer’s credit history, such as payment history, credit utilization, and the length of their credit history. This information helps determine a taxpayer’s overall creditworthiness and financial responsibility.

- Specific credit inquiries: Some software might conduct more specific credit inquiries, focusing on certain aspects of a taxpayer’s credit profile that are directly relevant to specific tax credits or deductions. For example, an inquiry might target whether a taxpayer has a mortgage or other debt that qualifies for a specific deduction.

Reasons for Using Credit Checks

The primary reason for incorporating credit checks in tax preparation software is to ensure accuracy and prevent fraudulent claims. By verifying a taxpayer’s financial information, software can more accurately assess eligibility for tax credits and deductions.

- Identifying eligibility for specific credits: Some tax credits are directly tied to specific financial situations, such as homeownership or student loan debt. Credit checks help verify these situations and ensure that the taxpayer meets the necessary criteria for claiming the credit. This prevents ineligible individuals from claiming these credits, which helps maintain the integrity of the tax system.

- Preventing fraud: Credit checks can help detect potential fraudulent claims. By verifying the accuracy of the financial information provided by the taxpayer, the software can minimize the risk of fraudulent activity, thereby protecting the tax system.

- Improving tax accuracy: More precise data allows for more accurate tax calculations and deductions. This approach helps to ensure that the correct amount of taxes is calculated and paid. The resulting accuracy benefits both the taxpayer and the government.

Comparison of Credit Check Procedures

Different tax preparation software platforms utilize credit checks in varying ways. The specific procedures employed can vary significantly, influencing the extent of the credit check and the information gathered.

| Software | Credit Check Procedure |

|---|---|

| TurboTax | TurboTax utilizes a standardized credit check process, typically employing credit reporting agencies. The specific details of their process are not publicly available. |

| Karma | Karma’s approach to credit checks is also likely to use credit reporting agencies, but the specifics are unclear. As a newer entrant, their procedures might differ in subtle ways compared to established players. |

| Competitors | Other tax preparation software competitors may have varying procedures. Some may have more extensive checks than others, or they may focus on particular aspects of the credit report. |

Privacy Concerns

The use of credit checks in tax preparation raises concerns about data privacy. Taxpayers need to understand the potential risks and implications.

- Data security: Ensuring the security of sensitive financial data is paramount. Taxpayers should choose software providers that have robust security measures in place to protect their information from unauthorized access.

- Data usage: Understanding how the software provider intends to use the collected data is essential. Transparent policies regarding data usage are crucial for building trust.

- Consumer rights: Taxpayers have rights regarding their financial data. Knowing these rights and exercising them is vital.

Customer Experience and Satisfaction

Navigating the complex world of tax preparation can be daunting. Choosing the right software can significantly impact the ease and stress associated with filing taxes. Customer experience plays a crucial role in selecting a tax preparation service, as it directly affects the overall satisfaction and likelihood of returning to a particular platform. This section delves into the customer feedback landscape, examining factors influencing satisfaction, potential pain points, and strategies competitors employ to enhance the user experience.

Customer Reviews and Feedback

Customer reviews and feedback provide valuable insights into the strengths and weaknesses of tax preparation software. Websites like Trustpilot and Google Reviews offer a platform for users to share their experiences, both positive and negative. Analyzing these reviews reveals recurring themes, such as ease of use, accuracy of calculations, customer support responsiveness, and overall satisfaction with the software’s features.

For instance, many users praise TurboTax for its user-friendly interface and comprehensive features, while others cite difficulties with specific tax forms or complex situations. Conversely, competitors like H&R Block and TaxAct often receive praise for their extensive support networks and straightforward guidance.

Factors Influencing Customer Satisfaction

Several factors significantly influence customer satisfaction with tax preparation software. Intuitive interfaces, clear instructions, and readily available support channels are key elements. Accurate tax calculations and timely processing are critical for a positive experience. The software’s ability to handle diverse tax situations and individual needs also plays a role. For example, users with complex financial situations might prioritize software that provides detailed explanations and options.

Figuring out the best turbo tax credit with Karma, Intuit, or competitor credit checks can be tricky. With Disney Plus price hikes looming, it’s smart to check out bundle deals to save some cash, like those discussed in this helpful article on disney plus price hike here how to get the best bundle deal. Ultimately, comparing credit check options from different providers remains a crucial part of getting the most favorable tax benefits and avoiding hidden fees.

Similarly, users with limited technical skills may favor software with a simple, user-friendly design.

Potential Pain Points and Areas for Improvement

Despite the advancements in tax preparation software, certain pain points persist. Difficulties in navigating complex tax forms, especially for individuals with multiple income streams or investments, remain a significant concern. Inadequate or slow customer support can also negatively impact the user experience. A lack of clear guidance during specific tax situations can also frustrate users, leading to potential errors or inaccurate returns.

Software updates that address these pain points are crucial to improving customer satisfaction.

Features Contributing to a Positive Customer Experience

Features that contribute to a positive customer experience encompass intuitive navigation, clear explanations, and readily accessible help resources. Tax preparation software should offer clear step-by-step guidance, reducing user confusion. A comprehensive knowledge base, FAQs, and live chat support options can further assist users. Automated calculations and error detection mechanisms are crucial for accuracy. Furthermore, advanced features, like personalized recommendations based on individual financial situations, can significantly improve the user experience.

Competitive Strategies for Improving Customer Satisfaction

Competitors are employing various strategies to enhance customer satisfaction. This includes investing in user-friendly interfaces and robust customer support systems. Furthermore, offering comprehensive knowledge bases, tutorials, and detailed FAQs can assist users in navigating complex tax scenarios. Personalized recommendations and tailored support based on user needs are also gaining traction. For instance, some companies offer personalized tax consultations to address specific user concerns, while others offer tailored advice on specific investment income or deductions.

Market Trends and Future Projections

The tax preparation software market is constantly evolving, driven by technological advancements and changing consumer preferences. This dynamic environment necessitates a keen understanding of current trends to anticipate future developments and adapt strategies accordingly. From the rise of mobile-first solutions to the integration of AI, the future of tax preparation is poised for significant transformation.Recent years have witnessed a surge in the adoption of online tax preparation services, driven by factors such as convenience, affordability, and increased accessibility.

This shift has significantly impacted traditional brick-and-mortar tax preparation businesses, forcing them to adapt or face obsolescence. The future of tax software hinges on how effectively these players respond to these evolving demands and embrace emerging technologies.

Recent Trends in the Tax Preparation Software Market

The tax preparation software market has experienced significant changes in recent years, marked by increased user demand for online and mobile accessibility. This shift is primarily driven by user preference for convenience and time-saving features.

- Rise of Mobile-First Solutions: Users increasingly prefer accessing tax preparation software through their mobile devices. This trend highlights the growing demand for on-the-go solutions, reflecting a modern work style and the need for immediate accessibility.

- Enhanced User Experience: Software providers are focusing on creating more intuitive and user-friendly interfaces, catering to a wider range of users, including those with limited tax knowledge. Improved navigation and simplified processes are crucial to enhancing the overall user experience.

- Integration of AI and Machine Learning: AI and machine learning are transforming tax preparation by automating various tasks, including data entry and error detection. This technology can significantly reduce preparation time and enhance accuracy.

- Emphasis on Data Security and Privacy: With increasing concerns about data breaches and privacy violations, users are demanding robust security measures from tax preparation software providers. This trend underscores the importance of data protection and compliance with relevant regulations.

Potential Future Developments in the Tax Preparation Industry

The tax preparation industry is expected to continue adapting to changing technological landscapes and user expectations.

- Integration of Blockchain Technology: Blockchain technology holds the potential to revolutionize tax preparation by enhancing transparency and security. This technology could facilitate secure data sharing and improve tax compliance, potentially leading to more accurate and streamlined processes.

- Increased Use of Virtual Assistants: Virtual assistants could play a greater role in providing personalized tax advice and support to users, facilitating a more interactive and user-friendly experience. This personalized approach could significantly improve user satisfaction and engagement.

- Personalized Tax Recommendations: The future of tax preparation software might include features that provide personalized recommendations based on individual financial situations and goals. This could allow users to make informed decisions and optimize their tax strategies.

Emerging Technologies Influencing the Tax Preparation Process

New technologies are continuously reshaping the tax preparation landscape, offering innovative solutions to improve efficiency and accuracy.

- Natural Language Processing (NLP): NLP can analyze user queries and provide relevant information and guidance, improving the overall user experience. For example, users can ask questions in natural language, and the software will respond with accurate and helpful information.

- Cloud Computing: Cloud-based tax preparation software allows for data storage and processing in the cloud, enhancing accessibility and security. This eliminates the need for extensive local storage, which can be a major advantage for users.

- Big Data Analytics: Big data analytics can help identify tax fraud patterns and optimize tax policies, ultimately improving the efficiency and fairness of the tax system.

Impact of Online Tax Preparation on the Market

The rise of online tax preparation has fundamentally altered the market, impacting traditional methods of tax preparation.

- Increased Accessibility and Convenience: Online tax preparation provides accessibility to a wider range of users, particularly those in remote areas or with limited access to traditional tax services. This accessibility fosters convenience, enabling users to complete their taxes from anywhere with an internet connection.

- Cost-Effectiveness for Users: Online tax preparation often proves more cost-effective for users compared to traditional methods, such as hiring a professional tax preparer. This affordability factor is a significant driver for the adoption of online solutions.

- Shift in Competition: The rise of online tax preparation has led to a more competitive market, prompting traditional tax preparation firms to adopt online platforms and adapt their strategies to compete.

Forecast of the Future of Tax Software

Based on current trends and projections, tax software is poised for further evolution and innovation.

- Predictive Analytics: Software could predict tax liabilities and provide users with proactive advice to optimize their financial strategies. This proactive approach could save users time and potentially reduce tax burdens.

- Personalized Financial Planning: Tax software could integrate with other financial planning tools to provide a comprehensive view of users’ financial situations and offer tailored recommendations.

- Enhanced Security Measures: Tax software will likely incorporate even more robust security measures to safeguard user data and protect against fraud. This emphasis on security is crucial to maintain user trust and confidence.

Final Conclusion

In conclusion, navigating the world of tax preparation software requires a keen understanding of the intricacies involved. TurboTax, Karma, and their competitors offer diverse features and approaches. This analysis highlights the factors to consider when selecting a tax preparation service, including credit checks, pricing, and customer reviews. The future of tax software is influenced by evolving market trends and technological advancements, which will undoubtedly shape the landscape in the coming years.