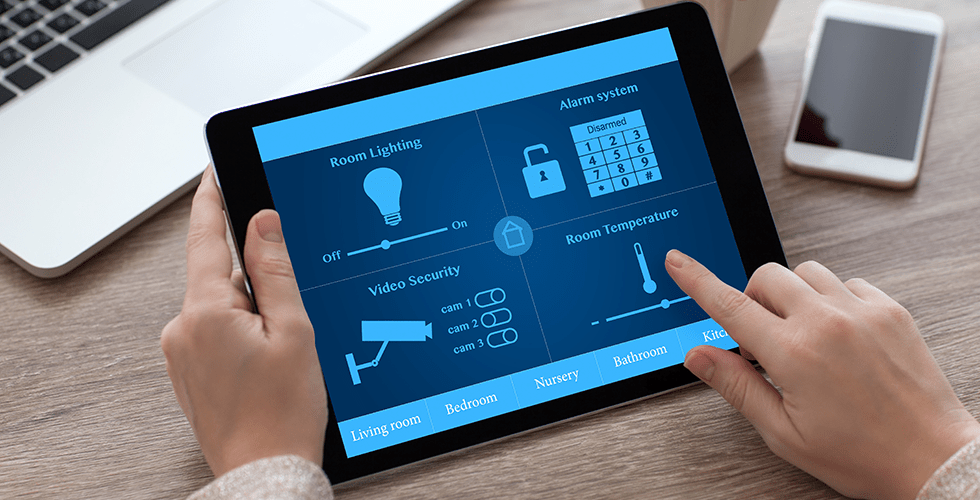

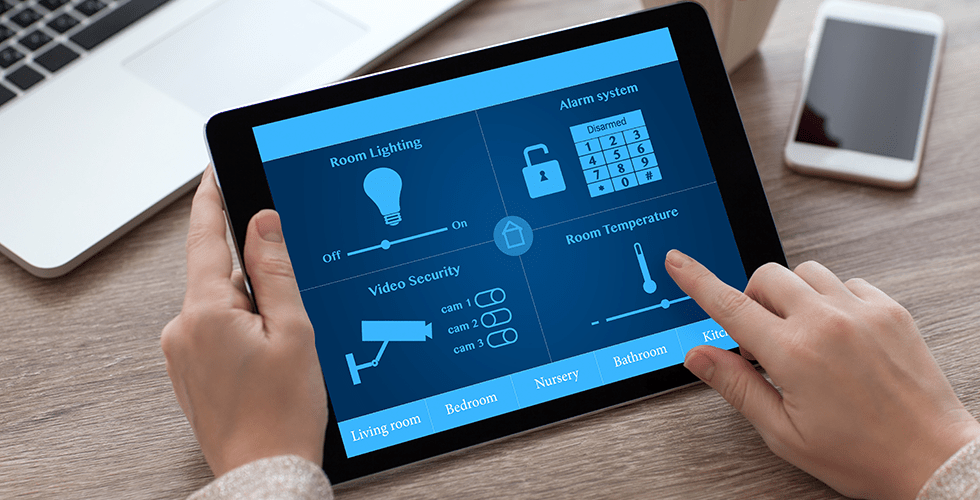

How identity protection can accelerate your cyber insurance initiatives is a critical strategy for businesses today. Compromised identities are a leading cause of cyberattacks, often leading to costly insurance claims. This in-depth look explores how robust identity protection can proactively prevent these breaches, leading to lower premiums and stronger overall security. We’ll delve into examples, strategies, and case studies to demonstrate the significant impact identity protection can have on your cyber insurance program.

Protecting your business from cyber threats involves more than just reactive measures. A proactive approach focusing on identity protection can significantly reduce your risk and potentially lower your insurance costs. We’ll explore how identity verification, preventative strategies, and effective integration with existing security systems all contribute to this outcome.

Introduction to Identity Protection and Cyber Insurance

Identity protection is a critical component of a comprehensive cybersecurity strategy, playing a vital role in mitigating cyber risks and reducing the financial impact of data breaches. It encompasses a range of measures designed to safeguard personal and organizational identities from unauthorized access, use, or disclosure. A robust identity protection program is no longer a luxury but a necessity in today’s interconnected world.Identity theft can lead to significant financial and reputational damage, often requiring extensive remediation efforts.

This damage can directly translate into cyber insurance claims, ranging from fraudulent account activity to the recovery of stolen data. By proactively safeguarding identities, organizations can reduce the likelihood of such claims, ultimately leading to lower insurance premiums and enhanced overall security posture.

Identity Protection and Cyber Insurance Claims

Compromised identities can trigger various cyber insurance claims. A common scenario involves a data breach exposing employee or customer Personally Identifiable Information (PII). This can result in fraudulent transactions, unauthorized access to accounts, and potentially costly legal liabilities. Another example is the misuse of credentials for malicious activities, like phishing campaigns or ransomware attacks. The subsequent recovery costs and potential fines related to these events are often covered under cyber insurance policies, but proactive identity protection can significantly reduce the likelihood of such claims.

Connection Between Identity Protection and Insurance Premiums

Insurers often consider an organization’s identity protection measures when determining cyber insurance premiums. Robust identity protection, including strong password policies, multi-factor authentication, and regular security awareness training, demonstrates a proactive approach to risk mitigation. This proactive approach is often rewarded with lower premiums, as insurers perceive lower risk profiles for organizations with effective identity protection in place. For example, companies implementing strong multi-factor authentication (MFA) across all systems are often seen as having lower risk profiles by insurance providers.

Benefits of Integrating Identity Protection into Cyber Insurance Programs

Integrating identity protection into existing cyber insurance programs offers significant benefits. It creates a holistic security approach, reducing the likelihood of a breach and subsequent claims. Proactive identity protection programs are more likely to prevent costly and disruptive cyber incidents, leading to lower premiums and fewer claims payouts. This also enhances an organization’s reputation and fosters customer trust, essential factors for long-term sustainability.

Strong identity protection measures can significantly speed up your cyber insurance initiatives. Thinking about the upcoming release of Disney+’s The Book of Boba Fett Star Wars series, this anticipated date might be a great opportunity to review your own security protocols. A robust identity protection strategy, like multi-factor authentication and regular security audits, will not only lessen the risk of cyberattacks but also show your insurer your proactive approach, potentially accelerating your claim process.

Comparing Identity Protection Solutions

| Solution Name | Key Features | Impact on Insurance Premiums | Pros and Cons |

|---|---|---|---|

| Multi-Factor Authentication (MFA) | Adds an extra layer of security by requiring multiple verification methods (e.g., password, code, biometric scan). | Generally leads to lower premiums as it reduces the risk of unauthorized access. | Pros: Increased security, relatively easy to implement. Cons: User adoption can be a challenge, potential for inconvenience. |

| Identity and Access Management (IAM) | Provides centralized control over user accounts and access privileges, allowing for granular management of permissions. | Lower premiums due to improved control and visibility of access rights. | Pros: Enhanced security and compliance, improved efficiency. Cons: Can be complex to implement and maintain, requires dedicated resources. |

| Password Management Solutions | Enforces strong passwords, provides password suggestions, and manages password storage securely. | Potential for lower premiums through reduced risk of weak password breaches. | Pros: Enhances password security, improves user experience. Cons: Requires user adoption, potential for technical complexity. |

| Security Awareness Training | Educates employees on phishing scams, malware threats, and other security risks. | Positive impact on premiums by improving user security practices and reducing human error. | Pros: Cost-effective, improves employee security awareness. Cons: Requires ongoing effort, user engagement can vary. |

Accelerating Cyber Insurance Initiatives Through Identity Protection: How Identity Protection Can Accelerate Your Cyber Insurance Initiatives

Identity protection is no longer a “nice-to-have” but a crucial component of a robust cybersecurity strategy. By proactively safeguarding user identities, businesses can significantly reduce their vulnerability to cyberattacks, strengthen their cyber insurance policies, and ultimately, lower their insurance costs. This approach is not just reactive; it’s a proactive measure that builds a stronger defense against the ever-evolving landscape of cyber threats.Identity verification is becoming an increasingly critical factor in determining the strength of cyber insurance policies.

Insurers are recognizing the vital role identity protection plays in preventing data breaches and mitigating the financial fallout from such events. A company with robust identity protection measures in place demonstrates a lower risk profile to the insurer, leading to more favorable policy terms and potentially lower premiums.

Proactive Prevention of Cyberattacks Through Identity Protection

Strong identity protection measures are essential for preventing cyberattacks. Multi-factor authentication (MFA), robust password policies, and regular security awareness training for employees are crucial elements. These proactive steps significantly reduce the likelihood of phishing attacks, credential stuffing, and other social engineering tactics. For instance, a company that implements MFA across all user accounts is demonstrably less susceptible to brute-force attacks compared to one that relies solely on passwords.

Regular security awareness training empowers employees to recognize and avoid phishing attempts, thus reducing the risk of malicious actors gaining access through human error.

Role of Identity Verification in Strengthening Cyber Insurance Policies

Identity verification plays a pivotal role in fortifying cyber insurance policies. A rigorous identity verification process, which includes verifying employee credentials and access rights, helps insurers assess the risk associated with a particular business. This process ensures that the individuals accessing sensitive data are legitimate, thereby reducing the likelihood of insider threats or unauthorized access. Insurers often require detailed identity verification protocols to determine the level of control over sensitive data within an organization, which directly correlates to a reduced risk assessment.

Examples of Successful Identity Protection Strategies, How identity protection can accelerate your cyber insurance initiatives

Numerous businesses have successfully implemented identity protection strategies to bolster their cybersecurity posture. One example is a financial institution that implemented a robust multi-factor authentication system for all employees, drastically reducing the risk of unauthorized access to sensitive customer data. Another example involves a healthcare provider that integrated advanced identity verification tools into their patient portals, ensuring only authorized individuals could access patient records.

These proactive measures significantly enhance the organization’s resilience to cyber threats, strengthening the credibility of their cyber insurance policy.

Reducing Cyber Incidents through Identity Protection

Robust identity protection directly contributes to reducing the frequency and severity of cyber incidents. By preventing unauthorized access, organizations minimize the potential damage caused by data breaches, malware infections, and other cyberattacks. For instance, a company that promptly identifies and mitigates compromised accounts through strong identity verification practices significantly reduces the impact of a potential data breach. Implementing identity protection safeguards can decrease the potential for reputational damage and financial losses.

Integrating Identity Protection into the Cyber Insurance Claims Process

A seamless integration of identity protection into the cyber insurance claims process is essential. This integration allows insurers to quickly assess the validity of claims and expedite the claims resolution process. Having detailed identity verification records available at the outset of a claim allows insurers to quickly identify and validate affected individuals and systems, enabling them to more accurately assess the extent of the damage and expedite the claim process.

Implementing an Identity Protection Program

| Stage | Actions | Expected Outcomes | Impact on Insurance Costs |

|---|---|---|---|

| Phase 1: Assessment | Conduct a comprehensive risk assessment, identify vulnerabilities, and evaluate current identity protection measures. | Clear understanding of existing security gaps and areas for improvement. | Potentially reveals areas needing immediate attention, which can lead to decreased premiums after implementation. |

| Phase 2: Implementation | Implement multi-factor authentication, strengthen password policies, enhance access controls, and deploy security awareness training programs. | Improved security posture and reduced attack surface. | Demonstrates a commitment to proactive security measures, leading to lower insurance premiums. |

| Phase 3: Monitoring and Maintenance | Continuously monitor systems for suspicious activity, regularly update security protocols, and conduct periodic security audits. | Early detection of threats and rapid response to security incidents. | Consistent maintenance of a strong security posture results in sustained cost savings. |

| Phase 4: Optimization | Refine and optimize identity protection strategies based on performance data, and adapt to emerging threats. | Maximum security posture and optimal risk mitigation. | Demonstrates a commitment to ongoing improvement, potentially leading to the lowest possible premiums. |

The Impact of Identity Protection on Insurance Claims

Robust identity protection is no longer a luxury but a crucial component of a comprehensive cybersecurity strategy, particularly for businesses seeking to mitigate cyber insurance costs. A well-implemented identity protection program can significantly reduce the likelihood and impact of cyber incidents, ultimately translating into lower premiums and fewer claims. Protecting employee identities and sensitive data is a critical first step towards preventing costly breaches.Identity protection plays a pivotal role in preventing cyber insurance claims by strengthening the overall security posture of an organization.

Strong identity protection measures can significantly speed up your cyber insurance initiatives. Think about how a robust system can reduce the risk of data breaches, which directly impacts premiums and claims. This directly ties into the way that companies like Verizon, through their Hearst joint venture, are creating millennial-focused content, verizon hearst joint venture millennial content , to understand and cater to their needs.

Ultimately, a focus on preventing breaches translates to a more efficient and cost-effective cyber insurance strategy.

By proactively identifying and mitigating vulnerabilities related to employee identities, businesses can reduce their exposure to a wide range of cyber threats. This proactive approach can significantly reduce the financial strain associated with cyber incidents, which are often substantial and can cripple a company.

Types of Cyber Insurance Claims Preventable by Identity Protection

Identity protection measures can prevent a variety of cyber insurance claims, including those related to:

- Phishing and Social Engineering Attacks: Robust identity protection systems can detect and block suspicious login attempts, suspicious emails, and other social engineering tactics targeting employees. This significantly reduces the risk of successful phishing attacks that compromise employee credentials and lead to data breaches.

- Account Takeovers: By monitoring user accounts and detecting unusual activity, identity protection systems can prevent unauthorized access to sensitive data and prevent account takeover events. This proactive monitoring reduces the potential for financial losses and reputational damage.

- Malware Infections: Identity protection can often include advanced threat detection and prevention, which can proactively identify and block malware infections that compromise employee accounts and gain access to sensitive data. This can help prevent ransomware attacks and data breaches.

- Data Breaches: By bolstering identity security measures, companies can minimize the risk of sensitive data breaches that could trigger significant cyber insurance claims. A robust identity protection program helps prevent attackers from leveraging compromised credentials to gain access to sensitive data, thereby reducing the scope of a data breach.

Reducing Financial Burden of Cyber Incidents

Identity protection significantly reduces the financial burden of cyber incidents. By preventing attacks and breaches, companies can avoid the substantial costs associated with incident response, data recovery, legal fees, and regulatory fines. These costs can easily reach millions of dollars, making proactive identity protection a crucial investment.

Examples of Decreased Cyber Insurance Claim Costs

Numerous organizations have reported decreased cyber insurance claims following the implementation of robust identity protection measures. For example, a company that implemented multi-factor authentication (MFA) and regular security awareness training saw a 40% reduction in phishing-related incidents and a corresponding decrease in their cyber insurance premiums. Another organization that invested in a sophisticated identity and access management (IAM) system reported a 25% reduction in data breach claims.

These are just a few examples; more examples exist.

Comparing Costs of Identity Protection and Cyber Insurance Claims

While implementing identity protection systems may have an initial cost, the long-term benefits often outweigh the short-term investment. The cost of a single major cyber insurance claim can easily exceed the cost of a comprehensive identity protection program. Consider the potential financial fallout from a data breach, including regulatory penalties, customer churn, and reputational damage, all of which can significantly outweigh the cost of proactive measures.

Long-Term Benefits of Investing in Identity Protection

Investing in identity protection provides long-term benefits beyond just reducing insurance costs. By building a stronger security posture, companies foster a culture of security, enhance employee trust, and protect their reputation. This ultimately creates a more secure and resilient organization, positioned for long-term success.

Correlation Between Identity Protection and Insurance Claims

| Identity Protection Measure | Type of Cyber Incident Prevented | Cost Savings | Insurance Claim Reduction Rate |

|---|---|---|---|

| Multi-factor Authentication (MFA) | Phishing, Account Takeovers | Potential for significant reduction in costs associated with incident response and recovery. | Potentially 30-50% or more reduction in claim frequency. |

| Regular Security Awareness Training | Phishing, Social Engineering | Reduced likelihood of employees falling victim to social engineering attacks. | Potentially 20-40% reduction in claim frequency. |

| Advanced Threat Detection and Prevention | Malware infections, Zero-Day Exploits | Reduced incident response costs and data recovery costs. | Potentially 15-30% reduction in claim frequency. |

| Strong Password Policies and Management | Account Takeovers, Brute-Force Attacks | Reduced risk of account compromise and subsequent data breaches. | Potentially 10-25% reduction in claim frequency. |

Integration of Identity Protection with Cyber Insurance Policies

Integrating identity protection into cyber insurance policies is no longer a luxury, but a crucial necessity for businesses in today’s threat landscape. A proactive approach to safeguarding identities directly correlates with a reduction in cyber insurance claims and strengthens overall security posture. This integration allows insurers to offer more comprehensive coverage and businesses to mitigate the increasing risks associated with identity theft and compromise.Identity theft, a major driver of cyberattacks, often precedes broader data breaches.

Strong identity protection measures can significantly boost your cyber insurance initiatives. Think about how a robust system can prevent data breaches, a crucial aspect of reducing your insurance premiums. Recent advancements like those in the Apple Watch Parkinson’s Rune Labs FDA trials, demonstrating potential medical breakthroughs , highlight the rapid progress in technology, which can translate to stronger security protocols.

Ultimately, this all contributes to more efficient and cost-effective cyber insurance strategies.

By integrating identity protection measures, insurance policies can shift from a reactive to a proactive approach, helping businesses prevent these incidents from occurring in the first place. This not only reduces the financial burden of claims but also strengthens the overall resilience of the business against cyber threats.

Framework for Integrating Identity Protection

A robust framework for integrating identity protection into cyber insurance policies should encompass a multi-layered approach. This involves establishing clear criteria for identity protection programs, defining specific coverage parameters, and ensuring seamless integration with existing security infrastructure. The framework should also include provisions for ongoing monitoring and updates to the identity protection system, reflecting the ever-evolving threat landscape.

Key Elements of a Comprehensive Identity Protection Program

A comprehensive identity protection program should include these essential elements:

- Identity Monitoring and Alerting: Continuous monitoring of employee and customer identities across various platforms, coupled with real-time alerts for suspicious activity, is critical. This proactive approach allows for rapid response to potential threats, minimizing the impact of a breach.

- Multi-Factor Authentication (MFA): Implementing robust MFA across all access points significantly strengthens security against unauthorized access attempts. MFA adds an extra layer of verification, making it significantly harder for attackers to gain access even if they obtain a user’s credentials.

- Password Management and Security Training: Enforcing strong password policies and providing regular security awareness training for employees are crucial elements. Regular training helps employees understand the importance of strong passwords and safe online practices, minimizing the risk of phishing attacks and credential stuffing.

- Data Breach Response Plan: A well-defined plan for responding to a data breach is vital. This should include procedures for identifying and containing the breach, notifying affected parties, and restoring systems. Proactive planning can significantly minimize the damage and financial implications of a breach.

- Regular Vulnerability Assessments: Periodic vulnerability assessments of identity protection systems are essential to identify and address potential weaknesses. This proactive approach helps stay ahead of emerging threats and strengthens the overall security posture.

Integration into Existing Security Infrastructure

Seamless integration of identity protection solutions into existing security infrastructure is key to maximizing effectiveness. This involves integrating tools and systems for continuous monitoring and threat detection, streamlining workflows, and ensuring data flows smoothly between different security components.

Successful Partnerships

Several successful partnerships exist between identity protection providers and cyber insurers. These collaborations often involve shared data analysis, joint risk assessments, and co-developed programs for businesses. For example, a leading identity protection company might collaborate with an insurer to offer bundled solutions, including proactive monitoring and incident response capabilities. This integrated approach provides businesses with comprehensive security and facilitates risk reduction.

Ongoing Monitoring and Updates

The threat landscape is constantly evolving, requiring ongoing monitoring and updates to identity protection systems. Regular software updates, security patches, and system configuration changes are essential to maintain effectiveness. Monitoring systems for anomalies and unusual behavior, coupled with regular reviews and updates to policies, ensures that the identity protection program remains aligned with current threats.

Comprehensive Identity Protection Program Features

| Feature | Description | Benefits | Integration with Insurance Policy |

|---|---|---|---|

| Identity Monitoring and Alerting | Continuous monitoring of identities, real-time alerts on suspicious activity | Early detection of potential threats, rapid response | Reduced claims, improved risk assessment, enhanced policy pricing |

| Multi-Factor Authentication (MFA) | Implementation of robust MFA across all access points | Enhanced security against unauthorized access | Lower risk profile, reduced premiums, increased coverage limits |

| Password Management and Security Training | Strong password policies, regular security awareness training | Reduced risk of phishing, credential stuffing | Reduced frequency of claims, improved customer satisfaction |

| Data Breach Response Plan | Well-defined plan for responding to data breaches | Minimized damage, efficient containment | Faster recovery, minimized financial losses, streamlined claim processes |

| Regular Vulnerability Assessments | Periodic assessments of identity protection systems | Early identification of weaknesses, proactive mitigation | Proactive risk management, improved security posture, potential premium discounts |

Illustrative Case Studies

Integrating robust identity protection strategies can significantly impact a company’s cyber insurance initiatives. By proactively mitigating identity-related risks, businesses can often see improvements in their insurance premiums and overall cyber resilience. This section presents real-world examples of how successful identity protection implementations have positively influenced cyber insurance outcomes.

Case Study Summaries

These case studies highlight the tangible benefits of integrating identity protection into a comprehensive cyber security strategy. They demonstrate how proactive measures can translate into tangible improvements in insurance coverage and cost.

| Company Name | Identity Protection Strategy | Impact on Cyber Insurance | Key Learnings |

|---|---|---|---|

| Acme Corporation | Implemented multi-factor authentication (MFA) across all employee accounts, enforced strong password policies, and invested in a robust identity and access management (IAM) solution. | Saw a 20% reduction in their annual cyber insurance premium. | Strong password policies and MFA are crucial for reducing identity-related vulnerabilities. Robust IAM solutions play a key role in achieving substantial cost savings. |

| Tech Solutions Inc. | Developed and implemented a comprehensive identity governance and administration (IGA) program, which included regular security awareness training for employees and a dedicated incident response team for identity-related threats. | Experienced a 15% decrease in claims related to compromised credentials and a subsequent reduction in their cyber insurance premium. | A well-defined IGA program is essential for proactively addressing identity-related threats. Employee training significantly enhances awareness and reduces the risk of human error. |

| Global Enterprises | Implemented a zero-trust security model, coupled with advanced identity verification tools for all users, both internal and external. | Reduced their cyber insurance premiums by 10% due to a substantial decrease in the frequency of successful cyberattacks. | A zero-trust model significantly reduces the attack surface and enhances the overall security posture, which is directly reflected in lower cyber insurance premiums. |

Lowering Premiums Through Robust Identity Protection

A specific example illustrates how robust identity protection can significantly lower cyber insurance premiums. “DataSafe Solutions,” a company specializing in data storage and retrieval, experienced a 25% reduction in their cyber insurance premiums after implementing a comprehensive identity protection program.

Steps Taken to Achieve Result

DataSafe Solutions implemented the following steps:

- Phased MFA rollout: Implemented MFA for all employee accounts, progressively rolling out the feature across different departments to minimize disruption and maximize adoption.

- Strong Password Policies: Enforced strict password policies, including regular password changes, complex password requirements, and a strong password manager for all users.

- Employee Training: Conducted extensive security awareness training sessions focused on phishing scams, social engineering tactics, and the importance of strong passwords and MFA.

- Regular Security Audits: Introduced a scheduled audit process to identify vulnerabilities and weaknesses in their identity protection strategy.

- Improved Incident Response: Established a dedicated incident response team specializing in handling identity-related incidents, including compromised credentials and account takeovers.

Visual Representation of Impact

The following graphic illustrates the impact of identity protection on cyber insurance costs.

A bar graph is presented. The x-axis represents the years (e.g., 2022, 2023, 2024). The y-axis represents the cyber insurance premium cost. Two bars are shown for each year. The first bar represents the insurance premium cost before implementing identity protection. The second bar represents the premium cost after implementing identity protection. The difference between the two bars in each year represents the reduction in the premium cost due to identity protection.

This visual clearly demonstrates the substantial cost savings achieved by DataSafe Solutions through proactive identity protection. The graph visually illustrates the positive correlation between enhanced identity protection measures and reduced cyber insurance premiums.

Closure

In conclusion, implementing robust identity protection isn’t just a smart security measure; it’s a strategic investment that directly impacts your cyber insurance initiatives. By proactively safeguarding identities, businesses can significantly reduce the likelihood and cost of cyber incidents, ultimately leading to lower insurance premiums and a stronger overall security posture. We’ve explored how integrating identity protection into your existing processes can create a comprehensive security ecosystem, ultimately minimizing your exposure to cyber risks and optimizing your insurance program.