Netflix warns content will suffer if its forced to fund network upgrades, signaling a potential crisis in the streaming giant’s future. This crucial announcement reveals a complex interplay of financial pressures, content production, subscriber impacts, and competitive challenges. The company faces a critical juncture: how can it balance the need for network infrastructure improvements with the equally vital task of maintaining high-quality content and a loyal subscriber base?

This article delves into the potential ramifications of this predicament, exploring potential solutions and long-term strategies.

Netflix’s current financial standing, including subscriber numbers, revenue streams, and profit margins, forms the foundation of this analysis. We’ll explore how network upgrade costs could impact these crucial metrics. Different upgrade scenarios, subscriber responses, and potential budget cuts will be examined. A comparison with similar companies and their handling of financial pressures will be included, offering insights into potential strategies for Netflix.

Netflix’s Financial Implications

Netflix, a global entertainment giant, faces a critical juncture as network upgrades become increasingly necessary. These upgrades, while essential for maintaining and enhancing streaming quality, carry substantial financial implications that directly impact subscriber retention, revenue generation, and overall profitability. Understanding these implications is crucial for investors and stakeholders alike.

Netflix’s Current Financial Standing

Netflix boasts a vast subscriber base, a significant revenue stream primarily from subscriptions, and a complex profit margin structure. Current subscriber numbers, revenue figures, and profit margins are dynamic and publicly available through financial reports. The company’s financial health is closely tied to its ability to attract and retain subscribers, manage content costs, and optimize its operations. Analyzing these key metrics is essential to understand the potential impact of network upgrade costs.

Impact of Network Upgrade Costs on Financial Metrics

Network upgrades are substantial investments. These costs will likely affect Netflix’s revenue streams and profit margins. Increased operational expenditure for infrastructure, equipment, and maintenance will reduce profit margins if not offset by increased revenue. The cost of these upgrades is a direct subtraction from the company’s available capital, impacting its ability to invest in other areas like content acquisition or marketing.

Potential Financial Scenarios

The financial impact of network upgrades hinges on various factors, including the scale of upgrades, subscriber response, and the company’s ability to manage costs. Several scenarios are possible:

- Scenario 1: Moderate Upgrades and Stable Subscriber Base: If upgrades are moderate in scope and subscriber response remains stable, the impact on profitability will be relatively manageable. Increased costs will likely be absorbed through optimized operational efficiency or cost-cutting measures.

- Scenario 2: Significant Upgrades and Subscriber Churn: Extensive upgrades might lead to increased subscription costs. If subscribers perceive the price increase as unjustified, they might opt for competitors, causing a significant subscriber churn. This could result in substantial revenue loss.

- Scenario 3: Upgrades and Successful Subscriber Retention: If Netflix effectively manages the upgrade costs and communicates the value proposition to its subscribers, they may see an increased subscription rate to offset the additional costs. This approach is analogous to how companies like Amazon manage pricing for their cloud services.

Examples from Similar Companies

Other streaming services, and companies dealing with extensive infrastructure upgrades, offer valuable case studies. For example, companies like Amazon Web Services have demonstrated that substantial infrastructure investments can lead to increased revenue streams. The key is to evaluate the relationship between investment and return on investment. Careful consideration of customer value and the return on investment from these upgrades is paramount.

Potential Cost Increases for Different Upgrade Scenarios

| Upgrade Scenario | Estimated Upgrade Cost (USD Billions) | Potential Revenue Loss (USD Billions) | Impact on Profit Margin (%) |

|---|---|---|---|

| Moderate Upgrades, Stable Subscribers | 2-3 | 0.5-1 | -1 to -2 |

| Significant Upgrades, Subscriber Churn | 4-5 | 1.5-2.5 | -3 to -5 |

| Upgrades, Successful Retention | 2-3 | 0.5-1 | 0-1 |

Note: These are illustrative figures and do not represent precise financial projections. Actual outcomes will depend on various factors including market conditions, competitive pressures, and subscriber behavior.

Content Creation and Production: Netflix Warns Content Will Suffer If Its Forced To Fund Network Upgrades

Netflix’s content creation engine is a complex machine, fueled by a constant stream of original programming and licensed content. The potential for budget cuts, however, poses a significant threat to this engine’s efficiency and output. A reduction in funding could lead to a ripple effect, impacting everything from the scope of ambitious series to the acquisition of popular films.

Understanding how such cuts would manifest in the realm of content creation is crucial to anticipating the future landscape of Netflix’s offerings.Budget constraints will inevitably force Netflix to make difficult choices about content creation. This pressure is not unique to Netflix; many other streaming services have navigated similar economic climates. Analyzing their strategies and outcomes provides valuable insights into how Netflix might adapt.

Netflix’s warning about potential content cuts if they have to foot the bill for network upgrades is a serious concern. It’s a bit like needing a new battery in your iPhone 14, but on a massive scale. Knowing the iPhone 14 Apple battery replacement price can help you budget, but the potential cost to consumers of streaming services like Netflix is much greater, impacting the quality of shows and movies we enjoy.

Ultimately, the burden of network upgrades should probably fall on the service providers, not the content creators.

The key is to find a balance between maintaining quality and maximizing efficiency in a financially constrained environment.

Impact of Budget Cuts on Original Programming

The production of original programming, a cornerstone of Netflix’s strategy, is particularly vulnerable to budget cuts. Showrunners, directors, and actors may face reduced compensation, leading to talent departures. Lower budgets may also restrict the use of high-end visual effects, specialized equipment, and premium locations, resulting in a noticeable decrease in production quality. Original series, in particular, often have extended production schedules, making them susceptible to cost overruns and delays.

These issues could be exacerbated by a reduction in the number of staff members working on a project.

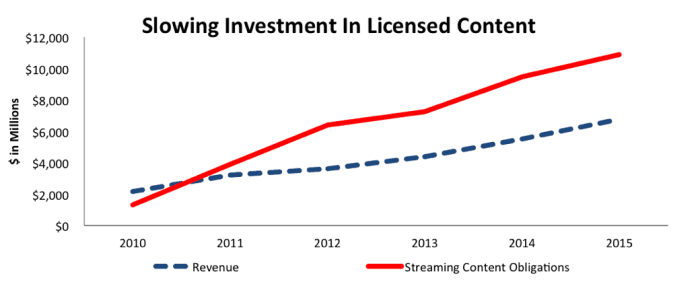

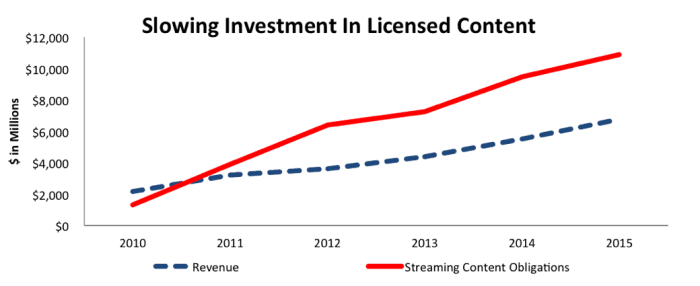

Impact on Licensing Agreements

Licensing agreements for movies and TV shows represent another area where budget cuts could significantly impact the quality and quantity of content. Netflix may be forced to prioritize acquiring less expensive content, potentially compromising the overall appeal and diversity of its library. The acquisition of rights to popular films might become more difficult, especially if other streaming services are also facing budget constraints.

This could affect the variety of genres and the appeal to different demographics.

Comparison of Content Types and Potential for Budget Reduction

- Original Series: Original series are often the most expensive to produce due to their lengthy production cycles, large casts, and high-quality production values. Budget cuts in this area could result in fewer episodes per season, smaller casts, or lower-quality visuals and sound. For example, a reduction in filming locations could impact the aesthetic appeal of a series.

- Movies: Movie productions can vary significantly in cost, from low-budget indie films to high-budget blockbusters. Netflix might prioritize acquiring lower-cost films or even scale back on acquiring movies altogether, which could impact the diversity of the movie selection available to subscribers.

- Documentaries: Documentaries often require extensive research, travel, and interviews, which can be expensive. Budget cuts might impact the scope of documentaries or lead to a decrease in the number of documentaries produced, especially those requiring extensive travel and research.

Potential Strategies for Adapting Content Production, Netflix warns content will suffer if its forced to fund network upgrades

- Content Consolidation: Netflix might focus on fewer, but higher-quality, original series, potentially reducing the number of projects in development. This could be a strategy to ensure higher-quality productions and more focused marketing efforts for fewer, impactful projects.

- Regionalization of Production: Producing content in regions with lower production costs could be a viable strategy. This could offer opportunities to explore diverse stories and narratives from various cultures, but also requires careful consideration of the target audience and cultural sensitivities.

- Collaboration with Other Streaming Services: Collaborating with other streaming services for content acquisition or production could offer a way to share costs and maximize resources. This approach might offer opportunities to share the burden of content acquisition and production costs.

Examples from Other Streaming Services

- Hulu: During economic downturns, Hulu has reduced the number of new shows and movies released, focusing on popular existing titles and established franchises to reduce costs. This strategy can be used to reduce content costs and increase revenue.

- Amazon Prime Video: Amazon Prime Video has often experimented with diverse content types, from critically acclaimed original series to popular movies and documentaries. This diversification allows them to attract various viewers, increasing their subscriber base and potential revenue streams.

Potential Budget Cuts Table

| Content Category | Potential Budget Cut Strategies |

|---|---|

| Original Series | Reduced episode count, smaller casts, lower-quality production values |

| Movies | Prioritizing lower-cost films, reduced acquisition of movies |

| Documentaries | Reduced scope, fewer documentaries produced |

| Licensing Agreements | Prioritizing less expensive content, fewer licensed films |

Impact on Subscriber Base

Netflix’s subscriber base is a crucial component of its financial health. Maintaining a loyal and growing subscriber base is essential for continued profitability and expansion. The cost of network upgrades, while necessary for improving service, can directly impact subscriber pricing and, consequently, subscriber retention. This section delves into the potential ramifications of these upgrades on Netflix’s subscriber base.

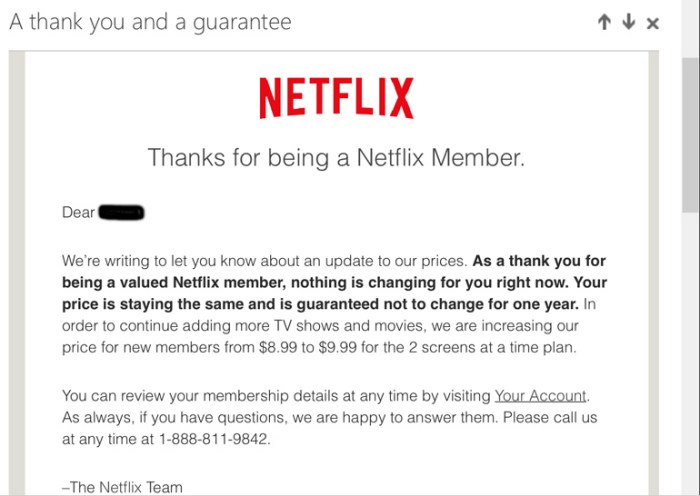

Pricing Implications

Network upgrades are expensive endeavors. The cost of these upgrades, including the development, deployment, and maintenance of new infrastructure, will need to be factored into Netflix’s overall budget. These costs will inevitably lead to an increase in the company’s operational expenses. To offset these increases, Netflix may need to adjust its pricing model. A potential response could be an increase in subscription fees for various tiers.

The extent of the price increase will depend on the scale of the upgrades and the company’s financial projections.

Subscriber Responses to Price Increases

Subscribers are sensitive to price changes. A price increase could lead to subscriber churn, as users might seek alternatives with more competitive pricing. This response will vary depending on individual financial situations and the perceived value proposition of Netflix compared to its competitors. Past experience with price increases in the streaming industry demonstrates that even seemingly small increases can result in significant subscriber losses if not carefully managed.

Strategies for Subscriber Retention

Maintaining subscriber satisfaction is crucial for retention. Strategies to mitigate potential churn include offering various subscription tiers, maintaining a diverse and engaging content library, and implementing proactive customer service strategies to address concerns or issues quickly and effectively. Improving the user experience, such as optimizing streaming quality, and offering incentives like exclusive content or bundled deals, can help offset the impact of price increases.

Importance of Quality Service

Maintaining high-quality service is paramount for retaining subscribers. A poor streaming experience, frequent buffering, or slow loading times can significantly erode subscriber satisfaction. This is critical in the streaming industry where quality of service is often a deciding factor in subscriber retention. Quality service directly correlates with subscriber retention, as demonstrated by numerous studies. A seamless streaming experience is essential to the value proposition of a streaming service.

Correlation Between Service Quality and Retention

The correlation between service quality and subscriber retention is strong. Studies show a direct relationship; a decrease in service quality leads to a corresponding decrease in subscriber retention. Conversely, improvements in service quality positively impact retention. The streaming experience is central to Netflix’s brand and customer loyalty.

Subscriber Price Scenarios and Projected Impact

| Price Scenario | Projected Impact on Subscriber Numbers (estimated) | Justification |

|---|---|---|

| No Price Increase | Stable or slightly positive growth | Maintains current subscriber base and potentially attracts new ones |

| Moderate Price Increase (e.g., 10-15%) | Slight decrease in subscriber numbers (2-5%) | Some subscribers may cancel subscriptions, but significant retention is expected. |

| Significant Price Increase (e.g., 20% or more) | Significant decrease in subscriber numbers (5-10% or more) | Many subscribers may switch to competitors or cancel their subscriptions. |

Note: These are estimates and the actual impact may vary depending on market conditions, competitor pricing, and other factors.

Competitive Landscape Analysis

Netflix’s potential budget cuts inject a new dynamic into the already intense streaming wars. Understanding how competitors react and how Netflix can differentiate itself in this environment is crucial. The streaming landscape is constantly evolving, and adapting to these changes will be vital for long-term success.The streaming market is highly competitive, with players vying for subscriber attention and market share.

Netflix’s position as a leader is under scrutiny, and competitors are likely to capitalize on any perceived weakness. A thorough analysis of the competitive landscape is essential to understand the potential implications of these budget cuts.

Competitor Reactions to Potential Netflix Budget Cuts

Netflix’s potential budget cuts will likely be viewed as an opportunity by competitors. They might aggressively pursue marketing campaigns to attract subscribers, potentially emphasizing the perceived value proposition of their service compared to Netflix. Some competitors might even lower prices temporarily to lure customers away from Netflix.

Netflix’s warning about potential content quality drops due to network upgrade costs got me thinking. If streaming giants are struggling to keep up with infrastructure, it might affect other tech too. For instance, if you’re looking to disable sleep tracking on your Nest Hub 2nd gen, you can find a helpful guide on disable sleep tracking nest hub 2nd gen.

This highlights how sometimes, the need for tech upgrades impacts our daily use. Ultimately, it all points back to the pressure on Netflix to balance these necessary improvements with delivering great content.

Netflix’s Differentiation Strategies

Netflix needs to focus on strategies that differentiate it from competitors. This could involve strengthening its original content offering with a renewed focus on high-quality, unique productions, further developing niche genres, or expanding into emerging markets. Building strong relationships with creators and filmmakers is also critical to retain and attract talent.

Successful Strategies of Competitors

Several competitors have successfully navigated financial pressures by focusing on specific market segments. For example, some have concentrated on a particular demographic or genre, creating a highly targeted and effective service. Others have successfully partnered with other businesses, creating a synergistic effect to drive subscriber growth. By learning from these examples, Netflix can better adapt to the changing market conditions.

Comparative Analysis of Budget Constraints

| Company | Estimated 2024 Budget (USD Billions) | Potential Impact of Budget Cuts | Potential Differentiation Strategies |

|---|---|---|---|

| Netflix | ~28 | Reduced investment in original content, potential staff reductions, potential delays in new productions. | Refocus on existing content library, increased marketing for current series/films, exploring international co-productions, cost-cutting in non-content areas. |

| Disney+ | ~12 | Potential reduction in original content, but less drastic due to diversified revenue streams. | Enhance existing content with more interactive elements, potentially focusing on specific demographic segments. |

| Amazon Prime Video | ~15 | Potential impact less certain given strong overall financial backing. | Further develop existing live-streaming features, emphasize more affordable subscription tiers. |

| HBO Max | ~7 | Potential for restructuring content strategy, and potentially partnerships with other networks. | Increase focus on existing successful franchises, and explore targeted ad-supported subscription models. |

Note: Budget estimates are approximate and may vary depending on the source.

Alternative Solutions for Network Upgrades

Netflix’s massive global reach necessitates a robust and scalable network infrastructure. Traditional methods of network expansion, while effective, can be expensive and time-consuming. This necessitates exploring alternative solutions that leverage emerging technologies and strategic partnerships to optimize cost and efficiency.Alternative solutions offer a nuanced approach to network upgrades, balancing cost-effectiveness with the need for reliable and high-speed delivery.

These solutions can range from cloud-based solutions that share resources to strategic partnerships that leverage existing infrastructure. By understanding the pros and cons of each approach, Netflix can identify the most suitable and impactful strategies for future network expansion.

Cloud-Based Solutions

Cloud-based solutions offer a dynamic and scalable alternative to traditional infrastructure investments. They allow Netflix to utilize pre-existing and expanding cloud resources, potentially reducing capital expenditure. Companies like Amazon Web Services (AWS) and Microsoft Azure provide extensive network capabilities, including content delivery networks (CDNs). This reduces the need for maintaining and managing vast physical infrastructure. However, reliance on third-party providers introduces potential latency concerns and security considerations.

Additionally, pricing models can be complex and fluctuate, making long-term cost prediction challenging.

Strategic Partnerships

Strategic partnerships can be a powerful tool for leveraging existing infrastructure and expertise. Collaborations with telecommunication companies, internet service providers (ISPs), or other content providers can offer access to wider networks and potentially lower costs. For example, a partnership with a company already operating a substantial network could allow Netflix to use that existing infrastructure for delivery, thereby reducing their own upgrade expenses.

However, these partnerships require careful negotiation and potentially introduce dependencies on other companies.

Innovative Approaches

Innovative approaches involve exploring cutting-edge technologies and solutions. For example, using software-defined networking (SDN) can enhance network flexibility and control. This approach allows for more efficient routing and traffic management, improving performance and reducing latency. Another innovative approach is using edge computing, which places processing power closer to the end-users. This can significantly reduce latency and improve streaming quality.

Netflix’s warning about potential content downgrades if they have to foot the bill for network upgrades is a real concern. It’s a reminder that even the most popular streaming services have to juggle investments. Thinking about buying a new mattress? Make sure your new bed has these three key things: mattress shopping make sure your new bed has these 3 things.

Ultimately, though, the worry about Netflix’s potential content issues is a reminder of the complexities of streaming services and the compromises they may have to make.

These approaches require significant investment in research and development but offer substantial potential for future growth.

Potential Partnerships

Potential partnerships should be carefully vetted based on network capacity, coverage, and technological compatibility. Telecom companies with extensive fiber optic networks and existing global reach could be ideal partners. Additionally, collaborations with cloud providers offering high-bandwidth connectivity and CDN services are a potential avenue for cost-effective upgrades. Partnerships with content delivery companies that already have an established presence in the streaming market could also prove beneficial.

Such collaborations can leverage economies of scale and expertise, potentially leading to a more streamlined and cost-effective upgrade process.

Summary Table of Alternative Solutions

| Solution | Advantages | Disadvantages |

|---|---|---|

| Cloud-Based Solutions | Scalability, reduced capital expenditure, access to advanced technology | Potential latency, security concerns, complex pricing models |

| Strategic Partnerships | Leveraging existing infrastructure, potentially lower costs, access to wider networks | Potential dependencies on other companies, careful negotiation required |

| Innovative Approaches (SDN, Edge Computing) | Enhanced network flexibility, improved performance, reduced latency | Significant investment in research and development, potential complexity |

Long-Term Strategic Considerations

Netflix’s future hinges on its ability to adapt to the evolving streaming landscape, and managing network upgrade costs is a critical component of this adaptation. Ignoring these costs could jeopardize the company’s long-term viability and its ability to deliver on its promise of high-quality content. Long-term planning is not just a nice-to-have but a necessity for navigating the uncertainties and opportunities that lie ahead.Sustaining a premium streaming experience while managing escalating infrastructure costs requires proactive strategic thinking.

This involves more than just immediate cost-cutting measures; it demands a holistic approach encompassing content delivery, consumption models, and brand management. The streaming industry’s rapid pace of innovation necessitates a forward-thinking approach to long-term viability.

Potential Long-Term Strategies for Mitigating Network Upgrade Costs

Netflix must develop a multi-pronged approach to address the escalating costs of network upgrades. These strategies must consider both immediate solutions and long-term investments in infrastructure and technology. A diversified strategy that balances immediate needs with future scalability is essential.

- Investing in Advanced Network Technologies: Exploring and implementing cutting-edge technologies like software-defined networking (SDN) and network function virtualization (NFV) can significantly improve network efficiency and reduce infrastructure costs in the long run. These technologies offer greater flexibility and scalability compared to traditional network architectures.

- Optimizing Content Delivery: Employing techniques like adaptive bitrate streaming (ABR) and dynamic content adaptation can optimize bandwidth usage. ABR allows streaming services to adjust the quality of the video based on the viewer’s network conditions, minimizing data consumption and network strain.

- Strategic Partnerships and Acquisitions: Collaborating with telecommunication companies or acquiring smaller, specialized network providers can create synergies and potentially reduce infrastructure costs. This could involve co-investing in network infrastructure or sharing resources.

Importance of Long-Term Planning and Adaptation in the Streaming Industry

The streaming industry is characterized by rapid technological advancements and evolving consumer preferences. Long-term planning is crucial for adapting to these changes and maintaining a competitive edge.

- Predictive Modeling and Forecasting: Analyzing trends in content consumption, viewer demographics, and technological advancements allows Netflix to anticipate future needs and plan accordingly. Data-driven insights can be used to make informed decisions regarding network upgrades and infrastructure development.

- Agile Infrastructure: Designing infrastructure that is flexible and adaptable to changing demands and technological advancements is vital. This allows Netflix to respond effectively to new streaming technologies and consumer preferences.

- Continuous Innovation: Staying ahead of the curve in content delivery and consumption models is critical. Netflix must continuously explore new technologies and adapt its infrastructure and processes to accommodate emerging trends.

Potential for Innovation in Content Delivery and Consumption Models

Innovative content delivery and consumption models can significantly impact Netflix’s long-term success and its ability to manage network upgrade costs.

- Decentralized Content Delivery: Deploying content closer to viewers can reduce network latency and bandwidth usage. This could involve partnering with edge computing providers or utilizing distributed cloud architectures.

- Interactive Streaming Experiences: Incorporating interactive elements into streaming content, such as user-generated content or live Q&A sessions, can create more engaging experiences for viewers. However, this may require significant upgrades to the network infrastructure.

- Targeted Streaming: Developing personalized streaming experiences tailored to individual viewer preferences can optimize bandwidth usage and enhance the overall viewing experience. This could involve recommending specific video qualities based on individual network conditions.

Maintaining a Strong Brand Image During Financial Difficulties

Maintaining a strong brand image is crucial for Netflix during periods of financial strain. A positive brand image can influence consumer perception and loyalty, ultimately impacting future revenue and growth.

- Transparency and Communication: Open and honest communication with subscribers about the challenges faced by the company and the measures taken to address them can foster trust and understanding.

- Focusing on Quality Content: Prioritizing the production and distribution of high-quality, engaging content can reinforce the brand’s reputation for excellence and attract new subscribers.

- Maintaining Exceptional Customer Service: Providing prompt and effective customer support during challenging times can build customer loyalty and address potential negative perceptions.

Timeline for Implementing Potential Long-Term Strategies

A phased approach to implementing long-term strategies is crucial for ensuring success and minimizing disruptions. Implementing new technologies and infrastructure upgrades takes time, and a well-defined timeline is essential for effective execution.

- Phase 1 (1-2 years): Focus on optimizing existing infrastructure and identifying opportunities for cost savings through partnerships and process improvements. This stage includes pilot programs for new technologies and a thorough assessment of potential partnerships.

- Phase 2 (3-5 years): Invest in advanced network technologies and explore decentralized content delivery models. This phase will require significant investment in research and development and may involve acquisitions or strategic partnerships.

- Phase 3 (5+ years): Explore and implement innovative content consumption models, focusing on personalized experiences and interactive features. This stage will require ongoing monitoring of market trends and adaptations to emerging technologies.

Last Recap

In conclusion, Netflix’s warning about potential content suffering due to network upgrade costs underscores the complex challenges facing the streaming giant. The analysis highlights the interconnectedness of financial stability, content production, subscriber retention, and competitive positioning. While the situation presents significant obstacles, potential solutions and long-term strategies are also evident, offering hope for navigating these hurdles and maintaining Netflix’s position at the forefront of the streaming industry.

The company’s ability to balance these competing pressures will determine its future success.