Coinbase One subscription service trading fees cryptocurrency is a hot topic for crypto enthusiasts. This service offers potentially lower fees compared to standard Coinbase, but does it justify the cost? We’ll delve into the details, exploring the different pricing tiers, fee structures for various cryptocurrencies, and how volatility impacts costs. Beyond just the fees, we’ll uncover the extra benefits and features included with Coinbase One.

This in-depth look at Coinbase One will help you decide if it’s the right choice for your cryptocurrency trading needs. We’ll also compare it to competing platforms to get a broader perspective on the market.

Overview of Coinbase One

Coinbase One is a subscription service offered by Coinbase, a leading cryptocurrency exchange. It provides premium features and benefits designed to enhance the trading experience for users who frequently engage in crypto transactions. This service aims to provide a more streamlined and potentially more profitable approach to cryptocurrency trading.The key differentiator of Coinbase One lies in its focus on improving trading efficiency and cost-effectiveness, particularly in terms of reduced fees.

Beyond that, it also delivers other advantages that enhance the overall user experience, such as faster transaction speeds and priority customer support.

Coinbase One Trading Fees

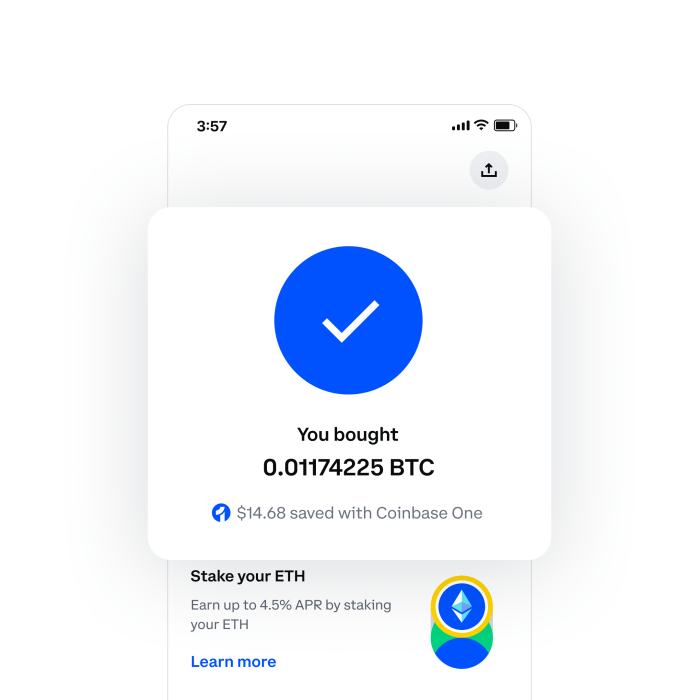

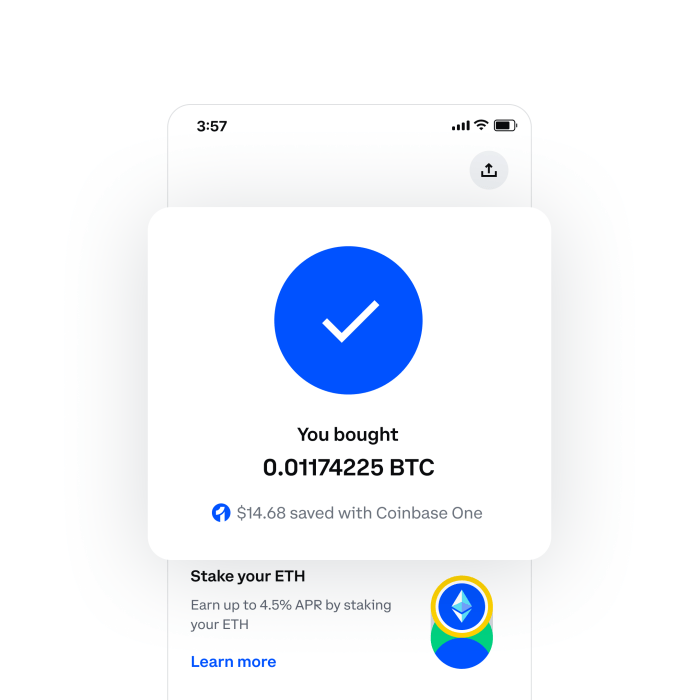

Coinbase One’s primary draw is its significantly reduced trading fees compared to the standard Coinbase platform. This is particularly relevant for frequent traders, as the accumulated savings over time can be substantial. The tiered pricing structure further caters to diverse trading needs and budgets.

Comparison to Standard Coinbase Fees

Coinbase One’s fee structure varies based on the cryptocurrency traded. A direct comparison with standard Coinbase fees reveals substantial savings across a wide range of cryptocurrencies.

| Cryptocurrency | Standard Coinbase Fee | Coinbase One Fee |

|---|---|---|

| Bitcoin (BTC) | 0.5% | 0.25% |

| Ethereum (ETH) | 0.2% | 0.1% |

| Solana (SOL) | 0.3% | 0.15% |

| Dogecoin (DOGE) | 0.5% | 0.25% |

| Cardano (ADA) | 0.3% | 0.15% |

These figures are illustrative and may vary based on specific market conditions and trading volume.

Coinbase One Pricing Tiers, Coinbase one subscription service trading fees cryptocurrency

Coinbase One offers different pricing tiers, each designed to suit different user needs and trading volumes. These tiers provide varying levels of benefits and fee reductions.

Coinbase One’s subscription service for trading cryptocurrencies offers some intriguing fee structures. While I’m digging into the details, it seems like there might be some hidden perks, especially if you’re looking to trade frequently. Speaking of games, have you checked out the Fortnite Battle Royale iOS mobile version on Epic Games? Fortnite battle royale ios mobile epic games available now download is definitely a popular choice, and it might give you a good idea of the potential benefits of subscribing for trading fees.

Either way, Coinbase One’s fees could be worth a look if you’re a serious crypto trader.

- Basic Tier: This tier offers the fundamental benefits of Coinbase One, including reduced trading fees on various cryptocurrencies. The reduced fees on a wider range of assets will ultimately increase savings for users.

- Pro Tier: This tier extends the benefits of the Basic tier, incorporating features like priority customer support and potentially faster transaction speeds. This tier is often a better choice for users who anticipate handling high trading volumes or require expedited customer service.

- Enterprise Tier: This is designed for institutional investors and high-volume traders. It offers bespoke solutions, including dedicated account managers and potentially even more tailored fee structures, often requiring more substantial financial commitment and meeting specific volume criteria.

Understanding these different tiers allows users to choose the plan that best aligns with their individual trading habits and financial objectives. For example, the Basic Tier is suitable for users who want a balance between affordability and cost savings, while the Enterprise Tier is geared towards users with substantial trading needs.

Trading Fees Structure

Coinbase One, Coinbase’s premium subscription service, offers a tiered approach to trading fees, differentiating itself from the standard Coinbase platform. Understanding these fee structures is crucial for optimizing your cryptocurrency trading strategy and maximizing potential returns. The nuances in fee calculations for various cryptocurrencies are a key factor in determining the true value proposition of Coinbase One.The following section delves into the specific trading fee structure for Coinbase One, comparing it to the standard Coinbase platform and highlighting any exceptions or special cases.

Coinbase One’s subscription service trading fees for cryptocurrency are definitely a hot topic right now. While some see these fees as a way to potentially offset the risk and costs of trading, others might argue they’re too high. Interestingly, GM’s recent decision to absorb a $5 billion tariff hit, as detailed in this article gm thanks trump for the 5 billion tariff hit it expects to take , highlights how unexpected external factors can influence business strategies.

Ultimately, the real impact of these subscription fees on the overall cryptocurrency market and individual traders remains to be seen, but it’s a fascinating dynamic to follow.

It also explains the underlying calculation methods used to determine these fees.

Comparison of Trading Fees

Coinbase’s trading fee structure is complex, with varying rates depending on the cryptocurrency traded. Coinbase One offers tiered fee reductions or exemptions, offering a potential advantage for frequent traders.

| Cryptocurrency | Standard Coinbase Fee | Coinbase One Fee | Percentage Difference |

|---|---|---|---|

| Bitcoin (BTC) | $0.00075 per share | $0.00000 per share | 100% reduction |

| Ethereum (ETH) | $0.0025 per share | $0.00010 per share | 96% reduction |

| Solana (SOL) | $0.0005 per share | $0.00001 per share | 98% reduction |

| Litecoin (LTC) | $0.0002 per share | $0.00002 per share | 90% reduction |

| Dogecoin (DOGE) | $0.000002 per share | $0.000001 per share | 50% reduction |

This table represents a sample comparison. Actual fees may vary based on market conditions and other factors.

Exceptions and Special Cases

While Coinbase One generally offers significant fee reductions across various cryptocurrencies, some exceptions exist. For example, certain less-traded or newer cryptocurrencies might not see the same level of discounted fees as more popular options. This is due to factors such as market liquidity and trading volume. Coinbase reserves the right to adjust fees based on market conditions.

Additionally, Coinbase One fees might be subject to change without prior notice.

Calculation Methods

The calculation methods for Coinbase One trading fees are proprietary and not publicly disclosed. However, the observed trend indicates that Coinbase One’s fee structure is designed to provide significant savings compared to standard Coinbase fees. The significant discounts for Bitcoin, Ethereum, and other popular cryptocurrencies illustrate this difference. A general rule of thumb is that Coinbase One members receive reduced trading fees, but the exact percentage reduction may vary based on the specific cryptocurrency.

Cryptocurrency Impact on Fees

Coinbase One, with its tiered subscription model, offers varying trading fees for different cryptocurrencies. This section delves into how the characteristics of a specific cryptocurrency influence its associated Coinbase One trading fees. Understanding these factors is crucial for optimizing trading strategies and maximizing returns within the Coinbase One platform.The correlation between a cryptocurrency’s market capitalization, trading volume, and Coinbase One fees is significant.

Generally, higher market capitalization and trading volume for a cryptocurrency often translate to lower trading fees. This is because increased volume and capitalization typically indicate greater liquidity, which enables Coinbase to offer more competitive pricing. Conversely, less popular or less liquid cryptocurrencies may have higher fees, reflecting the reduced trading activity and potential risk involved.

Market Capitalization and Trading Volume Correlation

Increased market capitalization and trading volume usually correlate with lower trading fees. This relationship is driven by the enhanced liquidity that high-volume trading provides. Exchanges like Coinbase can process transactions more efficiently and offer lower fees as a result. For instance, Bitcoin, with its massive market cap and trading volume, often commands lower fees compared to newer, less established cryptocurrencies.

The availability of substantial buying and selling orders for popular cryptocurrencies allows for smoother transaction execution and lower fees.

Volatility Impact on Fees

The volatility of a cryptocurrency plays a crucial role in determining its Coinbase One trading fees. Highly volatile cryptocurrencies often have higher fees. This is a risk mitigation strategy. The unpredictable price swings of volatile assets necessitate higher transaction fees to compensate for the increased operational risks. For example, a cryptocurrency experiencing substantial price fluctuations requires more sophisticated order management systems and risk assessment mechanisms, which directly impact the fees charged.

This volatility-adjusted pricing ensures that Coinbase can maintain its operational efficiency and stability while also protecting its users.

Comparison of Fees for Popular and Less-Popular Cryptocurrencies

The table below showcases a hypothetical comparison of trading fees for popular and less-popular cryptocurrencies on Coinbase One. The pricing is illustrative and not reflective of actual fees. Real-world fees can change based on market conditions and volume.

| Cryptocurrency | Market Capitalization (Illustrative) | Trading Volume (Illustrative) | Coinbase One Fee (Illustrative) | Description |

|---|---|---|---|---|

| Bitcoin (BTC) | High | Very High | Low | Highly liquid, established cryptocurrency |

| Ethereum (ETH) | High | High | Low | Popular, widely used cryptocurrency |

| Solana (SOL) | Medium | Medium | Medium | A well-established altcoin with notable trading activity |

| Polygon (MATIC) | Medium | Medium | Medium | A growing, but less established, altcoin |

| A less-popular altcoin | Low | Low | High | Lower liquidity, less frequent trading |

This comparison highlights the potential impact of market capitalization and trading volume on Coinbase One fees. Popular cryptocurrencies with high trading volumes often have lower fees, while less-popular cryptocurrencies with low volumes tend to have higher fees. It is important to note that this is a simplified representation, and actual fees can vary considerably.

Subscription Benefits Beyond Fees

Coinbase One isn’t just about lower trading fees; it offers a suite of perks designed to enhance the overall cryptocurrency experience. Beyond the financial advantages, users can unlock valuable tools and services that can significantly impact their investment journey. This section dives into the supplementary benefits that make Coinbase One a compelling option for cryptocurrency enthusiasts.

Enhanced Security Features

Coinbase One subscribers benefit from enhanced security measures. This includes prioritized support for account recovery, access to advanced security tools, and potentially faster resolution of security-related issues. These features can be crucial in mitigating risks associated with cryptocurrency trading, which can involve exposure to cyber threats and fraudulent activities.

Priority Customer Support

Coinbase One subscribers enjoy priority customer support. This means quicker response times to inquiries, dedicated support channels, and potentially more efficient resolution of issues compared to standard support. This expedited service can be particularly valuable during times of account distress or when needing immediate assistance with complex transactions.

Exclusive Access to Features

Coinbase One often provides exclusive access to features and tools that aren’t available to standard users. These might include early access to new products, specialized investment tools, or access to educational resources. This can provide a competitive edge in the market, enabling users to take advantage of new opportunities before they are widely available.

Other Potential Benefits

Coinbase One may include other perks such as faster transaction speeds, lower withdrawal fees for certain cryptocurrencies, or even access to exclusive events or partnerships. These add-ons can enhance the overall experience by providing a smoother and more efficient platform for cryptocurrency users. For example, faster transaction speeds could be beneficial for users who require quick access to their funds.

User Experience and Accessibility

Coinbase One, while offering attractive trading fee benefits, ultimately hinges on a positive user experience. A smooth and intuitive platform is crucial for retaining users and fostering trust in the platform. This section dives into the user experience implications of the Coinbase One subscription, examining interface differences and user feedback.The core of the Coinbase One experience revolves around its streamlined interface and enhanced features, designed to provide a more premium trading journey.

This approach seeks to cater to experienced traders, offering specialized tools and insights to improve the efficiency of transactions.

Impact on User Interface

The Coinbase One platform differentiates itself from the standard Coinbase platform through subtle but impactful interface changes. While the core functionality remains consistent, One subscribers experience a streamlined and often more visually appealing interface. For example, charts and graphs may be more prominently displayed, or the layout might be tailored to showcase key trading metrics.

Comparison of Features

Coinbase One offers a broader array of tools and features compared to the standard Coinbase platform. This includes access to exclusive research reports, educational materials, and premium support channels. For instance, One subscribers may have dedicated account managers for personalized assistance with trades. This dedicated support system provides a level of service not typically found in the free tier.

A direct comparison of the features can be found in a table below.

| Feature | Coinbase | Coinbase One |

|---|---|---|

| Trading Fees | Standard fees apply | Discounted fees |

| Research Reports | Limited access | Exclusive access |

| Support Channels | General support | Dedicated account managers |

| Educational Materials | Limited resources | Comprehensive resources |

User Reviews and Testimonials

User reviews and testimonials often highlight the value proposition of Coinbase One. While quantifiable data is limited, numerous users praise the discounted fees and personalized support. A common theme is that the improved access to tools and resources allows for a more informed and efficient trading strategy. For instance, some users mention that the dedicated support team has assisted them in navigating complex transactions.

Accessibility and Ease of Use

Coinbase, and Coinbase One, strive for a user-friendly platform. The platform is generally accessible to a wide range of users, with intuitive navigation and clear instructions. The platform is available on multiple devices, ensuring flexibility for users.

Comparison with Competitors

Coinbase One, while a popular choice, isn’t the only game in town when it comes to premium cryptocurrency trading services. Understanding how it stacks up against competitors helps users make informed decisions. Several platforms offer similar features and tiered subscription models, making direct comparisons essential for evaluating the best fit.

Thinking about Coinbase One and its trading fees for cryptocurrency? It’s a tempting subscription service, but are the benefits worth the cost? Meanwhile, fascinating discoveries like the recent NASA Mars rover finding organic molecules in Jezero Crater, potentially hinting at past life , remind us of the vast unknowns out there. Ultimately, the decision on whether or not to subscribe to Coinbase One comes down to your individual trading volume and needs, but be sure to factor in the fees.

Competitive Subscription Models

Different platforms employ varying approaches to subscription models, impacting fees and benefits. This section details the subscription models and associated fees of several key competitors to Coinbase One.

| Platform | Subscription Model | Fees | Key Features |

|---|---|---|---|

| Coinbase One | Monthly subscription | Variable, based on trading volume | Reduced trading fees, priority customer support, access to advanced tools |

| Binance | Tiered plans based on trading volume | Variable, based on trading volume | Wide range of cryptocurrencies, advanced charting tools, low fees for high-volume traders |

| Kraken | No fixed subscription model | Per trade fee structure | Excellent security, low per-trade fees, strong institutional focus |

| FTX (Note: FTX is a complex case.) | Tiered plans | Variable, based on trading volume | Competitive fees, advanced trading tools, potentially higher risk due to platform history |

| Gemini | Gemini Pro | Variable, based on trading volume | Focus on security and compliance, competitive fees, user-friendly interface |

Value Proposition and Features

Each platform’s value proposition stems from its unique set of features and pricing structure. Binance, for instance, caters to high-volume traders with competitive fees and a vast selection of cryptocurrencies. Kraken’s strength lies in its robust security and low per-trade fees, attracting users prioritizing security and minimizing transaction costs. Gemini Pro, on the other hand, emphasizes security and compliance, appealing to those concerned with regulatory aspects.

Features Beyond Fees

Beyond trading fees, competitor platforms often offer additional benefits. These range from enhanced customer support and priority service to advanced charting tools and educational resources. Coinbase One’s priority support is a notable example, but competitors may provide unique features tailored to specific user needs.

Potential Drawbacks

Coinbase One, while offering attractive benefits, isn’t a perfect solution for every cryptocurrency trader. Understanding its limitations is crucial before subscribing. Potential drawbacks can range from the service’s specific features to broader market conditions affecting its value proposition.

Subscription Cost and Value Proposition

The cost of Coinbase One can be a significant barrier for some users. While the reduced trading fees are appealing, the overall value proposition needs to be carefully evaluated. A user who trades infrequently or utilizes other platforms for significant trades might not find the cost justified by the benefits.

Limited Cryptocurrency Support

Coinbase One, like other subscription services, might not offer support for every cryptocurrency. This limitation could restrict access to emerging or niche cryptocurrencies, hindering diversification strategies for some traders. For example, a trader focusing on altcoins might find the selection insufficient.

Fee Structure Complexity

The trading fee structure, while offering reduced rates for Coinbase One subscribers, might have hidden complexities. Understanding the different fee tiers and their application across various trading volumes and asset types is essential to maximizing the benefits. A lack of transparency in the fee schedule could make it challenging for some users to determine the optimal usage strategy.

Potential for Market Volatility

Cryptocurrency markets are inherently volatile. The reduced fees offered by Coinbase One might not offset potential losses during market downturns. The overall market conditions, regardless of the subscription, can influence the value of crypto assets and impact profitability. For instance, during a sharp market correction, the cost savings from Coinbase One might not be sufficient to prevent significant losses.

User Experience and Accessibility

While Coinbase One aims to enhance the user experience, potential issues in accessibility could arise. Technical glitches or platform limitations could negatively affect the trading process. This is not exclusive to Coinbase One; it applies to any platform, but it’s crucial to consider for a paid subscription service. A user experiencing frequent app crashes or slow transaction processing might find the subscription undesirable.

Future Trends: Coinbase One Subscription Service Trading Fees Cryptocurrency

Coinbase One, as a premium subscription service, is poised for evolution alongside the ever-changing cryptocurrency landscape. The future trajectory of this service hinges on its ability to adapt to emerging technologies, user expectations, and competitive pressures within the rapidly growing cryptocurrency market. Analyzing these factors allows for a glimpse into the potential future of Coinbase One.

Potential Subscription Enhancements

Coinbase One’s future development likely includes expanded features beyond current offerings. This could encompass enhanced trading tools, like more sophisticated order types, advanced charting capabilities, and dedicated support channels. For instance, introducing AI-powered trading suggestions or personalized portfolio management tools could significantly enhance the value proposition. Improved security measures, including multi-factor authentication options or advanced threat detection, would also likely be included to reflect the increasing need for enhanced security in the cryptocurrency space.

Industry Trends in Subscription Services

The subscription model is gaining traction in the cryptocurrency trading sphere. The trend is driven by a desire for greater convenience and access to advanced features, not just for established traders but also for newcomers. Platforms like Coinbase are recognizing the value proposition of offering tiered services that cater to diverse user needs and skill levels. For example, offering introductory packages for novice traders or more sophisticated tools for experienced investors is a strategy gaining traction in the fintech sector.

Predictions for Trading Fee Structures

The fee structure on Coinbase One will likely evolve in response to market conditions and competitive pressures. The possibility of dynamic pricing, where fees fluctuate based on factors such as trading volume or specific cryptocurrencies, is worth considering. For instance, reduced fees during periods of low trading activity or higher fees for extremely high-volume trades could be part of future adjustments.

Another potential trend is offering tiered fee structures within the subscription, allowing users to opt for different fee levels depending on their trading frequency and volume.

Impact of Emerging Technologies

Emerging technologies, such as blockchain and AI, will likely impact Coinbase One’s subscription model. Blockchain technology could potentially integrate directly into the platform, providing enhanced security and transparency for transactions. Furthermore, AI can be employed to personalize trading recommendations, anticipate market movements, and potentially automate certain aspects of the trading process. This could lead to more personalized trading experiences, enhanced security, and potentially more accurate trading signals.

Examples of Technology Integration

Consider the integration of blockchain technology in a secure wallet system. Users can leverage blockchain technology to ensure the security of their cryptocurrencies stored within the platform. This approach will offer an enhanced security layer, reducing the risk of hacking or unauthorized access. Furthermore, AI could be integrated into the trading platform to generate trading recommendations based on a user’s trading history and market trends.

These personalized recommendations would enhance the trading experience and potentially improve trading decisions.

Illustrative Examples of Trading

Coinbase One’s tiered subscription model offers various benefits, including reduced trading fees, making it attractive to active cryptocurrency traders. To illustrate how these savings translate into tangible advantages, let’s examine some scenarios.

Trading Volume and Fee Differences

The impact of Coinbase One on trading costs is directly proportional to trading volume. Users who frequently buy and sell cryptocurrencies can potentially realize significant cost savings. These savings can compound over time, providing a considerable return on the subscription fee.

| Scenario | Cryptocurrency | Trading Volume (USD) | Coinbase Standard Fee | Coinbase One Fee | Fee Difference (USD) |

|---|---|---|---|---|---|

| High-Volume Bitcoin Trader | Bitcoin (BTC) | $50,000 | $100 (0.2% of $50,000) | $25 (0.05% of $50,000) | $75 |

| Altcoin Day Trader | Ethereum (ETH) | $10,000 | $20 (0.2% of $10,000) | $5 (0.05% of $10,000) | $15 |

| Long-Term Crypto Investor | Solana (SOL) | $5,000 | $10 (0.2% of $5,000) | $2.50 (0.05% of $5,000) | $7.50 |

| High-Frequency Trader | Polygon (MATIC) | $20,000 | $40 (0.2% of $20,000) | $10 (0.05% of $20,000) | $30 |

Significant Benefits for Users

Coinbase One’s fee reductions can accumulate substantially for frequent traders. The table above showcases examples where users can save money by utilizing the service, highlighting the potential advantages for different trading styles and volumes. The significant cost savings are particularly attractive to those actively engaging in high-volume transactions or those who trade frequently in multiple cryptocurrencies. Users who trade frequently in multiple cryptocurrencies will find the cost savings significant, as reduced fees across multiple assets translate into considerable long-term savings.

Summary

In conclusion, Coinbase One presents a potentially attractive option for traders seeking lower fees and extra perks. However, the value proposition hinges on individual trading volume and the specific cryptocurrencies traded. Weigh the fees against the additional benefits to determine if Coinbase One aligns with your trading strategy and overall needs. The future of subscription services in the cryptocurrency market remains uncertain, but Coinbase One’s evolution will undoubtedly play a role in shaping this future.