Amazon US sales tax collection all states is a complex issue, touching on the historical evolution of sales tax laws, Amazon’s compliance practices, and the varying regulations across each state. This in-depth look examines the intricacies of this topic, from the early days of sales tax collection to the modern challenges of online retail. We’ll explore the impact on state economies and discuss potential future trends.

The article will trace the history of sales tax collection in the US, detailing key legislation and court cases that shaped the landscape. It will then delve into Amazon’s specific practices, comparing them to other major online retailers. A crucial part will be analyzing the diverse state-level sales tax laws, rates, and exemptions. Further, the article will address the challenges and disputes that have arisen, and finally, assess the economic implications of Amazon’s practices on different states.

Historical Overview of Sales Tax Collection in the US

The US system of collecting sales taxes is a complex tapestry woven from state-level initiatives, landmark court rulings, and evolving economic landscapes. Understanding its historical evolution is crucial to appreciating the current challenges and nuances of this critical revenue source for many states. From the initial experiments in the early 20th century to the contemporary debates about online sales tax, the history reveals a dynamic and often contested relationship between the federal government, state governments, and businesses.The early 20th century saw the introduction of sales taxes as a means to supplement other forms of state revenue.

The approach to implementing these taxes varied significantly from state to state, with some experimenting with broad-based levies while others opted for more targeted applications. These early attempts often faced legal challenges and public resistance, shaping the future trajectory of sales tax collection.

Early Experiments and Legal Battles

The development of sales taxes wasn’t uniform across the United States. Different states adopted sales tax laws at various times, reflecting their unique economic circumstances and political priorities. Early legal battles and legislative struggles helped define the boundaries of state power in collecting sales taxes and the role of the federal government in this process.

| Year | Event | Legislation/Court Case | Impact on Sales Tax Collection |

|---|---|---|---|

| 1930s | Early experiments | Various state-level sales tax laws | States began to experiment with different sales tax structures, reflecting their economic needs and political priorities. These early implementations often faced legal challenges and public resistance, setting the stage for future debates. |

| 1960s | Expansion of sales tax | Several state legislative acts | More states adopted sales taxes, reflecting the growing need for state revenue. This period also saw the beginning of the debate about the application of sales taxes to interstate commerce. |

| 1992 | Supreme Court Ruling | National Bellas Hess, Inc. v. Department of Revenue | This ruling significantly limited the ability of states to collect sales taxes from out-of-state businesses selling goods to consumers within the state. This case was a major setback for states aiming to collect sales taxes from businesses with a significant presence across state lines. |

State-Level Approaches to Sales Tax Collection

State-level approaches to sales tax collection have varied significantly throughout history. Factors like economic conditions, political climates, and public perception have influenced the specifics of sales tax laws.

- Different States, Different Approaches: Some states opted for broad-based sales taxes encompassing a wide range of goods and services, while others preferred more targeted levies on specific items. This diversity reflected the varying needs and priorities of different state economies.

- The Role of Economic Conditions: Economic downturns or booms often influenced state decisions regarding sales tax collection. During periods of economic hardship, states might be more inclined to implement sales taxes to bolster their revenue streams, while economic prosperity could lead to a reduction or modification of the tax structure.

- Public Opinion and Political Climate: Public opinion and political climate played a crucial role in shaping state decisions about sales taxes. Public resistance or support for a particular sales tax structure could sway legislative decisions and influence the direction of sales tax policies.

Factors Influencing State Decisions

A variety of factors influenced state decisions regarding sales tax collection. The interplay between economic conditions, political considerations, and public opinion played a significant role in the evolution of sales tax laws across the United States.

- Economic Factors: Economic conditions, including the prevalence of different industries within a state, the overall economic climate, and the revenue needs of the state, were significant considerations in deciding on sales tax policies. States with a strong reliance on specific industries might adjust sales taxes accordingly to support the growth and vitality of those sectors.

- Political Considerations: Political motivations, including the desire to maintain public support, gain political favor, and meet budgetary needs, often influenced state legislative decisions related to sales tax. The political climate and the prevailing political ideologies also had an impact on how sales taxes were structured and implemented.

- Public Opinion: Public opinion, including consumer concerns about the impact of sales taxes on everyday purchases and public perceptions of tax fairness, significantly influenced the decisions of state legislators regarding sales tax policies.

Amazon’s Sales Tax Collection Practices: Amazon Us Sales Tax Collection All States

Amazon’s journey towards comprehensive sales tax compliance across all US states represents a significant shift in the online retail landscape. This evolution reflects a growing understanding of the complexities involved in managing sales tax obligations and the importance of treating all customers fairly, regardless of their location. This commitment also demonstrates a proactive approach to legal and ethical business practices.Amazon’s current sales tax collection practices involve a multifaceted approach, tailored to comply with the diverse and often intricate regulations of each state.

This dynamic approach ensures that Amazon adheres to the tax laws of every jurisdiction where it operates, and it has resulted in a significant investment in the infrastructure and personnel required for accurate and timely tax collection.

Amazon’s State-Specific Sales Tax Compliance

Amazon utilizes a sophisticated system to track sales tax obligations for each state. This system analyzes sales data, identifies applicable tax rates, and calculates the correct tax amount due for each transaction. This comprehensive process is crucial for accurate tax reporting and ensures compliance with the ever-evolving regulations of different states.

Methods of Sales Tax Collection

Amazon employs several methods to comply with state sales tax requirements. These methods include automated systems for calculating and remitting taxes, partnerships with state tax authorities for streamlined reporting, and a robust network of compliance professionals who ensure adherence to tax laws. This detailed approach demonstrates a commitment to accuracy and efficiency in tax management.

Comparison with Other Major Online Retailers

Amazon’s sales tax compliance practices are generally considered robust and comprehensive compared to some of its competitors. The company’s large-scale approach and dedicated resources provide a more systematic and structured approach to compliance. Other retailers may have varying levels of sophistication and complexity in their sales tax processes, and some may rely more on state-by-state variations and partnerships.

Comparative Table: Amazon vs. Other Online Retailers

| Retailer | States | Policy | Compliance Record |

|---|---|---|---|

| Amazon | All 50 US States | Complex, state-specific system for tax calculation and remittance | Generally considered highly compliant, with occasional disputes or discrepancies |

| Retailer B | Subset of US States | Simpler, potentially relying on default rules or less granular tax calculations | Varying compliance records; potential for more significant discrepancies in tax calculation or remittance |

| Retailer C | Subset of US States | Utilizes third-party tax services, potentially with varying levels of accuracy and consistency | Record may depend on the specific third-party tax provider and the retailer’s oversight |

Note: Retailer B and Retailer C are examples and do not represent specific companies. The table illustrates a potential comparison, not an exhaustive evaluation.

Figuring out Amazon’s US sales tax collection across all states can be tricky. It’s a complex web of regulations, and staying on top of it all is a real challenge. Thankfully, tools like remote notifier android forward notifications your phone your computer can help streamline communication and organization in your business, which can help with keeping track of sales tax obligations.

Ultimately, understanding these sales tax rules is crucial for Amazon sellers to avoid potential penalties and ensure compliance.

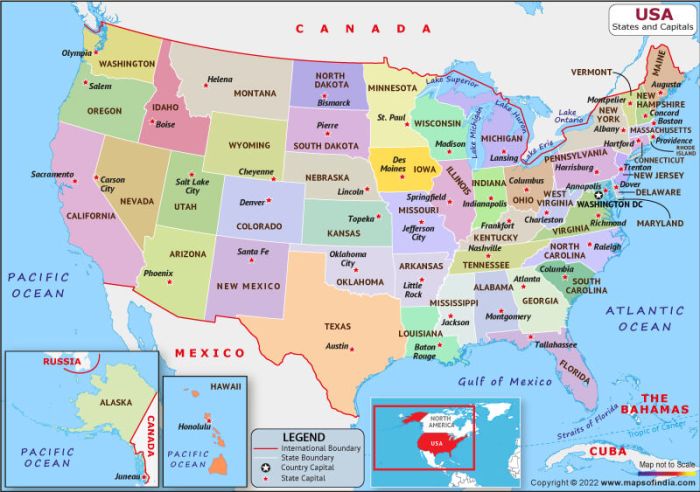

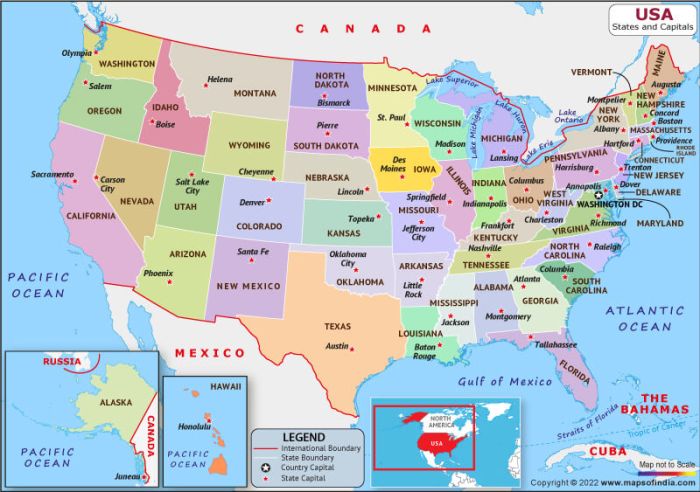

State-Level Sales Tax Laws and Regulations

Navigating the complex landscape of sales tax in the US is a crucial aspect of e-commerce. State-level regulations vary significantly, impacting both businesses and consumers. This section delves into the intricacies of these laws, providing a comprehensive overview of the diverse sales tax systems across the country. From rates to exemptions, understanding these differences is essential for accurate tax calculation and compliance.State sales tax laws and regulations are designed to ensure fair and consistent taxation, though the methods and rates differ substantially.

This leads to a diverse and intricate structure. Each state sets its own rules regarding what is taxable, the applicable tax rates, and the specific exemptions. This variability necessitates careful consideration for businesses operating in multiple states.

Sales Tax Rates Across US States

Sales tax rates vary substantially from state to state. Some states have no sales tax at all, while others have rates exceeding 10%. This significant disparity creates challenges for businesses operating in multiple states. The table below presents a snapshot of sales tax rates across different US states, highlighting the wide range of applicability. Note that these rates can be further impacted by local jurisdictions.

| State | Sales Tax Rate (as of 2023) |

|---|---|

| Alabama | 4% |

| Alaska | 0% |

| Arizona | 6.6% |

| Arkansas | 6.85% |

| California | 7.25% (varies by county) |

| Colorado | 2.9% (varies by county) |

| Connecticut | 6.35% |

Exemptions and Exceptions to Sales Tax Rules

Numerous exemptions and exceptions exist within state sales tax regulations. These exemptions often apply to specific products or services, and their applicability is subject to the individual state’s laws. For instance, some states exempt certain food items from sales tax, while others might offer exemptions for educational materials or medical supplies. Understanding these exemptions is crucial for accurate tax calculation and compliance.

- Food and Groceries: Many states exempt certain food and grocery items from sales tax. This exemption often does not include prepared meals or restaurant services. This can vary considerably across states.

- Clothing and Apparel: Sales tax exemptions for clothing and apparel can also differ widely, with some states providing no exemption while others do.

- Medical Supplies: Medical supplies and services are frequently exempted from sales tax to encourage access to healthcare.

Detailed Analysis of Specific Sales Tax Rules

Specific sales tax rules can vary considerably across states, often based on local laws. For instance, some states may have higher rates for certain items, while others have additional local taxes in specific counties. Understanding these nuances is critical for businesses operating in multiple jurisdictions. A comprehensive analysis would require a detailed examination of the individual regulations for each state.

Navigating Amazon’s US sales tax collection across all states can be tricky. Understanding the rules is key for accurate pricing and compliance, but did you know that some foods just aren’t ideal for vacuum sealing? Check out this helpful guide on never vacuum seal these 7 foods to avoid potential problems down the line. Ultimately, staying informed about Amazon’s sales tax policies remains crucial for any seller or shopper.

Consult state revenue departments for specific guidance.

Challenges and Disputes in Sales Tax Collection

Navigating the complexities of sales tax collection, particularly for online retailers, has presented numerous hurdles for both states and businesses. The digital marketplace has blurred traditional jurisdictional boundaries, making it difficult to determine which state’s tax laws apply to a transaction. This has led to significant disputes and ongoing legal battles, impacting revenue streams for states and operational efficiency for online businesses.The shift towards online commerce has created a new set of challenges for states in enforcing sales tax laws.

Traditional methods of collecting sales tax, reliant on physical presence and brick-and-mortar stores, no longer fully capture the economic activity of the digital marketplace. This discrepancy necessitates innovative approaches to tax collection and resolution of the ensuing disputes.

Key Challenges Faced by States

States face significant challenges in effectively collecting sales taxes from online retailers. Determining the appropriate jurisdiction for tax collection, given the often ambiguous nature of online transactions, is a primary hurdle. Moreover, the lack of readily available data on online sales activity for out-of-state retailers compounds the issue, making it difficult to identify and track taxable transactions. The inherent complexity of applying different state laws across diverse jurisdictions also creates a significant administrative burden.

Key Challenges Faced by Online Retailers

Online retailers, in turn, face the challenge of complying with numerous and often conflicting sales tax regulations across various states. Navigating the intricacies of state-specific tax laws, calculating and remitting the appropriate tax amounts, and maintaining accurate records across multiple jurisdictions presents a significant operational and financial burden. The lack of a standardized system for sales tax collection across states adds to the complexity, making it difficult for businesses to streamline their processes.

Disputes Between States and Online Retailers

Disputes have frequently arisen between states and online retailers concerning the application of sales tax laws. One key area of contention revolves around the nexus requirement, which determines whether a business has sufficient connection to a state to be subject to its sales tax laws. This lack of a clear standard often leads to disagreements on whether a business owes sales tax in a particular state.

Cases involving large online retailers and numerous states highlight the difficulty in enforcing sales tax collection, given the logistical complexities and varying interpretations of the nexus threshold.

Role of the Supreme Court in Shaping the Legal Landscape

The Supreme Court’s rulings have played a crucial role in shaping the legal landscape of online sales tax collection. Key Supreme Court decisions have defined the scope of state authority in collecting sales taxes from out-of-state retailers, thereby impacting the ability of states to collect sales taxes from online retailers. The ongoing evolution of these legal precedents continues to influence the practices of both states and online retailers.

Amazon’s US sales tax collection across all states is a complex issue, right? While I’m not an expert on tax law, it seems like there’s a lot of debate about how it’s handled. Interestingly, this recent news about Google’s upcoming Wear OS 5.1 update, rumored to be tied to Android 15 here , could have some unforeseen implications for online retail tax collection practices.

Hopefully, the new features will make tax collection easier and more transparent for both consumers and businesses like Amazon.

Organizing Challenges and Disputes

The following table categorizes disputes by state and issue, highlighting the complexity and variation across jurisdictions. It provides a snapshot of the diverse challenges encountered in the field of online sales tax collection.

| State | Issue | Description |

|---|---|---|

| California | Nexus | Disputes over the minimum level of activity required for a business to be subject to California sales tax. |

| New York | Collection Method | Disagreements on the appropriate methods for collecting and remitting sales taxes. |

| Texas | Jurisdictional Issues | Questions regarding the appropriate state to collect sales tax for transactions originating from Texas. |

| Washington | Nexus | Disputes over the minimum level of activity required for a business to be subject to Washington sales tax. |

Impact of Amazon’s Sales Tax Collection on State Economies

Amazon’s shift to collecting sales taxes across all US states has significant implications for state economies, impacting both revenue streams and the overall economic landscape. The varying levels of sales tax rates and differing regulatory environments create complexities, potentially affecting state budgets and public services. This analysis explores the multifaceted impact on state economies, considering both high and low sales tax states, and the potential consequences for small businesses.The transition to universal sales tax collection by Amazon necessitates a deeper understanding of its consequences.

States rely on sales tax revenue for funding crucial public services, including education, infrastructure, and healthcare. Amazon’s practices, therefore, influence the financial capacity of these services, creating an intricate relationship between online retail giants and state economies.

Impact on State Revenue Collection

Amazon’s sales tax collection fundamentally alters the way states generate revenue from online transactions. Historically, states have struggled to collect sales taxes from businesses operating outside their borders. Amazon’s compliance with the Supreme Court’s decision on the nexus requirement enables states to collect taxes from sales made to their residents. This shift in practice has a tangible impact on state budgets.

Effect on State Budgets and Public Services

The additional revenue generated by Amazon’s sales tax collection directly affects state budgets. This additional revenue can be used to fund vital public services, potentially improving education, infrastructure, and other areas. However, the extent of the impact varies significantly based on state-specific factors, including the base sales tax rate.

Comparison Across States with Varying Sales Tax Rates, Amazon us sales tax collection all states

States with higher sales tax rates may experience a proportionally larger increase in revenue from Amazon’s sales tax collection, potentially offsetting some of the negative impacts of online sales competition. Conversely, states with lower sales tax rates might experience a smaller impact, as the incremental revenue increase might be less substantial compared to states with higher sales tax rates.

The overall economic impact is influenced by factors beyond just sales tax rates, such as the relative size of the online retail market in each state.

Impact on Small Businesses

Amazon’s sales tax collection practices can affect small businesses in various ways, particularly those operating in states with different sales tax collection laws. The implementation of these laws may introduce additional compliance burdens and potentially create an uneven playing field. Small businesses may face increased administrative costs for tracking sales tax obligations, which can strain their resources. This could be further exacerbated by differences in sales tax laws and compliance standards across different states.

Summary Table: Impact on State Economies

| State Category | Sales Tax Rate (Example) | Potential Impact on Tax Revenue | Potential Impact on Economic Activity |

|---|---|---|---|

| High Sales Tax States | 9-10% | Significant increase in tax revenue, potentially offsetting loss from traditional retail. | Potential for growth in online retail jobs and related industries, potentially affecting brick-and-mortar stores. |

| Low Sales Tax States | 4-5% | Moderate increase in tax revenue, potentially leading to less significant budget impact compared to high sales tax states. | Potential for growth in online retail jobs and related industries, but impact on traditional retail might be less significant. |

| States with Complex Sales Tax Laws | Variable | Potential for challenges in tax collection and compliance for both Amazon and small businesses. | Potentially slower growth in online retail sector and potential for economic disparities between states. |

Future Trends and Potential Solutions

The digital economy continues to evolve, demanding innovative approaches to sales tax collection. Online retailers face unique challenges in accurately determining and remitting sales taxes to various jurisdictions. Predicting future trends and developing effective solutions are critical for both businesses and governments to ensure a fair and efficient system.The shift towards a more globalized and interconnected marketplace necessitates a reevaluation of existing sales tax frameworks.

As online shopping continues to dominate, new methods for collecting and remitting sales taxes are needed to keep pace. Addressing the complexities of cross-border transactions and varying state regulations is crucial for the future of online commerce.

Potential Future Trends in Sales Tax Collection

The landscape of sales tax collection is dynamic, with several key trends emerging. Increased automation and data analytics are expected to play a significant role in streamlining the process. Real-time data processing will allow for more accurate tax calculations and timely payments. Furthermore, the growing use of artificial intelligence and machine learning will help predict sales tax liabilities with greater precision, minimizing errors and reducing compliance costs.

Blockchain technology may also be employed for secure and transparent tax record-keeping, fostering greater trust and efficiency.

Potential Solutions to Address Challenges in the Digital Economy

Several solutions are emerging to address the challenges of sales tax collection in the digital age. One key area is the development of more sophisticated, automated systems for calculating and remitting sales taxes based on location data. This will improve accuracy and reduce errors. Additionally, improved communication and collaboration between states and online retailers will be essential.

Clearer guidelines and standardized reporting processes will help alleviate the burden on both sides.

Innovative Approaches to Sales Tax Collection

Innovative approaches are crucial for a smooth and efficient sales tax collection system. A potential solution involves the use of real-time location-based tax calculation software that automatically determines the applicable sales tax rate based on the customer’s address at the time of purchase. Another approach involves the establishment of a centralized sales tax collection platform that streamlines the process for online retailers operating in multiple states.

Summary of Potential Solutions

| Solution | Advantages | Disadvantages |

|---|---|---|

| Real-time location-based tax calculation software | Improved accuracy, reduced manual effort, potentially lower compliance costs. | Requires significant investment in technology and data infrastructure. Potential for technical glitches and data errors. |

| Centralized sales tax collection platform | Streamlines the process for multi-state retailers, potentially reducing compliance costs, and promoting fairness. | Requires substantial cooperation and agreement among states, potentially facing resistance from some states. |

| Blockchain technology for tax record-keeping | Enhanced security and transparency, reducing fraud and errors. | Requires significant investment in infrastructure and integration with existing systems, potential regulatory hurdles. |

| Improved data sharing and communication protocols | Promotes better understanding of tax obligations and expectations, leading to smoother compliance. | Requires trust and cooperation between states and businesses, potential for disagreements on data privacy and access. |

Final Thoughts

In conclusion, Amazon’s sales tax collection practices have significantly impacted the US economic landscape. From historical context to present-day challenges, this analysis underscores the complex interplay between state laws, online retail giants, and the evolving digital economy. The future of online sales tax collection promises further scrutiny and potential innovative solutions. The article concludes with an examination of future trends and possible solutions to the problems.